Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 26, 2017

New PMI for Uganda signals improving private sector business conditions

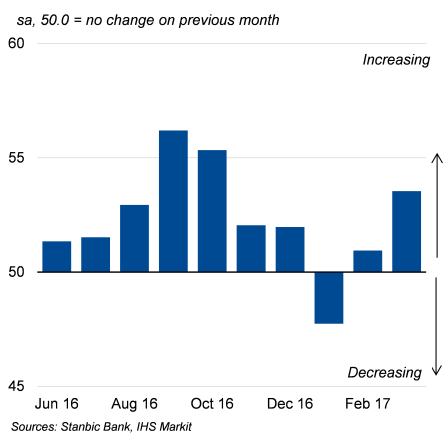

At 53.5 in March, up from 50.9 in February, the newly-released Stanbic Bank Uganda PMI pointed to a further improvement in business conditions at Ugandan private sector companies. The survey, sponsored by Stanbic Bank and produced by IHS Markit, has been conducted since June 2016 and covers the agriculture, industry, construction, services and wholesale & retail sectors. The headline figure derived from the survey is the Purchasing Managers' Index" (PMI") which provides an early indication of operating conditions in Uganda.

Stanbic Bank Uganda PMI

The headline index has now signalled expansion in nine out of the ten months of data collection. Improved operating performances were signalled for the agriculture, industry, services and wholesale & retail sectors during March.

Ugandan private sector companies reported increases in both output and new orders for the second straight month in March. A number of panellists mentioned that successful advertising campaigns had helped them to take advantage of generally stronger client demand.

The rise in total new work was hampered by falling exports, however. New business from abroad has fallen in all ten months of data collection so far, the latest decrease reflecting weaker demand from European markets.

With new orders increasing, further job creation was registered in March. Staffing levels rose in the agriculture, services and wholesale & retail sectors, whereas lower employment was seen in the industrial sector. Higher employment led to an increase in staff costs in the Ugandan private economy. Wages and salaries rose across the agriculture, industry, services and wholesale & retail sectors.

A larger workforce was cited as a factor behind depletion of outstanding business in March. Alongside new equipment, greater staff numbers contributed to available spare capacity to divert towards completing existing contracts.

On the prices front, overall costs continued to increase during March. Apart from rising wages and salaries, cost increases reflected higher purchase prices - a by-product of increased input buying activity at Ugandan companies.

Presenting the inaugural PMI report for March 2017, Anne Juuko Stanbic Bank's Head of Global Markets said:

"The latest figures show that Uganda's private sector is slowly recovering from the effects of the last election cycle and the global economic slowdown. At 53.5 in March up from 50.9 in February, the seasonally adjusted PMI pointed to further improvement in business conditions at Ugandan private sector firms in March.

"The employment figures show that with new orders increasing further job creation was registered in March. These higher overall employment levels indirectly led to an increase in staff costs with the larger workforce also being the primary reason behind depletion of outstanding business in March.

"On the prices front overall costs continued to increase during March. Apart from rising wages, cost increases reflected higher purchase prices, a by-product of rising input buying activity by Ugandan companies."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26042017-Economics-New-PMI-for-Uganda-signals-improving-private-sector-business-conditions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26042017-Economics-New-PMI-for-Uganda-signals-improving-private-sector-business-conditions.html&text=New+PMI+for+Uganda+signals+improving+private+sector+business+conditions","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26042017-Economics-New-PMI-for-Uganda-signals-improving-private-sector-business-conditions.html","enabled":true},{"name":"email","url":"?subject=New PMI for Uganda signals improving private sector business conditions&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26042017-Economics-New-PMI-for-Uganda-signals-improving-private-sector-business-conditions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+PMI+for+Uganda+signals+improving+private+sector+business+conditions http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26042017-Economics-New-PMI-for-Uganda-signals-improving-private-sector-business-conditions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}