Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 24, 2015

Curtain being pulled across the coal face

Energy utilities, prised for their captive consumption base and predictable cash flows face upheaval as pricing dynamics and environmental progress creates opportunities for short sellers.

- Shorts get coal windfall as Drax shares hit an all-time low on UK 2025 energy deadline

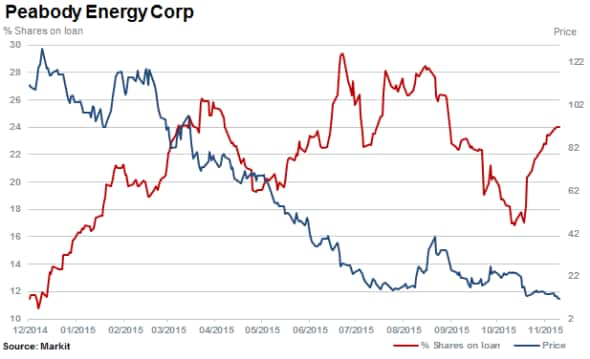

- Short demand in Peabody surges as cost to borrow soars after Q3 loss reported in October

- Drop off in energy demand offsets lower prices as short interest spikes in ChinaHuaneng

UK & US join coal divesture

Early in October 2015, a California Governor signed into law a bill that requires the state's public pension funds to divest from coal companies deriving 50% of their revenues from thermal coal. One of the largest funds manages almost $300bn. The alignment of pension funds' investment themes with social agendas is spreading and has seen Norway's parliament endorse the divestment of its $900bn sovereign wealth fund away from coal.

The commodities slump has also taken its toll on the lure of coal based energy investments. Over the past five years, excluding coal across a wide portfolio of assets across the Russel 3000 has proven more rewarding.

Shorts far from the coal face

Coal is responsible for around a quarter of the current power generation in the UK but a clear date has now been set by government to switch off coal energy supply by 2025.

News of the deadline sent shares in Drax, the operator the largest coal fired power station in the UK, to an all-time low.

Short sellers have been tracking Drax for some time as one of the biggest CO2 emitters in the UK. Short interest had increased over the last 12 months to 10% of shares outstanding on loan. Drax stock meanwhile has fallen 60%. Efforts to diversify and transform into a less carbon intensive biomass producer have been thwarted by plummeting energy prices and progressing renewables.

China energy prices under pressure

Weaker demand emanating from China has largely been blamed for the slump in commodity prices globally. Now the slowdown is impacting Chinese energy producers who should be benefiting from lower (coal) input costs.

The Hong Kong listed unit of the largest producer in China, Huaneng Energy saw shares fall and short interest spike to 11.7% as the company announced a capital raising ahead of an expected cut in power prices. The company, while benefiting from lower coal prices has reported a slump in demand and coupled with price weakness has seen shares fall 30% in the last six months.

Public policy impacts

Given the increased global scrutiny of generating power from coal faces Peabody a primary coal producer, in the US has seen a significant increase in short interest over the past month after reporting a third quarter loss. 25% of shares are now outstanding on loan with short sellers clamouring to sell the stock - driving the cost to borrow above 80%. Overall short interest has increased 41% while the stock price halved in the last month.

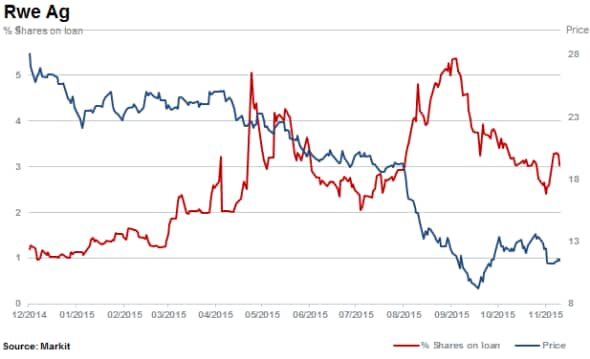

While there has been state legislated divestment from coal mandated in the US, targets set in the UK, and Norwegian divestment adopted, Germany has turned its back on nuclear generated power completely.

With the costs of decommissioning plants resting with the owners such as RWE, CDS spreads and short interest has spiked with share prices falling dramatically.

Shares in RWE have fallen by two thirds in the last 12 months.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Equities-Curtain-being-pulled-across-the-coal-face.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Equities-Curtain-being-pulled-across-the-coal-face.html&text=Curtain+being+pulled+across+the+coal+face","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Equities-Curtain-being-pulled-across-the-coal-face.html","enabled":true},{"name":"email","url":"?subject=Curtain being pulled across the coal face&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Equities-Curtain-being-pulled-across-the-coal-face.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Curtain+being+pulled+across+the+coal+face http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24112015-Equities-Curtain-being-pulled-across-the-coal-face.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}