Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2017

US Flash PMI surveys show economic growth moderating in first quarter

The US economy shifted down a gear in March. A slowing in the pace of growth signalled by the Flash PMI surveys suggests that the economy is struggling to sustain momentum. Hiring has also slowed and business confidence remains below the level seen at the start of the year.

The Output Index from the Markit Composite PMI, which covers both manufacturing and services, fell for a second successive month in March, dropping from 54.1 in February to a six-month low of 53.2.

At 54.4, the first quarter average is down slightly from 54.6 in the fourth quarter of last year and signals a fractional moderation in GDP growth from the 1.9% annualised pace seen at the end of 2016. Historical comparisons indicate that the survey readings are consistent with annualised GDP growth of 1.7% in the first quarter.

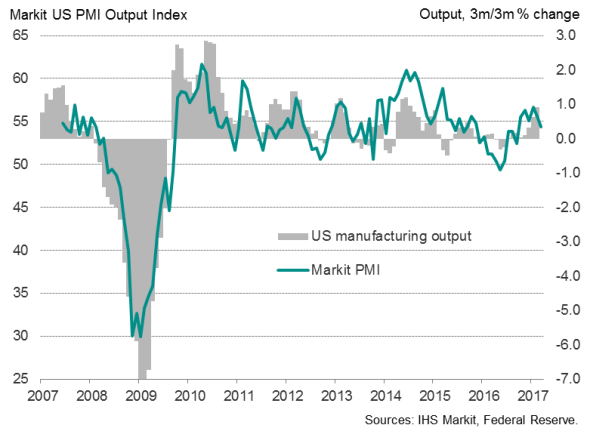

Both service sector activity and manufacturing output grew at the slowest rates for six months, with the respective rates of expansion having peaked in January.

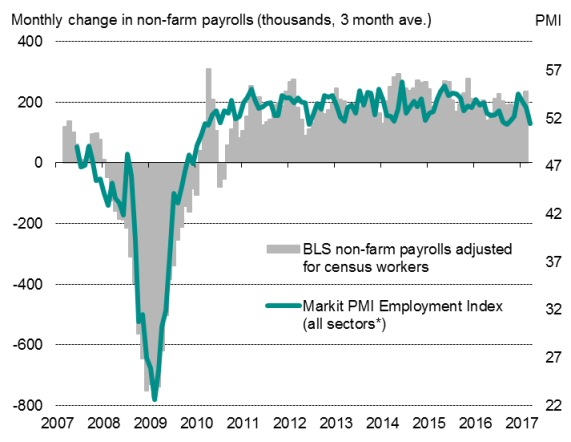

The survey has also signalled a marked waning in growth of new orders in recent months, which has in turn been a key cause of slower hiring. The employment readings from the survey consequently deteriorated for a third successive month in March, suggesting private sector hiring is running at a reduced rate of around 120,000 per month. Both manufacturing and service sector job growth moderated in March.

Goods export orders remained especially subdued, blamed in many cases on the strong dollar, rising only modestly. However, the slight pull-back in the currency in March was linked to an improvement on the near-stagnation of export sales seen in February.

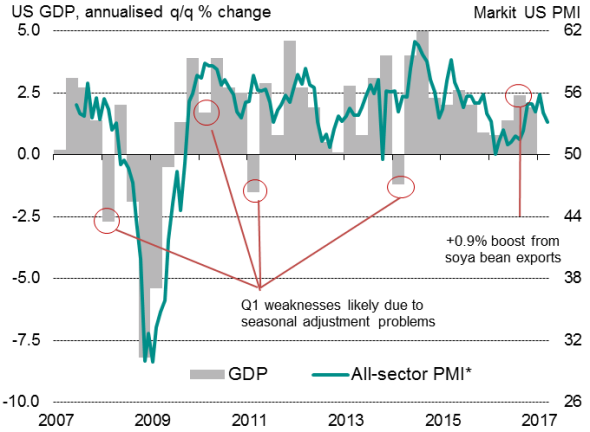

Markit US PMI and GDP

The Markit PMI data give a reliable advance picture of the underlying trend in GDP data. Times when the survey data have diverged from the official GDP numbers can usually be accounted for by the GDP numbers being distorted, either by residual seasonality or one-off effects such as surge in soya bean exports in the third quarter of 2016.

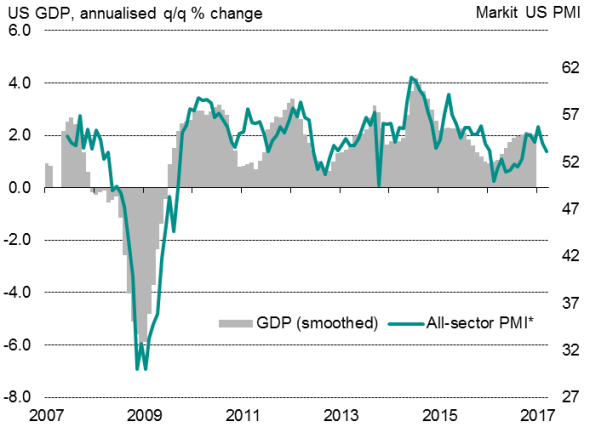

Smoothing the GDP data (using a centered moving average) to remove some of the distortions and residual seasonality reveals a higher correlation (89%) with the PMI and allows easier interpretation of the survey data.

The PMI data for January to March are historically consistent with GDP growing at an annualised rate of 1.7% in the first quarter.

Markit US PMI and smoothed GDP

Sources: IHS Markit, Commerce Department.

The still-strong dollar helped keep import costs down, however, and average input prices rose only modestly again, albeit the rate of inflation was up from February.

Higher prices in the manufacturing sector in particular were often linked to suppliers being busier and increasingly able to negotiate higher prices. The Suppliers' Delivery Times Index - a key gauge of capacity constraints and core inflation - signalled the most marked deterioration in lead times for two years.

As for the outlook, companies' expectations of their own business activity levels in the coming year rose from February's five-month low but remained considerably below January's peak, suggesting optimism has waned since the start of the year.

Employment

Manufacturing output

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-us-flash-pmi-surveys-show-economic-growth-moderating-in-first-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-us-flash-pmi-surveys-show-economic-growth-moderating-in-first-quarter.html&text=US+Flash+PMI+surveys+show+economic+growth+moderating+in+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-us-flash-pmi-surveys-show-economic-growth-moderating-in-first-quarter.html","enabled":true},{"name":"email","url":"?subject=US Flash PMI surveys show economic growth moderating in first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-us-flash-pmi-surveys-show-economic-growth-moderating-in-first-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Flash+PMI+surveys+show+economic+growth+moderating+in+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-us-flash-pmi-surveys-show-economic-growth-moderating-in-first-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}