Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 26, 2015

Chinese challenges extend to Grohe's credit

European manufacturer Grohe has seen its 5-yr CDS spread widen sharply as Chinese subsidiary Joyou files for bankruptcy.

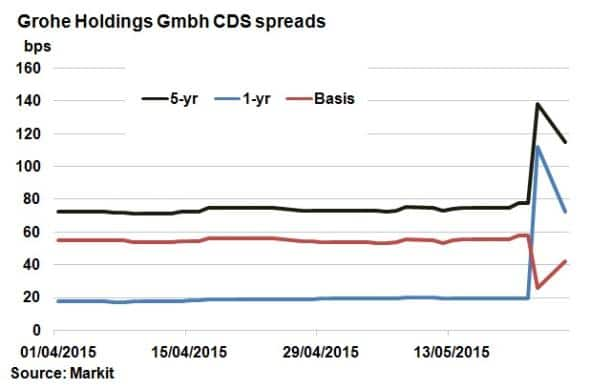

- Grohe Holdings 5-yr CDS spread has widened 38bps over the last two trading day

- Grohe's CDS curve has flattened with the basis between the 1-yr/ 5-yr down 16bp

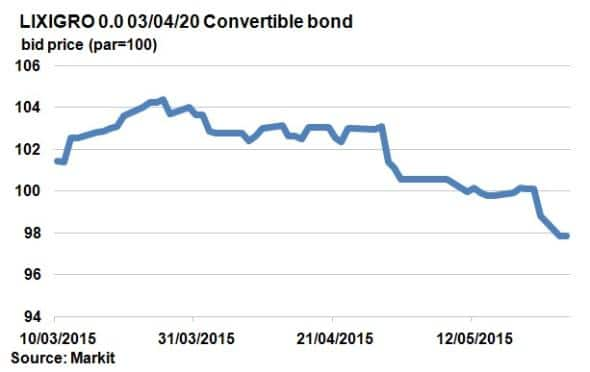

- Parent company Lixil has seen the price on its 2020 convertible decrease 6pts since March

Chinese equity performance has been nothing short of sensational this year, with the Shenzhen Stock Exchange Composite Index up 104%. But hidden in the stock market euphoria, Chinese credits have increasingly come under pressure amid rising debt burdens and corporate accounting scandals.

Last month saw property developer Kaisa default on its foreign debt, while water utility company Sound Global's bonds were hit when accounting irregularities surfaced. Solar energy firm Hanergy and Goldin, a property finance group, also have recently been targeted with regards to questionable operations.

The latest Chinese company to become embroiled in a scandal is Joyou, a sanitary fittings manufacturer listed in Germany. The company filed for bankruptcy last week, the effects of which were far reaching. Joyou is majority owned by German sanity fittings manufacturing giant Grohe, which is owned by Lixil Group, a Japanese global leader in building materials and housing equipment.

Grohe Holdings

Last Wednesday Joyou announced that it was insolvent and filed for bankruptcy amid a scandal around its Chinese operations that allegedly falsely stated sales and assets. The company immediately announced that $300m of guarantees given to creditors were to be written off. The alarm was raised about a month ago when the company warned shareholders of potential problems. Since then the once $400m company has lost nearly all its market value.

Credit spreads in Grohe Holding's widened sharply. Its 5-yr CDS spread widened 60bps last Friday, from 77bps to 138bps, before settling at 115bps at yesterdays close. The CDS curve also experienced flattening across the term, the basis between 1-yr and 5-yr spreads tightened 16bps. At the very short end, 6-month CDS spread also widened causing the curve to become slightly inverted. This movement caused The Leading Risk Indicator within Markit's Research Signal's credit factor platform to issue an unexpected alert, expecting further widening of the credit spread.

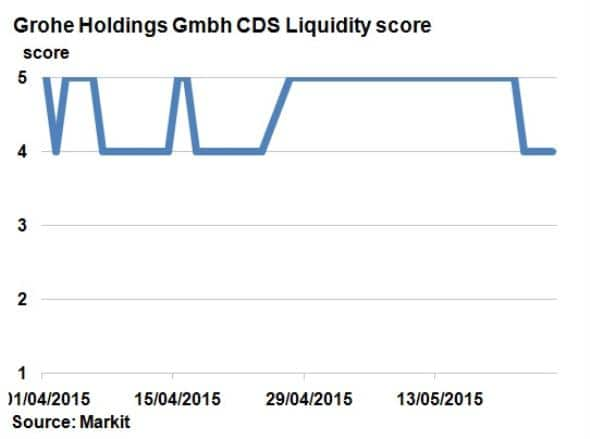

CDS liquidity in Grohe Holdings also picked up slightly, with the Markit liquidity score moving from 5 to 4 (1 being the most liquid, 5 being illiquid). End of day contributor depth remains at 7, however.

Grohe bought control of Joyou in 2011 after a two year cooperation deal. In January 2014, Lixil bought Grohe in what was then one of the largest transactions between a German firm and a Japanese acquirer. Ultimately the losses will funnel through to Lixil, who admit that due diligence wasn't carried out properly during the acquisition of Grohe and that they only recently discovered the accounting irregularities.

Having already announced a write down on its Grohe stake, unsurprisingly, Lixil's credit has taken a hit. Its 2020 convertible bond has lost and 2.25pts (cash basis to par) since last Wednesday and 6pts since the middle of March, according to Markit's bond pricing service.

Joyou's case has yet again highlighted the risks involved with investing in China.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Credit-Chinese-challenges-extend-to-Grohe-s-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Credit-Chinese-challenges-extend-to-Grohe-s-credit.html&text=Chinese+challenges+extend+to+Grohe%27s+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Credit-Chinese-challenges-extend-to-Grohe-s-credit.html","enabled":true},{"name":"email","url":"?subject=Chinese challenges extend to Grohe's credit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Credit-Chinese-challenges-extend-to-Grohe-s-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+challenges+extend+to+Grohe%27s+credit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Credit-Chinese-challenges-extend-to-Grohe-s-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}