Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2016

US flash manufacturing PMI ends third quarter on disappointing note

The US manufacturing sector ended the third quarter on a disappointing note, adding to signs that the economy has failed to gather significant momentum after a disappointing first half of the year.

The September Markit US flash Manufacturing PMI fell to a three-month low of 51.4, down from 52.0 in August. Some comfort can be gleaned from the average reading for the third quarter of 52.1 being up on 50.9 seen in the second quarter and the best quarterly average seen so far this year. However, the relatively low level of the headline manufacturing PMI over the past three months remains indicative of a near-stagnant manufacturing economy, as measured by official production data, and only modest growth of the wider economy.

An annualised GDP growth rate of only around 1% is being signalled by the manufacturing PMI, similar to that indicated by the composite PMI up to August (which includes services).

The PMI was dragged down by manufacturers reporting the weakest rise in new orders since December, in turn linked to the first (albeit marginal) drop in exports since May.

There was better news on employment, with hiring picking up to show the second-strongest increase in factory headcounts since January. However, the survey is only indicative of a mere 3,000 rise in the official measure of manufacturing payrolls.

Markit PMI v ISM as indicators of US GDP

Although only covering around 10% of the economy, the manufacturing PMI acts as a good barometer of the health of the wider economy. This is in part due to the sector being heavily influenced by both international trade flows and domestic demand (both from consumers and businesses).

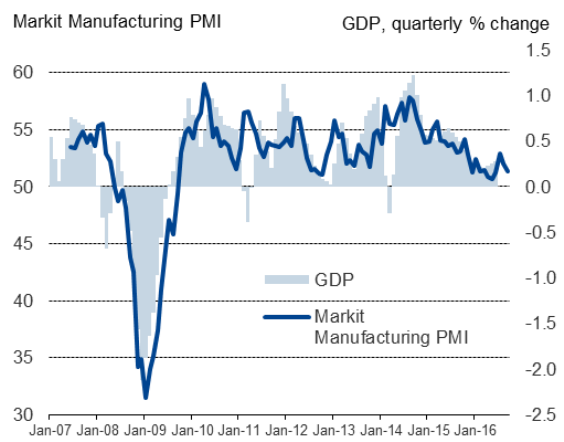

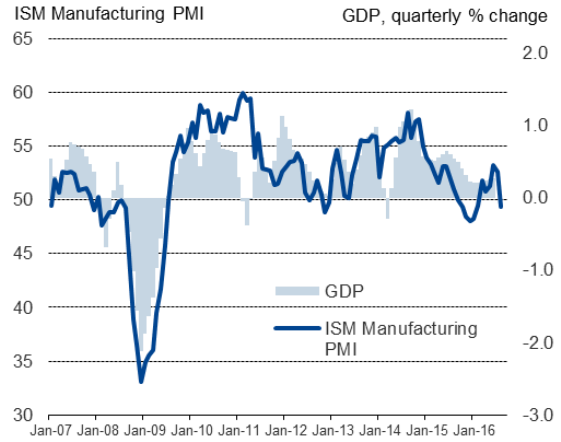

Since 2008, the correlation between Markit's PMI and official GDP growth has been 82%, rising to 91% if official data are smoothed (using a moving average) to remove undue volatility in the official services. A manufacturing PMI reading of 50 is broadly-equivalent to no change in GDP. Each index point divergence from 50 is approximately equivalent to a 0.1% quarterly rate of change in GDP.

US GDP v Markit Manufacturing PMI (up to September)

US GDP v ISM Manufacturing PMI (up to August)

Sources: IHS Markit, ISM, Commerce Department.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Economics-US-flash-manufacturing-PMI-ends-third-quarter-on-disappointing-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Economics-US-flash-manufacturing-PMI-ends-third-quarter-on-disappointing-note.html&text=US+flash+manufacturing+PMI+ends+third+quarter+on+disappointing+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Economics-US-flash-manufacturing-PMI-ends-third-quarter-on-disappointing-note.html","enabled":true},{"name":"email","url":"?subject=US flash manufacturing PMI ends third quarter on disappointing note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Economics-US-flash-manufacturing-PMI-ends-third-quarter-on-disappointing-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+manufacturing+PMI+ends+third+quarter+on+disappointing+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26092016-Economics-US-flash-manufacturing-PMI-ends-third-quarter-on-disappointing-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}