Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 26, 2017

Trump Triggers Transatlantic Trading

North American investors have rekindled their love of European stocks since the new administration came to power in January.

- US investors have piled over $7.8bn into European exposed ETFs so far in Q2

- Investors pass on currency hedged ETFs as the euro rallies against the dollar

- UK and Italian funds fail to inspire investors so far this quarter

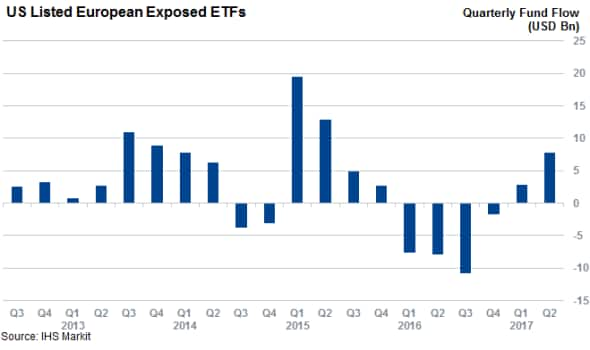

Political uncertainty in the five months since the Trump administration came to power has driven North American investors to park ever-growing piles of cash overseas - and European focused ETFs have been a large beneficiary. Transatlantic funds have long been firm favorites, but the lack of economic traction across large swaths of the European continent - and a steady US economy - caused investors to take pause. The retrenchment in eastbound investments was short lived though as these funds have gone on to amass over $10bn of new assets year-to-date.

Most of these inflows occurred over Q2 following growing cynicism on the Trump administration's ability to deliver on the reforms the market bet on. Meanwhile, European political uncertainty has gone in the opposite direction after the French election eased fears of a resurgence in populism across the continent. The ETF industry still has room to go to recover the $27bn withdrawn from North American Europhile ETFs in 2016; yet momentum is growing for the strategy, as these funds gathered $1bn a week since the first round of the French election.

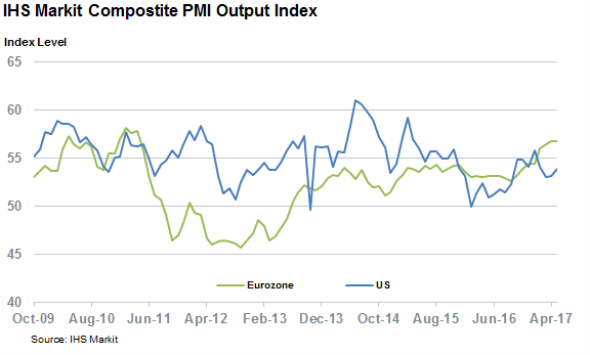

Facts on the ground are starting to play into investor's hands as the Eurozone economy grew at a faster pace than the US over the last four months, according to the IHS Markit Economics Composite PMI. Surveys in both regions indicated solid growth, but the Eurozone survey was particularly strong, as it indicated economic activity in the region grew at the fastest rate since 2011.

The Eurozone's strong growth has also prompted the market to discount the possibility of further quantitative easing in the region, which has driven a rally in the value of the euro relative to the dollar. The surging euro isn't raising many alarm bells with investors, as the vast majority of funds allocated to transatlantic trade have gone to unhedged funds, an indication investors are putting faith in euro's ability to hold on, or build, on its 7% year-to-date surge against the dollar.

The 30 funds which protect against currency fluctuations have still managed to gather new assets yet the $1bn of inflows gathered by this strategy so far in Q2 is small fry given that several of these funds experienced such flows on a weekly basis in 2015.

Not every country manages to ride the trend

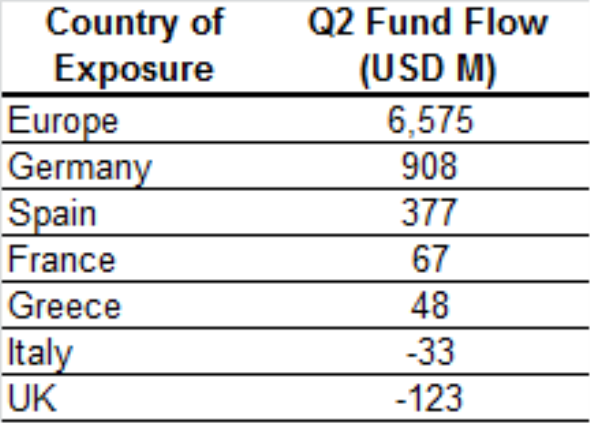

Currency hedged funds aren't the only ones to miss out on the recent wave of inflows. North American investors have so far chosen to steer clear of UK exposed funds, after ongoing questions about Brexit negotiations drove a net $123m outflow across the seven funds in the region that invest in the UK.

Italian funds have also seen some selling after investors pulled $33m from the iShares MSCI Italy Capped ETF, which is the main fund focused on Italy.

Italy's periphery neighbour Spain sits on the other side of the scale, as North American investors ploughed more than $370m into ETFs that invest in the country's equities. These strong inflows represent roughly 50% of the AUM managed by these funds at the start of the quarter.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052017-Equities-Trump-Triggers-Transatlantic-Trading.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052017-Equities-Trump-Triggers-Transatlantic-Trading.html&text=Trump+Triggers+Transatlantic+Trading","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052017-Equities-Trump-Triggers-Transatlantic-Trading.html","enabled":true},{"name":"email","url":"?subject=Trump Triggers Transatlantic Trading&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052017-Equities-Trump-Triggers-Transatlantic-Trading.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trump+Triggers+Transatlantic+Trading http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052017-Equities-Trump-Triggers-Transatlantic-Trading.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}