Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 25, 2016

US flash PMI downturn dampens second quarter rebound hopes

Hopes of US economic growth rebounding in the second quarter were dealt a blow by weak flash PMI data from Markit. A slowdown in the pace of growth signalled by the May surveys suggests the US economy could see GDP rise at a disappointing rate similar to that recorded in the opening quarter of the year.

The survey data also indicated a further easing in order book and employment growth in May, while price pressures lifted higher.

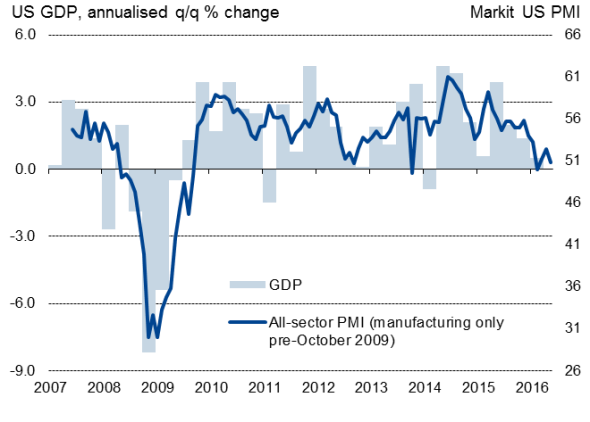

US 'economic growth' v Markit PMI

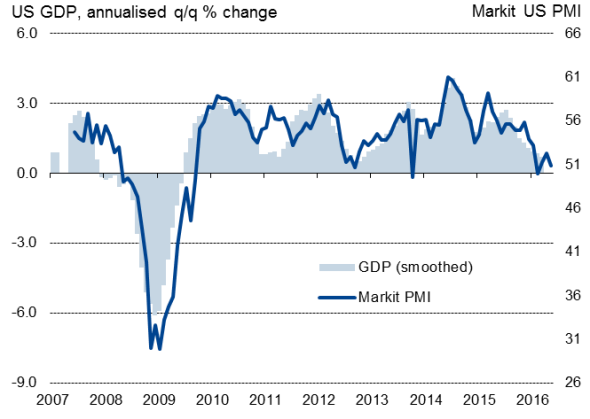

US smoothed* 'economic growth' v Markit PMI

* GDP smoothed using a centred moving average

No signs of second quarter rebound

The seasonally adjusted Markit Flash US Composite PMI Output Index fell from 52.4 in April to 50.8 in May to signal one of the weakest monthly expansions of business activity seen since the global financial crisis.

Over the past three-and-a-half years, only October 2013 (when the government shutdown affected business activity in some sectors) and last February (when adverse weather conditions were reported by some companies) have seen weaker PMI numbers.

So far in the second quarter, the PMI has averaged 51.6, only marginally higher than the mean of 51.5 recorded in the first quarter. As such, the PMI points to second quarter GDP rising at an annualised rate of just 0.7%, unchanged on the pace signalled by the PMI for the first quarter. Official initial estimates, still subject to revision, put first quarter growth at 0.5%.

Service sector growth has slowed to one of the weakest rates seen since 2009, and manufacturing is already in its steepest downturn since the recession, according to Markit's surveys.

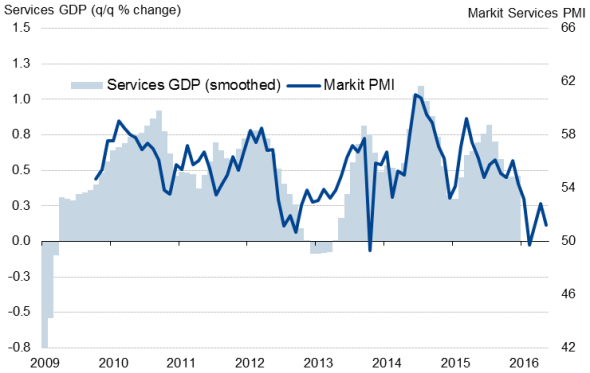

Service sector activity

Growth has slowed in line with waning demand: the surveys showed inflows of new business at manufacturing and service sector companies rising at the second-slowest pace since 2009. Backlogs of work tumbled at the steepest rate since August 2013 as inflows of new work failed to fully replace prior orders.

