Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 25, 2015

Transportation losing steam

Short sellers have increased positions in the road and rail sector, despite the sector having outperformed the overall market in recent months.

- Average short interest for the transportation sector has increased by 7% in 2015

- Short interest in Avis has increased, despite strong results expectations

- Turmoil in energy has impacted rail operators as volumes and prices fall

Transport rally slowing

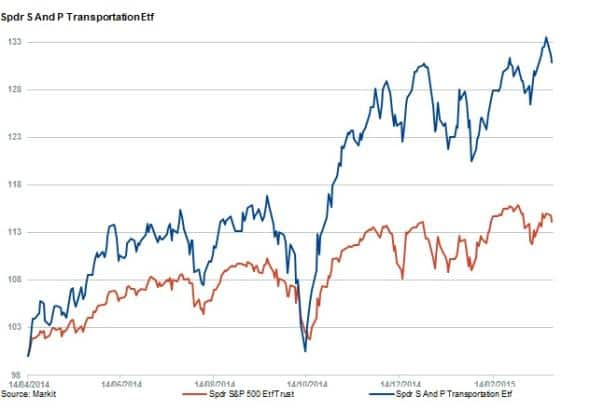

Since January 2012 the transportation sector in the US has performed well with the price of the SPDR S&P Transportation ETF having increased by 138%. Over the last 12 months, the ETF has outperformed the SPDR S&P 500 ETF by 16.6%.

The outperformance can be attributed to the dramatic decline in the oil price which is a large proportion of operating costs in the sector. However, with the US economic recovery having been driven, in part, by the shale gas revolution, the lower oil price has also resulted in lower volumes and fuel surcharges.

Sector sort interest

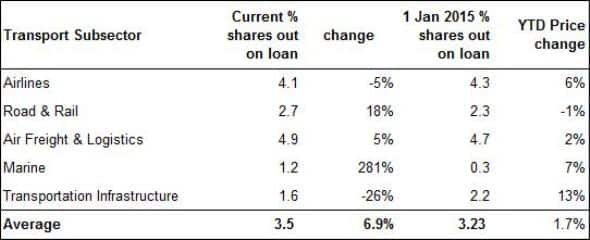

Across the constituents of the S&P Transportation index, three subsets represent 95% of all firms. Road & rail is the largest subsector accounting for 48% of firms, followed by airlines and air freight & logistics.

While airlines and air freight & logistics record relatively high levels of average short interest at 4.1% and 4.9% respectively, the increased demand to borrow is most prevalent in road & rail companies.

The average short interest across the road & rail subsector has increased by 18% since the start of the year to 2.7% of total shares on loan.

Shorting road & rail

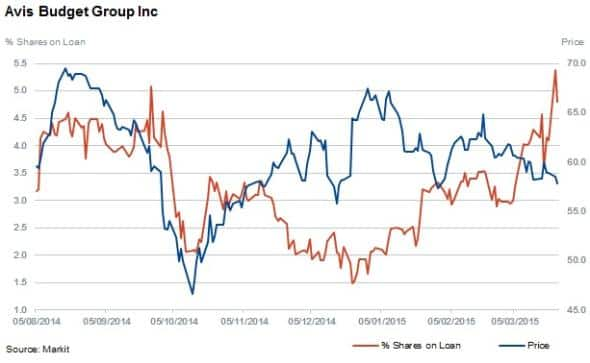

Seeing a jump in short selling in recent weeks is car rental firm Avis Budget Group, which owns Zipcar.

Avis has delivered five years of double digit CAGR, both in revenue and earnings. Analysts are forecasting a strong 2015 financial year, putting the company's prospects at odds with the increased short selling activity. The company does have significant international earnings exposure with 31% of its revenues coming from overseas. This could partially explain short seller's motives as continued dollar strength could dilute earnings.

