Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 24, 2015

Week Ahead Economic Overview

The week sees the release of worldwide manufacturing PMI results plus unemployment and consumer price numbers in the eurozone. The publication of non-farm payrolls and factory orders data will add to the policy debate in the US, while the final estimate of second quarter GDP is out in the UK.

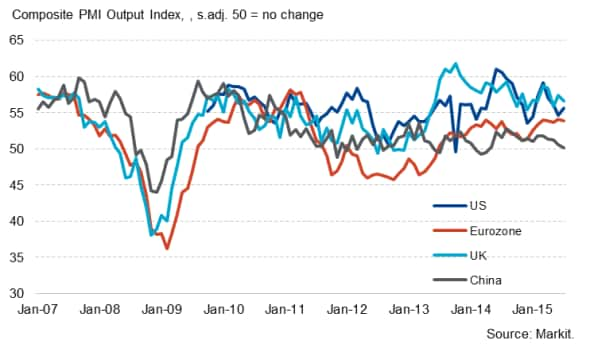

Composite PMI Output Index

After the Fed decided to keep interest rates on hold at their September meeting, attention now shifts to December as the next most likely month for US interest rates to start rising. The release of final manufacturing PMI results, factory orders data and the all-important employment report will add to the 'data dependent' policy debate at the Federal Reserve.

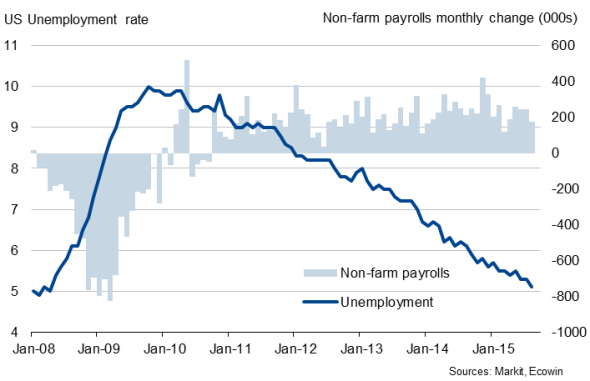

Non-farm payrolls are expected to rise by 203k, according to the latest Thomson Reuters poll, and it's also likely that August's figure of a 173k increase will get revised higher. Further improvements in the labour market would clearly be arguments for an imminent rate hike, after unemployment hit a seven-and-a-half year low of 5.1% in August.

Before the jobs report, the US sees ISM and Markit final PMI data for manufacturing. The September flash PMI indicated that manufacturing expanded at its slowest pace for two years, with producers struggling against the strong dollar and weak growth in key export markets. Moreover, employment and new order growth in the sector have slowed. If confirmed by the final data, this could help push the first rate hike into next year.

US labour market

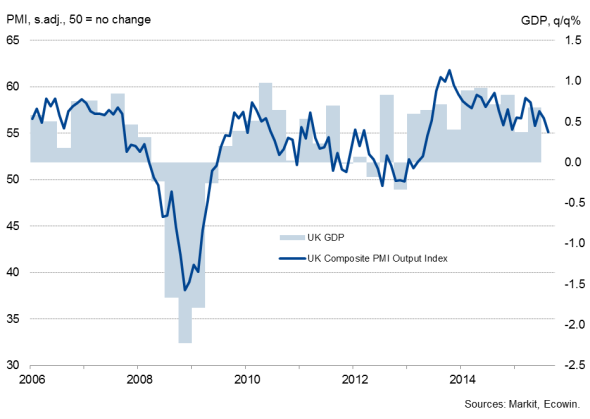

Over in the UK, the third and final estimate of second quarter GDP is released by the Office for National Statistics (ONS) on Wednesday. According to the second estimate, the UK economy grew by 0.7% in the three months to June, in line with business survey data and up from the disappointing 0.4% at the beginning of the year. However, PMI data available for the third quarter so far point to a slowdown in economic growth, with the pace of expansion down to 0.5% at best. The release of construction and manufacturing PMI results will therefore be viewed carefully for insights into the health of the UK economy at the end of Q3.