Looking towards the year ahead, business confidence in the service sector fell to the lowest seen since the survey began in October 2009 as a result of the slowdown in demand as well as growing uncertainty regarding the presidential election, according to anecdotal evidence provided by survey participants. Companies and their clients were often seen to have been unwilling to commit to new projects in an increasingly uncertain economic and political climate.

Hiring hit by uncertainty

The deteriorating order book situation and waning business optimism also led to a further pull-back in hiring as companies scaled down their expansion plans.

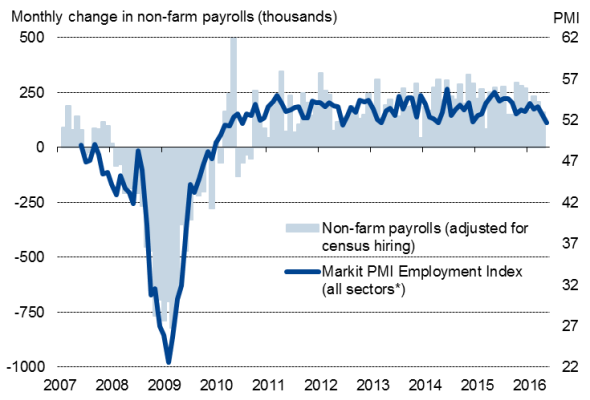

The weighted average of the employment indices from the two Markit PMI surveys fell to its lowest since April 2014. The surveys are signalling a non-farm payroll rise of 128,000 in May, down from a signal of 159,000 in April and an average of 197,000 in the first three months of the year. Official data showed a similar slowdown to 160,000 in April.

US non-farm payrolls v Markit PMI

Sources for charts: Markit, Datastream

The survey data indicated that ongoing manufacturing job losses, running at around 7,000 in May according to historical comparisons with official data, were offset by net job creation in the service sector, but even here the rate of hiring was the slowest for almost one-and-a-half years.

Fed tests

Markit's PMI surveys were one on the very few indicators that provided an early warning that the economy was slowing sharply in the first quarter and that non-farm payroll growth was weakening, so the ongoing malaise signalled in the second quarter is of particular concern for Fed policymakers expecting the slowdown to be short-lived.

After more hawkish than expected minutes were seen from the April FOMC meeting, markets have priced in a greater likelihood of interest rates rising in either June or July. The futures-based probability of a June hike has increased to 37%.

However, the Fed has set three tests before hiking interest rates again, wanting to see signs that the economy is regaining momentum in the second quarter, that the labour market continues to improve and that price pressures are rising. But with the surveys showing no sign of any growth rebound and the labour market cooling, only the latter test is passed according to the PMI data.

Furthermore, with prices rising largely on the back of higher oil prices, rather than a fundamental improvement in demand, is seems that even core inflationary pressures remain subdued.

To find out more contact economics@markit.com.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Economics-US-flash-PMI-downturn-dampens-second-quarter-rebound-hopes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Economics-US-flash-PMI-downturn-dampens-second-quarter-rebound-hopes.html&text=US+flash+PMI+downturn+dampens+second+quarter+rebound+hopes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Economics-US-flash-PMI-downturn-dampens-second-quarter-rebound-hopes.html","enabled":true},{"name":"email","url":"?subject=US flash PMI downturn dampens second quarter rebound hopes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Economics-US-flash-PMI-downturn-dampens-second-quarter-rebound-hopes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+downturn+dampens+second+quarter+rebound+hopes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Economics-US-flash-PMI-downturn-dampens-second-quarter-rebound-hopes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}