Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2017

Japan Flash Manufacturing PMI signals solid Q1 GDP

PMI data signal the slowest rate of growth of Japan's manufacturing sector since December 2016. At 52.6 in March, the Nikkei Flash Japan Manufacturing PMI was down from 53.3 in February.

However, the PMI has now remained above the 50.0 no-change level for seven successive months, and the average reading over the first quarter is the highest since the first quarter of 2014, indicating solid growth momentum.

The headline manufacturing PMI comprises various sub-indices derived from survey questions on output, new orders, employment, inventories and suppliers' delivery times. This means the PMI acts as a broad indicator of the health of the manufacturing sector.

The sub-indices reveal more detail about each month's performance than the headline PMI. At the moment, exports continue to grow at a steady clip, as yen weakness boosts competitiveness, although some pull-back in export growth was seen in March due to the yen's recent recovery against the US dollar.

The currency's weakness means inflationary pressures have risen, with input prices climbing markedly.

Further increases in new orders, backlogs of work and purchasing activity, albeit at softer rates, meanwhile all point to the upturn continuing in April.

The Flash PMI data reinforce confidence that the sustained expansion in the manufacturing sector will provide a significant fillip to the economy in the first quarter. February's Nikkei Japan Services PMI also point to a robust tertiary sector performance.

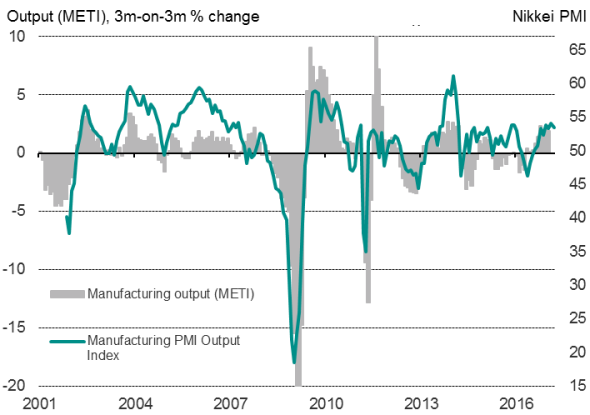

Manufacturing output

Output growth remains solid

Although growth of manufacturing output eased from February, the rate of expansion in recent months has been sufficient to suggest manufacturing will contribute substantially to the economy in the first quarter.

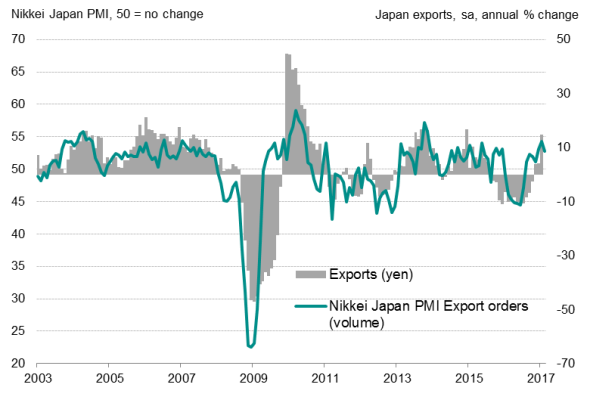

Export demand drives production higher

A major driver of the increase in production was a further rise in manufacturing exports during March. The new export orders index indicated that export sales rose for the seventh straight month, albeit at the slowest rate since December.

The survey found stronger overseas demand was supported by a relatively weak yen. However, the recent appreciation of the yen, up 5% against the US dollar so far this year, may provide less of a competitive advantage if the trend continues.

Exports

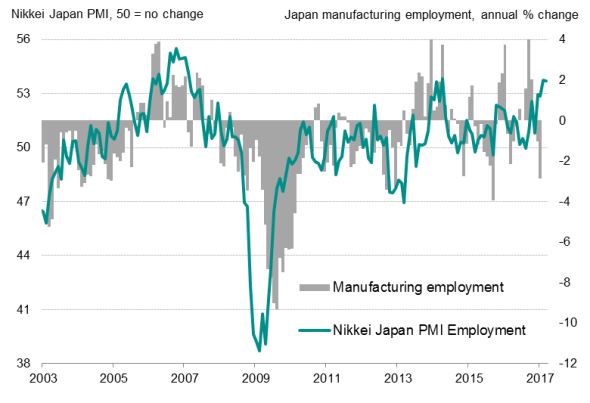

More hiring as capacity pressures build

Factory hiring continued at a robust pace in March, with the rate of job creation unchanged from February's near three-year peak. The appetite to hire was largely driven by a solid pipeline of incoming new orders and rising backlogs.

Manufacturing jobs

Sources: IHS Markit, Nikkei, Thomson Reuters Datastream

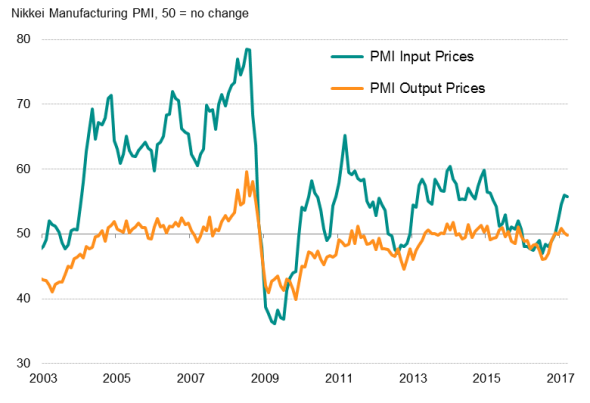

Inflationary pressures persist

Manufacturers' average input prices continued to rise at one of the steepest rates seen since January 2015. This was in part due to the weaker yen driving up the cost of imported inputs, while higher prices for global commodities were another factor.

However, greater cost burdens were seemingly absorbed by Japanese manufacturers, as average prices charged by goods producers fell fractionally in March.

Prices

Sources: IHS Markit, Nikkei.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-japan-flash-manufacturing-pmi-signals-solid-q1-gdp.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-japan-flash-manufacturing-pmi-signals-solid-q1-gdp.html&text=Japan+Flash+Manufacturing+PMI+signals+solid+Q1+GDP","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-japan-flash-manufacturing-pmi-signals-solid-q1-gdp.html","enabled":true},{"name":"email","url":"?subject=Japan Flash Manufacturing PMI signals solid Q1 GDP&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-japan-flash-manufacturing-pmi-signals-solid-q1-gdp.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+Flash+Manufacturing+PMI+signals+solid+Q1+GDP http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032017-economics-japan-flash-manufacturing-pmi-signals-solid-q1-gdp.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}