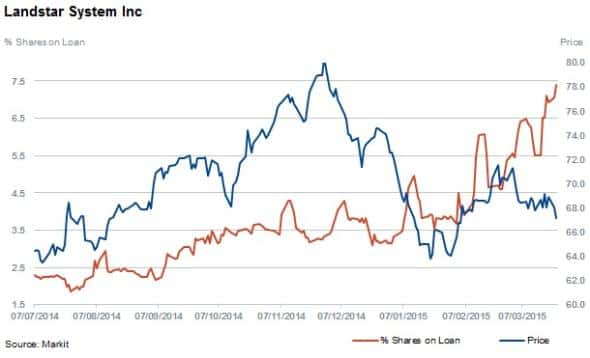

Landstar System provides integrated intermodal transport and freight solutions throughout North America. The company's shares out on loan have more than doubled since the start of the year reaching 7.4%. The share price of the relatively small logistics player ($3bn market cap) has decreased by 7% year to date.

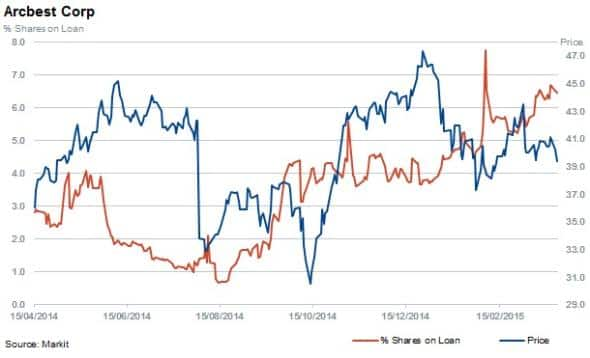

Arcbest shares have declined by 15% year to date while short sellers have increased positions by 72%. The total shares out on loan has risen to 6.5%. The US freight transportation and logistics provider is one of the largest 'less than truck load' transportation providers. Like peer, Landstar, it should be benefiting from lower operating costs due to lower oil prices, but both are currently being targeted by short sellers.

Railroads losing energy

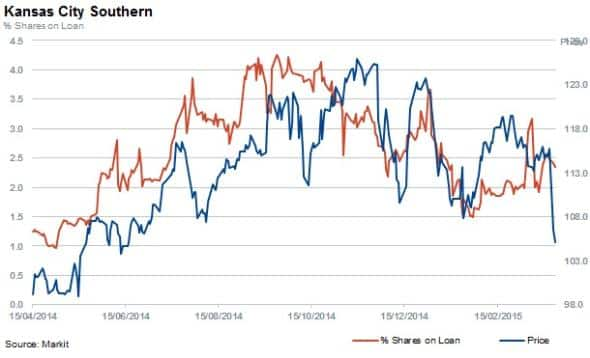

Train operators in the US have been hard hit by cheaper energy prices and the stronger dollar. This Monday, Kansas City Southern saw its shares dive by 8% as the company released guidance lowering earning expectations for 2015.

The company cited lower expected energy revenues due to declining hydraulic fracturing activity and falling volumes in "frac sand and metals". Additionally coal shipments have been negatively affected by the increased use of cheaper natural gas and Mexican Peso earnings are being diluted by the strong dollar.

Short sellers have covered positions in Kansas City Southern by 36% since the start of the year, while the share price declined by 14%.

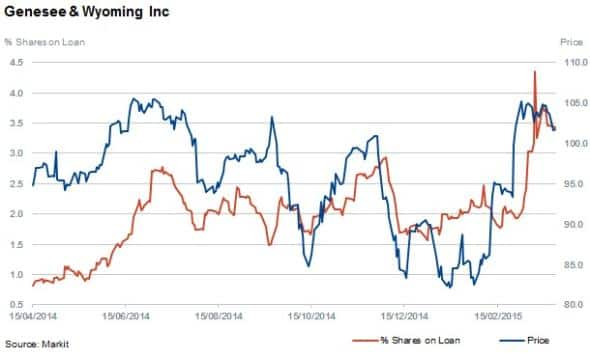

Relatively smaller rail operator, Genesee & Wyoming has seen its share price rise in recent weeks with a 91% increase in short interest to reach 3.4% of the total shares on loan. The company has significant rail networks in the US with major exposure to coal haulage and 20% of revenues derived from Australian operations which are susceptible to US dollar strength.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-equities-transportation-losing-steam.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-equities-transportation-losing-steam.html&text=Transportation+losing+steam","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-equities-transportation-losing-steam.html","enabled":true},{"name":"email","url":"?subject=Transportation losing steam&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-equities-transportation-losing-steam.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Transportation+losing+steam http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25032015-equities-transportation-losing-steam.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}