Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2015

Flash PMI surveys highlight divergent policy outlook amid US outperformance

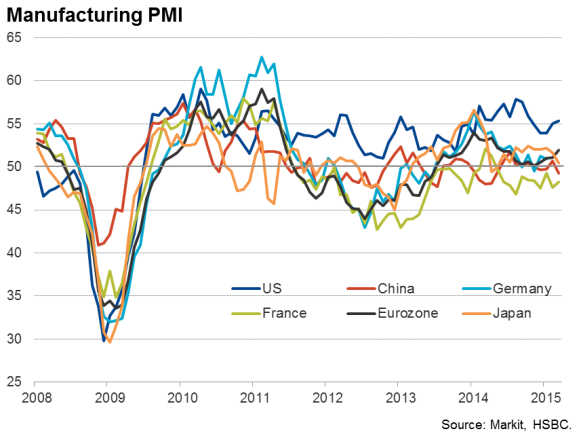

Business conditions across the world's major economies continue to diverge in March, according to flash PMI data, highlighting the need for differing policy responses.

The US's manufacturing performance continued to impress at the end of the first quarter, with the PMI edging up from 55.1 in February to a five-month high of 55.3. The improvement in the US survey data suggests a revival of economic growth after the slowdown seen at the turn of the year, when the downturn in the PMI was accompanied by three consecutive months of falling manufacturing output and retail sales.

With the US economy showing signs of renewed life, and the Fed opening the door to tighten policy at any time, a June interest rate hike remains a distinct possibility. However, weak inflation and wage growth points to September being the most likely month in which the FOMC will decide to start tightening policy.

The buoyancy of the US PMI data sit in stark contrast to deteriorating trends in Asia, where PMI surveys will add to calls for further stimulus in China and Japan.

The China flash PMI meanwhile fell to an 11-month low, knocking the authorities' hopes that the economy will grow by around 7% in 2015. The reading of 49.2 signals a renewed downturn in business conditions, but most worrying were signs that factory jobs were being cut at the fastest rate since 2009 as companies scaled back capacity in line with the tougher trading climate. The increasing impact of the economic slowdown on the labour market is seen as a key factor likely to push the Chinese authorities into further efforts to stimulate demand.

A near-stagnation of manufacturing activity in March meanwhile suggested that Japan's disappointing recovery is once again losing momentum. The latest flash PMI of 50.4 points to renewed economic weakness after Japan pulled out of a brief recession in the final quarter of 2014. The survey also indicates a softening of price pressures. With growth faltering and price pressures cooling, the survey results add further to the likelihood of the Japanese authorities stepping up their stimulus efforts.

An improvement in the eurozone flash PMI to a near-four year high meanwhile provides welcome news to a region awaiting signs that the ECB's quantitative easing is stimulating the real economy. The data suggest that eurozone GDP looks to have expanded by 0.3% in the first quarter, buoyed by a 0.4% expansion in Germany and signs of a long-awaited recovery in France. The composite PMI, covering both services and manufacturing rose to 54.1, with the PMI for the goods-producing sector up to a ten-month high of 51.9.

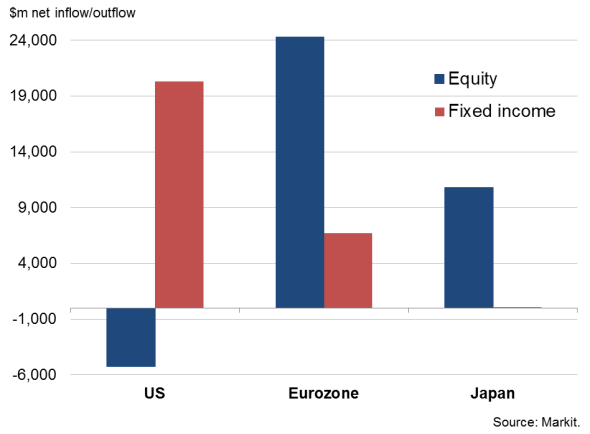

Investors seek exposure to eurozone equities, as well as seeking higher yields for US debt

Investors have flocked to gain exposure to eurozone equities since the central bank announced its stimulus plans. ETFs exposed to the eurozone equities enjoyed record inflows of $24bn so far in the first quarter, including an $8bn net inflow in March, far outstripping the prior quarterly record of $9bn seen in the third quarter of 2011.

Investors have also sought greater exposure to Japan, front-running the possibility of further stimulus. ETFs exposed to Japanese equities have so far enjoyed net inflows of almost $11bn this year, which would be the largest increase since the second quarter of 2013, when investors cheered the Bank of Japan's announcement to buy "60-70 trillion per year.

In contrast, investors have sought to reduce their exposure to US equities, withdrawing a net $5.2bn so far this year from related ETFs. This constitutes the first quarterly net outflow from US-exposed equity funds since the third quarter of 2013.

ETF flows 2015 year-to-date

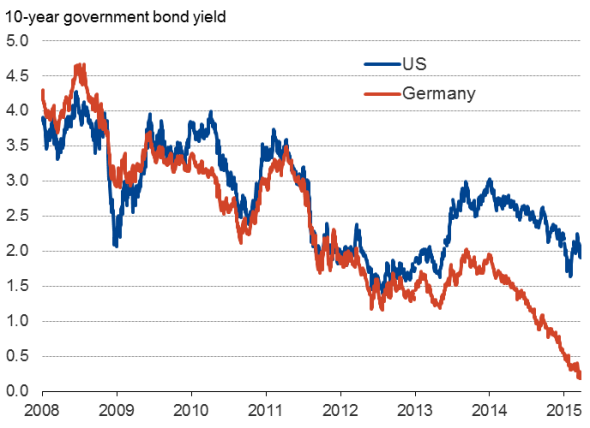

Where investors have been attracted to the US, however, is in the bond market. With government bonds yields falling negative in the eurozone as the ECB buys up debt as part of its newly-launched asset purchase programme, investors have increased their exposure to US Treasuries, yields of which have risen alongside the prospect of the Fed hiking interest rates. The spread between US and German government debt has reached a record high as a result, as has the spread between US and German corporate debt, according to Markit iBoxx data.

Government bond yields

While eurozone-exposed fixed income ETFs have seen a record $6.7bn inflow this year, US-exposed fixed income funds have seen net inflows of some $20bn, building on a net $25bn inflow in the fourth quarter of last year and dwarfing the rise seen in the euro area.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Flash-PMI-surveys-highlight-divergent-policy-outlook-amid-US-outperformance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Flash-PMI-surveys-highlight-divergent-policy-outlook-amid-US-outperformance.html&text=Flash+PMI+surveys+highlight+divergent+policy+outlook+amid+US+outperformance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Flash-PMI-surveys-highlight-divergent-policy-outlook-amid-US-outperformance.html","enabled":true},{"name":"email","url":"?subject=Flash PMI surveys highlight divergent policy outlook amid US outperformance&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Flash-PMI-surveys-highlight-divergent-policy-outlook-amid-US-outperformance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+surveys+highlight+divergent+policy+outlook+amid+US+outperformance http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032015-Economics-Flash-PMI-surveys-highlight-divergent-policy-outlook-amid-US-outperformance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}