Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 23, 2016

Shorts hold on to positions in retailers heading into Black Friday

US listed retail stocks are riding high, but short sellers are showing no signs of surrendering

- Retailers recouped most of their ytd underperformance since the election

- Short interest in US retailers higher than 12 months ago

- Most popular 2016 shorts: Finish Line, Childrens Place and Williams-Sonoma

The surge in US inflation expectations in the wake of the Trump election has lifted retail shares sharply higher in the two weeks since the vote. While the jury is still out as to the impact Trump's policies will have on consumer spending, the market seems to be focusing on the surging inflation expectations' potential to boost top line retail sales.

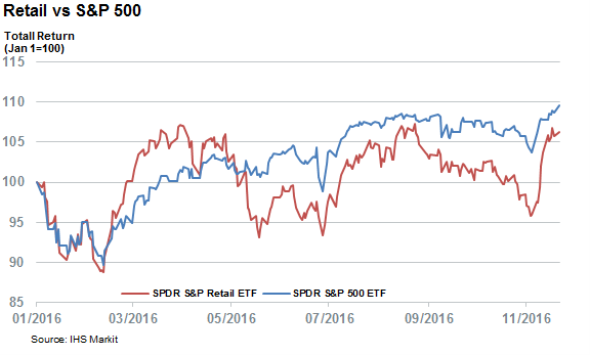

This newfound confidence in retailers has seen the sector's shares regain ground lost to the rest of the market since the start of the year. The SPDR S&P Retail ETF, whose year to date (ytd) total returns were 9% behind those delivered by the SPDR S&P 500 ETF on the eve of the election, is now only 3% behind the market after a 9% surge. Investors have been keen to ride this trend as ETFs exposed to US retrial shares have seen $260m of inflows over November; the highest in over 18 months.

While the strong momentum in retail shares is notable its own right, it is doubly important as it comes at the eve of Black Friday which kick starts the crucial six week holiday shopping period where stakes are doubled for the sector.

Short sellers stay the course

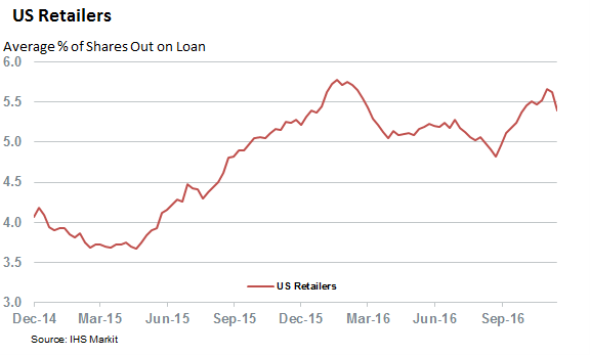

As with the wider post-election rally, short sellers have been caught out by this sudden reversal of fortunes as US retail shares entered the election with average levels of short interest that matched the multi-year highs seen at the start of the year. Average short interest across the sector on the eve of the election was only 6% off the previous yearly highs set back in February; a 17% jump in the weeks preceding the election.

While some shorts closed out their positions in the subsequent two weeks post-election, the current average short interest across retailers heading into Black Friday is still marginally higher than the levels at the same time last year - indicating that faith in the rally is still tenuous.

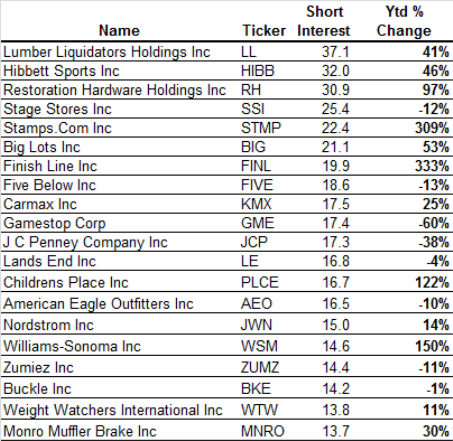

This lack of confidence around the price rises is evidenced in the four high conviction retail short positions, which have seen short interest at least double since the start of the year. All four of these companies have seen their shares surge by at least 12% since the election, but demand to borrow their stock has remained strong despite current the pain felt by short sellers.

This is especially true for sports retailer Finish Line, which has seen a threefold increase in short interest ytd. Its stock is up by 15% since the election, but short sellers have doubled down as demand to borrow its shares has surged by nearly a fifth over the same period of time.

Children's Place and William Sonoma have seen some marginal covering, but their current short interest levels are still over twice the January figures.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112016-Equities-Shorts-hold-on-to-positions-in-retailers-heading-into-Black-Friday.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112016-Equities-Shorts-hold-on-to-positions-in-retailers-heading-into-Black-Friday.html&text=Shorts+hold+on+to+positions+in+retailers+heading+into+Black+Friday","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112016-Equities-Shorts-hold-on-to-positions-in-retailers-heading-into-Black-Friday.html","enabled":true},{"name":"email","url":"?subject=Shorts hold on to positions in retailers heading into Black Friday&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112016-Equities-Shorts-hold-on-to-positions-in-retailers-heading-into-Black-Friday.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+hold+on+to+positions+in+retailers+heading+into+Black+Friday http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23112016-Equities-Shorts-hold-on-to-positions-in-retailers-heading-into-Black-Friday.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}