Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 25, 2016

Securitised peer-to-peer loans see risk escalate

Recent troubles at Lending Club have only compounded risk in the peer-to-peer credit market

- P2P backed loans were introduced in 2014 and saw spreads fall to lows in mid-2015

- Average spread on senior P2P loan backed securities has widened 76% since last October

- Markit Liquidity score among P2P securities has deteriorated to 2.69 from 1.50 last December

The start of May saw peer-to-peer (P2P) loans company Lending Club, fall into trouble as it failed to address $22m of false loans properly. Its founder was quickly ousted and the aftermath of the scandal revealed the true extent of the company's business model as one which relied heavily on hedge funds as lenders, putting scrutiny on the P2P market.

P2P sector

The impact of Lending Club's problems on financial markets was most evident in its stock price, which halved. Less visible was its impact on credit markets and in the market for securitised P2P loans. The risk in the sector spiked just after the announcement, but wider analysis shows the danger in the P2P industry has been on the rise since last October.

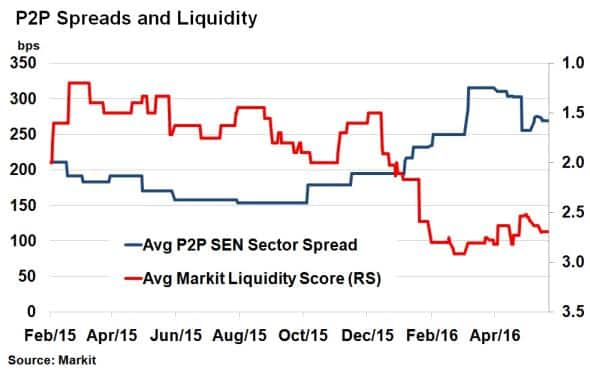

According to Markit's securitised products pricing service, the average spread in the senior P2P sector has widened to 269bps, from 153bps last October, a 76% rise. And it's not just the risk of default that has been growing; P2P bonds have become harder to trade, with liquidity in the sector falling in tandem.

The average Markit Liquidity score, which incorporates bid/ask spreads, market depth, dealer quotes and trade volumes, experienced a sharp fall at the start of this year. The average score has deteriorated to 2.69 as of March 23rd, from 1.50 last December (1 being most liquid and 5 being least liquid).

The higher costs associated with P2P securitisation is in contrast to the values seen mid last year. P2P backed securities originated in 2014 and the buoyant sector saw spreads tighten from over 200bps in February 2015 to 153bps by the summer. Market volatility in the wider credit market and subsequent loss of confidence in the P2P market saw spreads widen to over 300bps by March this year before some respite saw spreads tighten to 255bps.

Latest woes at Lending Club in the industry have meant spreads remain at elevated levels. The prospect of further regulatory scrutiny has continued to haunt the P2P industry, which may ultimately affect P2P lender's ability to access the securitization markets in the future.

For any information about securitized pricing or sector products, please contact USABSPRICING@markit.com

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Credit-Securitised-peer-to-peer-loans-see-risk-escalate.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Credit-Securitised-peer-to-peer-loans-see-risk-escalate.html&text=Securitised+peer-to-peer+loans+see+risk+escalate","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Credit-Securitised-peer-to-peer-loans-see-risk-escalate.html","enabled":true},{"name":"email","url":"?subject=Securitised peer-to-peer loans see risk escalate&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Credit-Securitised-peer-to-peer-loans-see-risk-escalate.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securitised+peer-to-peer+loans+see+risk+escalate http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25052016-Credit-Securitised-peer-to-peer-loans-see-risk-escalate.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}