UK GDP and the PMI

Final PMI results plus unemployment and inflation data releases will be important for eurozone data watchers as the ECB mulls over the possible need for further stimulus. ECB boss Mario Draghi has already said that the bank would not "hesitate" to expand its QE programme if inflation and economic growth are weaker than expected.

Despite a slight dip, September's flash PMI rounded off the region's best quarter for four years, with the survey data consistent with a 0.4% rise in GDP in the third quarter. Manufacturing PMI results are published on Thursday and will include more national detail.

Annual inflation in the eurozone meanwhile dropped to 0.1% in August as the low oil price continued to exert downwards pressure on consumer prices.

Moreover, unemployment data are released in the region on Wednesday. The jobless rate fell to 10.9% in July, but business survey data signal that the rate of job creation eased to an eight-month low in September, as many firms focused on boosting productivity.

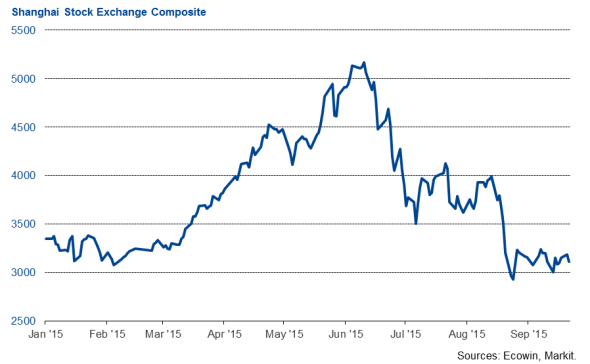

With China's stock market having shed 45% since June and signs of economic growth having slowed intensifying, data watchers are eagerly awaiting the release of final PMI data for China and other countries across the region to gauge the extent to which the malaise may be spreading. Results of the manufacturing PMI surveys are released on Thursday. Flash data signalled that China's goods-producing sector is buckled under the weight of a brutal combination of accelerating job losses, slumping export orders and the unwanted build-up of unwanted inventories. The flash Caixin China General Manufacturing PMI fell to a six-and-a-half year low.

Chinese stock market

Monday 28 September

In Germany, import price data are published by the Deutsche Bundesbank.

Meanwhile, consumer confidence numbers are out in Italy.

Personal income and pending home sales figures are meanwhile issued in the US.

Tuesday 29 September

The Reserve Bank of India announces its latest monetary policy decision.

The European Commission releases economic sentiment data for the currency union.

Germany and Spain see the publication of retail sales and consumer price numbers.

The Bank Austria Manufacturing PMI is released.

House price information and mortgage approvals data are meanwhile issued in the UK.

The latest IGP-M Inflation Index is released in Brazil.

Meanwhile, producer price figures are out in Canada.

The US Conference Board publishes consumer confidence data, while S&P/Case-Shiller home prices are also updated.

Wednesday 30 September

Building permit and private sector credit data are issued in Australia.

In Japan, industrial output figures and housing starts numbers are released.

Infrastructure output and M3 money supply data are published in India alongside federal budget information.

Trade balance figures and M3 money supply information are out in South Africa.

Unemployment and consumer price data are meanwhile issued for the eurozone.

In France, producer price and consumer spending numbers are published, while Spain sees the release of current account data.

Retail sales and producer price figures are out in Greece.

The UK sees the final release of second quarter GDP numbers, while monthly GDP figures are issued in Canada.

Budget balance information are published in Brazil.

ADP national employment data are updated in the US.

Thursday 1 October

Manufacturing PMI results are released worldwide.

Results of the latest Bank of Japan Tankan business sentiment survey are out.

New car sales numbers are published in South Africa.

ISTAT releases public deficit information for Italy.

In Brazil, trade balance figures are issued.

The US sees the release of initial jobless claims numbers.

Friday 2 October

The G20 energy ministers meet in Istanbul.

In Australia, retail sales numbers are published.

Japan sees the release of unemployment and household spending data.

Eurostat issues producer price figures for the currency bloc.

The Markit/CIPS UK Construction PMI is published.

Meanwhile, Brazil sees the release of industrial output data.

Non-farm payrolls and factory orders numbers are the closing highlights of the week.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24092015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}