Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 24, 2015

Turkey's uncertainty worries investors

The political uncertainty gripping Turkey spooked investors, with the country's CDS spreads and bonds all seeing increased bearish sentiment since the inconclusive June election.

- Turkey's CDS spread at a new 12 month high of 283bps

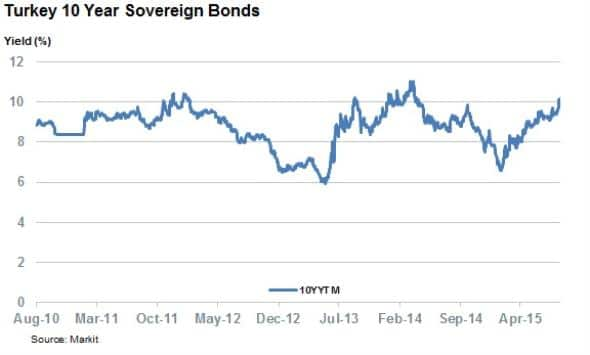

- Turkish 10 year government bonds have widened by over 220bps year to date

- Dollar denominated Turkish corporate bond spreads have widened to 15 month highs

Turkey's ruling AK party's inability to form a government in the wake of the June 7th election has the country set to return to the polls in November. This political uncertainty, combined with the resumption of hostilities with Kurdish PKK separatists, has weighed heavily on the Turkish lira which has sunk by over 10% against the US dollar to a new all-time low since the June election.

This instability has also been felt in the country's credit market, with both sovereign and corporate bonds trading with increased bearish sentiment in the wake of the recent election.

CDS spread at new recent highs

Turkey's CDS spreads have been steadily rising over the last few weeks and last week's failure to form a stable government has seen this measurement of the country's credit risk climb to new recent highs. 5 year Turkish CDS spreads stood at 215bps on the eve of the Turkish election and the subsequent ten weeks have seen that number climb to 283bps; over a quarter higher.

Most of the recent widening occurred in the wake of the country's resumption of hostilities with the PKK, which raised the prospects of further political turmoil given the fact that the Kurdish HDP party managed to enter parliament for the first time in the June election. The HDP's strong performance in these elections offers a new political reality for Turkey's president Recep Erdogan, whose AK party was deprived of the parliamentary majority which it had enjoyed over the last decade.

Government bonds under pressure

Turkey's domestic bonds have also felt the market's recent bearishness seen in the country's CDS spread. Turkey's 10 year Lira denominated bonds have sold off heavily and now trade at 10.08%; the first time they have traded above 10% since early 2014. That rate had stood at 9% on the eve of the June election.

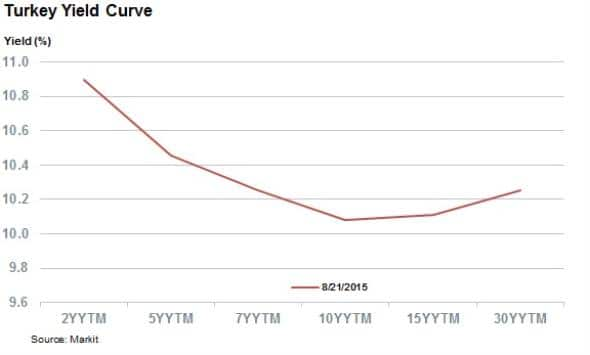

The recent selloff means that the country's yield curve is now inverted, with short dated bonds now yielding more than longer dated peers. This trend generally indicates short term stress; unsurprising given the lack of political consensus currently engulfing the country.

Corporate bonds also under stress

This climate of uncertainty is also starting to trickle down to Turkish corporate bonds, even those denominated in US dollars. The Markit iBoxx USD Corporates Turkey Index has seen its yield jump by 45bps since the start of June to trade at the widest level since April 2014.

This jump was entirely driven by investors demanding additional yield to hold Turkish corporate bonds, as the index's spread over benchmark US bond yields has risen to 400bps, up from 340bps in the eve of the election.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-Credit-Turkey-s-uncertainty-worries-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-Credit-Turkey-s-uncertainty-worries-investors.html&text=Turkey%27s+uncertainty+worries+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-Credit-Turkey-s-uncertainty-worries-investors.html","enabled":true},{"name":"email","url":"?subject=Turkey's uncertainty worries investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-Credit-Turkey-s-uncertainty-worries-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkey%27s+uncertainty+worries+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24082015-Credit-Turkey-s-uncertainty-worries-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}