Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2016

Week Ahead Economic Overview

The US is likely to see an upward revision to second quarter GDP, and durable goods orders and flash PMI results will provide insights into third quarter economic growth. In Japan, inflation, industrial production, unemployment and retail sales numbers are published. Consumer price and labour market data are also updated in the eurozone.

The US Fed left interest rates unchanged at its September meeting but it looks likely that monetary policy could be tightened again in December. Of course a lot depends on the data flow, with durable goods orders and flash PMI results likely to add to the policy debate.

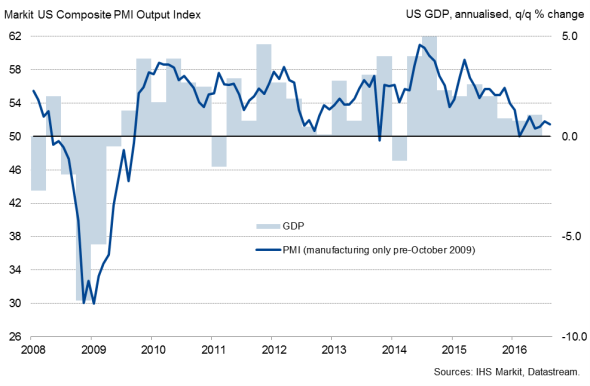

US GDP and the PMI

US durable goods orders surged 4.4% in July, largely driven by strong growth of civilian aircraft orders and core capital goods. However, the outlook for manufacturing remains bland, with Markit's PMI data suggesting that the sector continued to grow only slightly in the third quarter and the latest Reuters poll predicting a 1.5% decline in durable goods orders in August.

Data watchers will also be eyeing the latest flash PMI numbers for the US service sector, as well as updated second quarter GDP and consumer sentiment data. IHS Markit expects consumer spending to remain the mainstay of the economy, with improving trends in housing and capital spending also supporting growth. The latest forecast predicts GDP growth of 1.5% for 2016, with the second quarter likely to see a modest upward revision to the previous annualised 1.1% growth rate.

After the Bank of Japan announced the introduction of yield curve control in an attempt to spur economic growth, markets will now turn to the release of latest data points for information of the health of the country's economy.

The release of inflation data will be especially interesting, given the fact that the Bank of Japan has vowed to overshoot its 2% inflation target on purpose. Consumer prices fell for the fifth month running in July and the latest IHS Markit forecasts predict that the bank's target won't be reached until 2020.

Meanwhile, industrial production data will be viewed for more information on Japan's goods-producing sector. The Nikkei Japan Manufacturing PMI has been in negative territory for much of the year, though signalled a modest expansion for the first time in seven months in September. However, the weakness of the PMI suggests that industry will fail to make a positive contribution to the overall economy in the third quarter. Unemployment and retail sales data are also out during the week.

Japanese manufacturing output and the PMI

Sources: Nikkei, IHS Markit, Datastream.

Updated inflation and unemployment data in the eurozone are meanwhile likely to add to the policy debate at the ECB. Consumer prices rose just 0.2% in August while wages increased at the slowest pace in nearly six years; a clear worry for eurozone policymakers. If the weak price trend continues, more stimulus may be on the cards. IHS Markit forecasts inflation of just 0.3% for 2016.

Although the jobless rate held steady at a five-year low of 10.1% in July, there is still a big divergence with high unemployment in countries such as Greece, Italy and Spain contrasting with low rates in Austria and Germany. Latest PMI results suggest that job creation wavered at the end of the third quarter. Eurostat releases latest labour market numbers on Friday.

The UK sees final second quarter GDP numbers alongside housing market data and consumer confidence figures. Although GDP is currently estimated to have risen 0.6% in the second quarter, latest Bank of England minutes signalled a further rate cut is likely in coming months as the pace of expansion looks to have slowed in recent months. Meanwhile, consumer confidence numbers will provide policymakers with more information on spending trends. The GfK index rebounded in August from a Brexit-related decline in the prior month.

Monday 26 September

In Germany the latest Ifo Business Climate Index and import price numbers are published.

Retail sales and trade data are released in Italy.

BBA mortgage approval figures are meanwhile out in the UK.

The US sees the publication of latest new home sales numbers.

Tuesday 27 September

M3 money supply data are issued for the eurozone.

Germany sees the releases of retail sales figures, while industrial sales orders numbers are out in Italy.

CBI distributive trades data are published in the UK.

In Brazil, consumer confidence, current account and producer price figures are updated.

Building permit numbers are issued in the US alongside latest flash PMI results from IHS Markit and home prices from Case Shiller.

Wednesday 28 September

M3 money supply information are published in India.

Consumer confidence numbers are released by GfK in Germany and by INSEE in France.

Business confidence and wage data are meanwhile out in Italy.

In the US, durable goods orders figures are out.

Thursday 29 September

August retail sales numbers are issued in Japan.

Producer price figures are published in South Africa.

Economic sentiment data are out in the eurozone.

In Germany, inflation and unemployment numbers are updated.

The Bank Austria Manufacturing PMI is published.

Meanwhile, Spain sees the release of retail sales and consumer price figures.

The Bank of England publishes latest mortgage data.

The US sees the release of its third estimate for second quarter GDP. Moreover, initial jobless claims and pending home sales numbers are issued.

Friday 30 September

Manufacturing PMI results are out in South Korea, Malaysia and China.

New home sales and private sector credit data are are released in Australia.

Japan sees the release of household spending, consumer price, unemployment, industrial output and housing starts data.

India sees the release of latest infrastructure output figures.

In South Africa, M3 money supply and trade balance numbers are out.

Unemployment and flash inflation data are meanwhile issued in the eurozone.

Consumer spending figures are issued in France, while Italy sees the release of producer price numbers.

Spain issues current account data.

Final second quarter GDP results and GfK consumer confidence numbers are out in the UK.

Brazil sees the publication of unemployment figures.

In Canada, monthly GDP and producer price numbers are issued.

Personal consumption and income data are released in the US alongside latest Chicago PMI and Reuters/Michigan consumer sentiment results.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}