Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

Week Ahead Economic Overview

The highlights of the week come from the US, where GDP data for the third quarter and Flash US Services PMI data are released and the Board of Governors of the Federal Reserve announces its latest interest rate decision. The week also sees updates on inflation and unemployment for the eurozone amid industrial production numbers and labour market data for Japan.

The Board of Governors of the Federal Reserve will announce their latest interest rate decision. The meeting comes at a time when stock markets have been volatile as analysts try to gauge the underlying health of the US economy and the policy response.

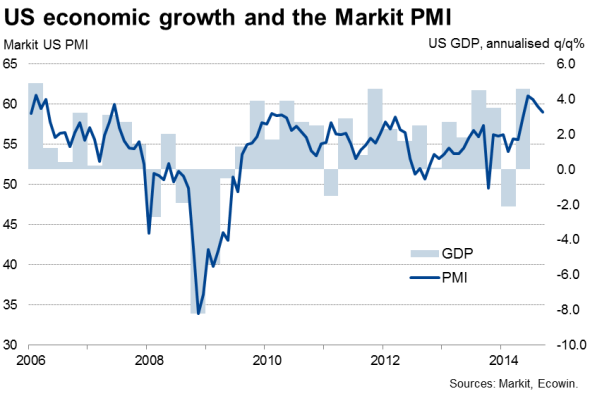

The meeting comes during a week in which the first estimate of third quarter GDP in the US looks set to show a continuation of the strong economic growth seen in the second quarter. Industrial production rose 0.8% in the three months to September, confirming buoyant survey data. Retail sales were also up 1.0% compared to the second quarter, and with Markit's domestically-focused Services PMI showing ongoing strength, we expect domestic consumption to have made a healthy positive contribution to the third quarter GDP figures. The PMI surveys point to annualised growth of just over 3%.

However, the Fed is alert to worries about the potential damage that any premature tightening of policy could cause, especially at a time when the global economy is struggling. Some policymakers such as Dudley and Evans are therefore veering towards allowing the economy to 'run hot', meaning the most likely scenario remains one of rates staying on hold until mid-2015.

Markit's Flash US Services PMI will meanwhile give first insights into the performance of the world's largest economy at the beginning of the final quarter of 2014.

In the eurozone, flash inflation and unemployment numbers are out. In September, inflation fell to a five-year low of 0.3%, stoking fears that the single currency area is moving closer to deflation. Unemployment was stable at 11.5% in August, with the jobless rates in Southern Europe remaining well above the region's average. In September, the European Central Bank took further steps to bolster the faltering eurozone economic recovery and also announced the commencement of a programme to buy asset backed securities and covered bonds, which started in October. Flash PMI data suggest some of the concerns about a renewed recession in the eurozone are overblown, but the region is nevertheless going through another weak spot which is causing prices and employment to fall.

Eurozone inflation

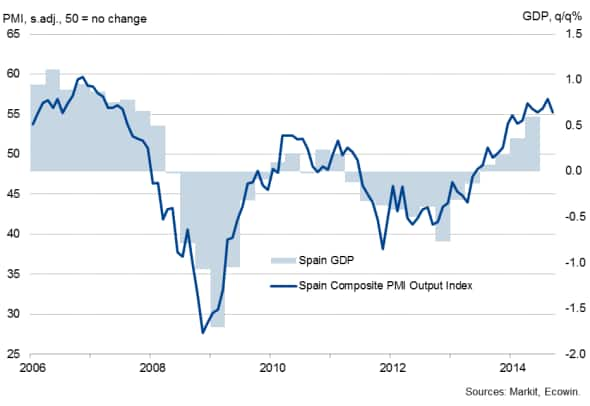

Another highlight in the currency union is the first estimate of third quarter GDP in Spain. Despite weakening slightly in September, survey data suggest that we should expect another quarter of solid economic growth, after the Spanish economy expanded 0.6% in the three months to June. The Bank of Spain has estimated a 0.5% rise.

Spanish GDP and the PMI

In Japan, a preliminary estimate of industrial output numbers for September will give further insight into third quarter GDP growth. A monthly fall in industrial production of 1.9% in August leaves the sector needing an improbably large rebound in September if it is not to prove a drag on overall output in the third quarter. Survey data suggest we should see the official production trend pick up. However, even a September monthly rise of 3% would leave production 1.9% lower than Q2.

Japan's inflation numbers will also be closely watched for indications as to whether the government is succeeding in defeating deflation. Prices rose 3.3% on a year ago in August, though partly as a result of April's sales tax hike.

Monday 27 October

The Services Producer Price Index for September is issued by the Bank of Japan.

Germany sees the release of import price numbers and the Ifo Business Climate Index.

In the eurozone, M3 money supply information are issued.

Nationwide house price data and CBI distributive trades information are out in the UK.

Flash US Services PMI results are released by Markit, while the world's largest economy also sees the publication of pending home sales data.

Tuesday 28 October

Retail sales numbers are issued in Japan and Germany.

The National Bureau of Statistics China publish their latest Monthly Report on Industrial Profits of Enterprises above Designated Size.

Italy sees the release of business confidence data.

In South Africa, a labour market update is provided.

Durable goods orders, Conference Board consumer confidence data and the S&P/Case-Shiller Home Price Index are all out in the US.

Wednesday 29 October

Industrial production figures are out in Japan, while M3 money supply data are issued in India.

Consumer confidence data for October are meanwhile released by INSEE in France.

The National Institute of Statistics Spain issues retail sales numbers.

Eurostat issue an update on the region's quarterly balance of payments.

In the UK, consumer credit and M4 money supply data are published by the Bank of England.

The Board of Governors of the Federal Reserve announces its latest interest rate decision.

Producer price figures are meanwhile out in Canada.

Thursday 30 October

The Bank Austria Manufacturing PMI is released by Markit.

Trade prices and home sales data are out in Australia.

The Reserve Bank of New Zealand announces its latest interest rate decision.

Unemployment data and flash inflation numbers for October are published in Germany.

Spain also sees the release of consumer prices figures, alongside the first estimate of third quarter GDP.

Business sentiment data are meanwhile issued for the euro area, while Greece sees the release of producer price figures.

Producer price data are also out in South Africa.

In the US, third quarter GDP data are released, followed by initial jobless claims.

Friday 31 October

The HSBC Russia Manufacturing PMI is published by Markit.

The Bank of Japan publishes a statement on monetary policy, while households spending data, inflation numbers and unemployment figures are also out.

Producer price data are released in Australia.

In the UK, the Gfk Group issues an update on consumer confidence, while the Office for National Statistics releases national accounts information.

In India, infrastructure output data for September are published.

Trade balance numbers are meanwhile out in South Africa.

Flash inflation numbers for October and unemployment figures for September are issued in the eurozone.

Greece sees the release of retail sales numbers, while current account data are out in Spain.

In Canada, gross domestic product data for August are published.

Employment cost information, personal consumption expenditure and spending data and the Reuters/Michigan Consumer Sentiment Index are all released in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}