Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 25, 2015

UK short sellers profit from selloff

The current market correction has played into the hands of short sellers, as average short positions heading into the downturn stood at their highest level in over 18 months.

- Average short interest in the FTSE 100 index is up by more than a third year to date

- Commodities exposed firms saw the largest increase in short interest since January

- FTSE 250 firms also targeted in recent weeks, with short interest peaking ahead of Monday

Yesterday's "Black Monday" selloff saw the FTSE 100 lose 4.6% of its value to close at its lowest level since January 2013. While the pace of the selloff, the largest since 2011, caught many by surprise, short sellers were well positioned as the average demand to borrow shares across the index stood at a recent high in the lead-up to Monday's slump.

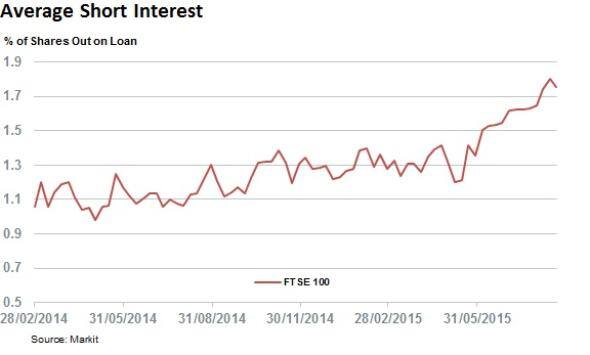

FTSE 100 short interest at recent high

Average short interest stood at 1.75% on the eve of Monday's selloff. This number was just off the recent 18 month high in short interest registered in the previous week, and over 43% higher than where it stood at the front of the year.

The steady increase in shorting activity in the lead up to Monday's selloff indicates that a growing portion of market participants were getting increasingly sceptical of the recent market environment; a position that proved well timed given Monday's selloff.

Natural resources most targeted

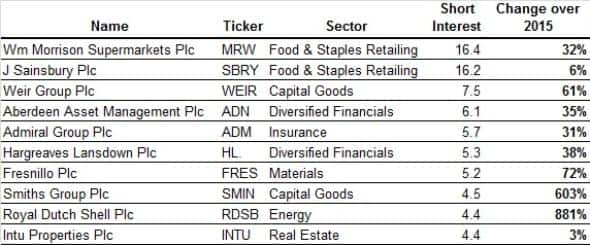

The firms which attracted the most scepticism from short sellers are evidenced in the 10 most shorted FTSE 100 constituents; a list which is replete with firms with high exposure to the recent commodities slump and emerging markets.

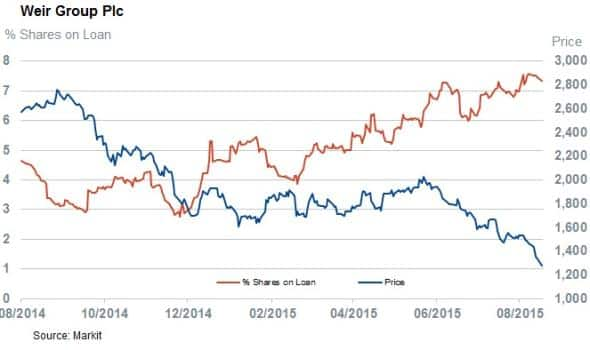

The third most shorted index constituent, behind perennial shorts Morrison's and Sainsbury's, is engineering and equipment firm Weir Group which services the oil and gas and mineral industries. The current commodities slump and the resulting impact on the industry's capital investment prospects has seen analysts trim 20% off their revenue expectation for Weir Group's current year. This weak operating environment has seen short sellers hone in on Weir shares, with demand to borrow shares more than doubling in the last 12 months to the highest level since early 2014.

The other capital goods firm, Smiths Group, also has a large exposure to the energy sector through its John Crane division which represented a third of the group's total revenues. The surge in demand to borrow Smiths shares has been even more pronounced than in Weir, with shorting activity now over five times the levels seen in January.

Firms with direct exposure to commodities have also been on short sellers' target, list with Fresnillo and Royal Dutch Shell both making the top ten most shorted. The latter saw the largest jump in short interest, which is now nearly nine times higher than at the start of the year with 4.4% of Shell shares now out on loan.

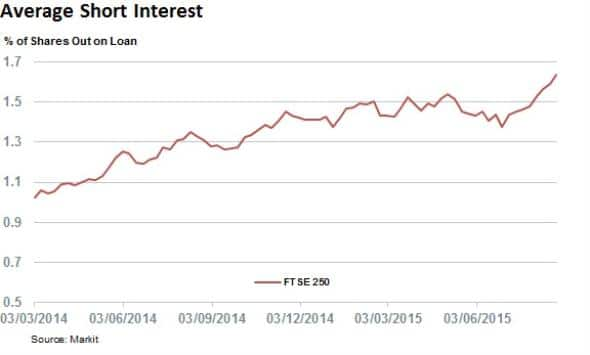

FTSE 250 also targeted

Short selling in UK stocks has not been concentrated solely on large cap shares as the constituents of the mid cap FTSE 250 index have seen a similar rise in average short interest. The index's constituents now have an average of 1.6% of shares out on loan, the highest in 18 months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Equities-UK-short-sellers-profit-from-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Equities-UK-short-sellers-profit-from-selloff.html&text=UK+short+sellers+profit+from+selloff","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Equities-UK-short-sellers-profit-from-selloff.html","enabled":true},{"name":"email","url":"?subject=UK short sellers profit from selloff&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Equities-UK-short-sellers-profit-from-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+short+sellers+profit+from+selloff http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25082015-Equities-UK-short-sellers-profit-from-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}