Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 24, 2015

Greek yields surge; Petrobras recovers

Investors have grown increasingly impatient with Greece as it negotiates with its creditors; meanwhile Petrobras' positive steps are starting to appease credit investors.

- Greek ten year bond yields hit 2012 levels as payment deadlines loom

- Petrobras' credit spreads have dropped 30% in April

- Credit markets show little sign of UK election risk, unlike in 2010

Greece

Europe's finance ministers met today for their latest Eurogroup meeting, with Greece firmly at the top of the agenda. The tussle to unlock €7.2bn of bailout funds has intensified over the past month as negotiations between Greece's leaders and 'the institutions' (IMF, EU and ECB) remain in deadlock. The institutions want Greece to get more serious about economic reforms while Greece's government wants to stand by its anti-austerity mandate.

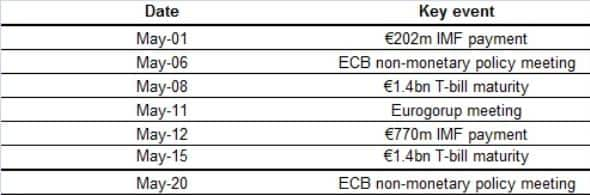

With Greece's coffers running dry and €972m of IMF payments and €2.8bn of maturing T-bills due for repayment in May, time is running out. Greek bond yields have taken a turn for the worse with short term yields sky rocketing above 25%. Even the ten year bond, which is less susceptible to imminent credit events, has spiked above 12%; a level which was last seen in 2012.

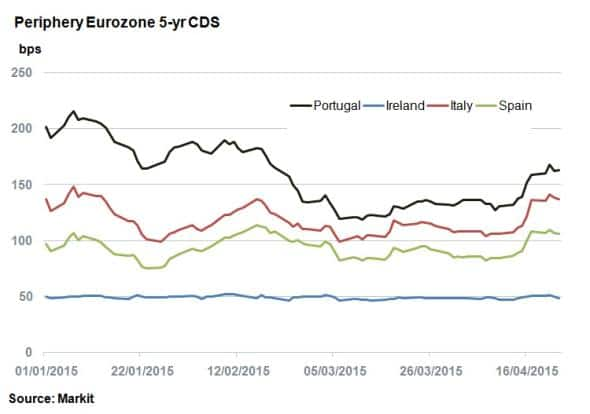

While the default risk associated with a Grexit spillover into Europe's periphery has rescinded since the ECB implemented QE, jitters are beginning to resurface. Portugal, Ireland and Italy have seen their 5-yr CDS spreads widened to two month highs.

Petrobras

Embroiled in Brazil's biggest corruption scandal, state owned Petrobras finally released quarterly results. Heavy write downs and corruption losses ensued, but the process of cleaning up the stricken oil giant has at least begun.

On March 13th, 5-yr CDS spreads hit 711bps, an all-time high, with low oil prices also damaging operations. April has seen investor mood brighten in Petrobras credit; a sign of confidence in the company's recovery plans.

This month alone, 5-yr CDS spreads have dropped 165bps to 390bps; the last time spreads were at this level was on December 11th last year.

It still too early to tell if the credit market has yet to fully endorse the company's turnaround strategy as credit spreads still above historical norms, but sentiment appears to be moving in the right direction.

UK election

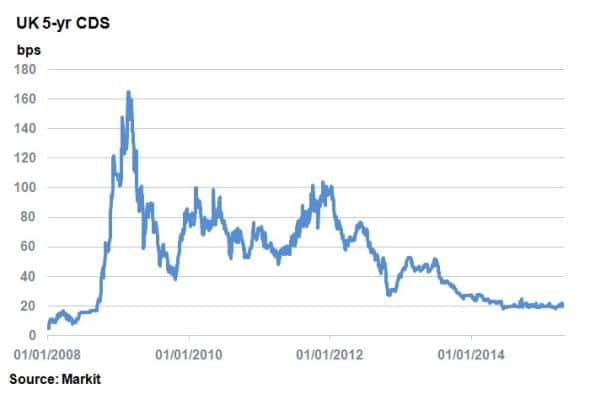

The recent general election opinion polls signal a high probability of another hung parliament. Although major think tanks have outlined that Labour wants to borrow more and the Conservatives have promised an EU membership referendum in 2017, credit markets have shown little reaction.

This contrasts with the last general election in 2010 when 5-yr CDS spreads increased from 76bps to 92bps as political uncertainty grew. This time around the UK is in healthier fiscal position, enjoying a higher growth rate and less credit market contagion.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-credit-greek-yields-surge-petro.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-credit-greek-yields-surge-petro.html&text=Greek+yields+surge%3b+Petrobras+recovers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-credit-greek-yields-surge-petro.html","enabled":true},{"name":"email","url":"?subject=Greek yields surge; Petrobras recovers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-credit-greek-yields-surge-petro.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+yields+surge%3b+Petrobras+recovers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24042015-credit-greek-yields-surge-petro.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}