Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2015

Eurozone flash PMI holds close to four-year high despite Greek uncertainty

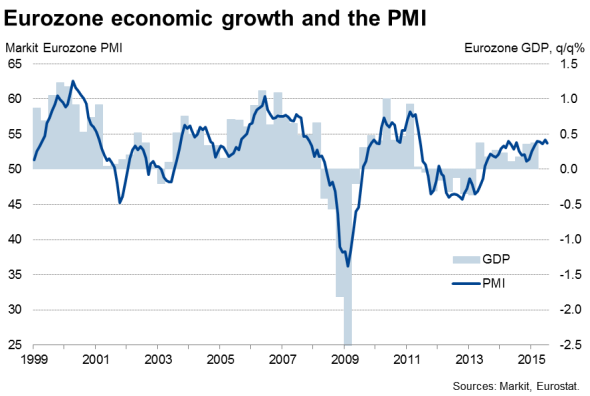

Eurozone economic growth lost only slight momentum in July amid the rollercoaster events of the Greek debt crisis during the month. The rate of expansion remained reassuringly robust to suggest that it was by-and-large 'business as usual' for the region as a whole.

At 53.7, the Markit Eurozone PMI" fell from June's four-year high of 54.2 but remained slightly above the average seen over the first half of the year.

The survey data were collected between July 13-23, after the July 5 Greek referendum and commencing on the day that Greece and its creditors subsequently struck an agreement on the country's third bailout, though there was little conclusive evidence from survey respondents as to the extent to which the events directly affected business activity either positively or negatively.

The PMI suggests the eurozone continues to enjoy its strongest performance in terms of both economic growth and job creation seen over the past four years. The survey indicates that the economy grew 0.4% in the second quarter and sustained this steady pace at the start of the third quarter.

The ECB will therefore probably be somewhat reassured by the solid PMI readings, given the events of the month.

Although the survey also showed business confidence in the service sector hitting the lowest so far this year, recent positive developments in relation to Greece suggest the pace of growth could pick up again in coming months. The region should therefore enjoy growth of at least 1.5% this year providing there is no re-escalation of 'Grexit' worries, though new twists in the saga are of course by no means assured.

Deflation worries should also be allayed further by average prices charged for goods and services steadying in July, the survey gauge rising tantalisingly close to the neutral level to buoy hopes that August will see prices rising for the first time in three-and-a-half years.

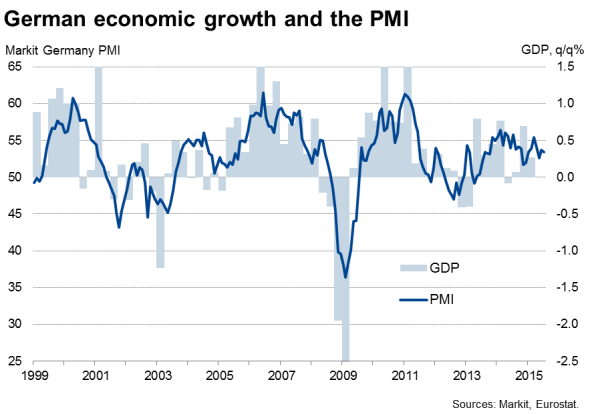

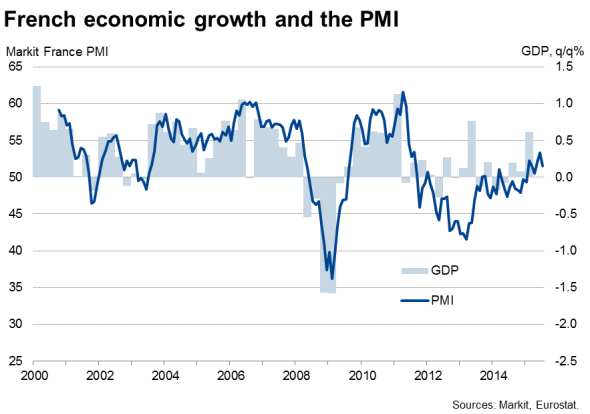

The survey points to the German economy growing at a 0.3% rate at the start of the third quarter, sustaining the pace that the survey also signalled for the second quarter. In France, the weaker PMI reading is consistent with a more modest 0.2% expansion (though rising government spend could - as has been the case in recent years - propel France to a stronger rate of expansion).

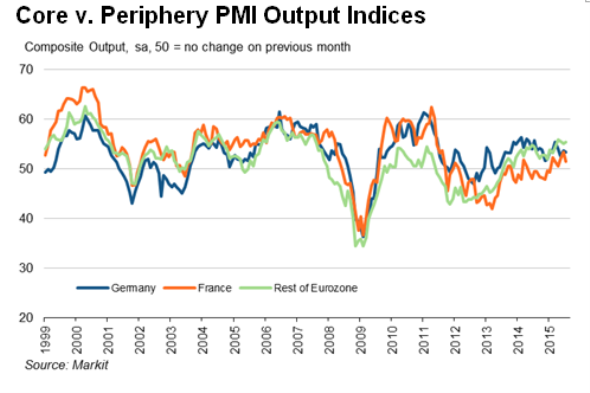

However, with the PMIs dipping in both France and Germany in July, the star of the show was once again the rest of the region, which in fact saw business activity growth accelerate slightly further ahead of the two 'core' member states in July. More detail on these other countries will only be known with the publication of the final PMI data on 3rd August.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Eurozone-flash-PMI-holds-close-to-four-year-high-despite-Greek-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Eurozone-flash-PMI-holds-close-to-four-year-high-despite-Greek-uncertainty.html&text=Eurozone+flash+PMI+holds+close+to+four-year+high+despite+Greek+uncertainty","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Eurozone-flash-PMI-holds-close-to-four-year-high-despite-Greek-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI holds close to four-year high despite Greek uncertainty&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Eurozone-flash-PMI-holds-close-to-four-year-high-despite-Greek-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+holds+close+to+four-year+high+despite+Greek+uncertainty http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Eurozone-flash-PMI-holds-close-to-four-year-high-despite-Greek-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}