Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2017

US Flash PMI points to weak end to second quarter

The US economy ended the second quarter on a softer note, with flash US PMI data showing a slight loss of momentum since May. While the survey data continue to signal that the economy grew in the second quarter, the data add to recent evidence which points to only a modest pace of expansion, especially in manufacturing.

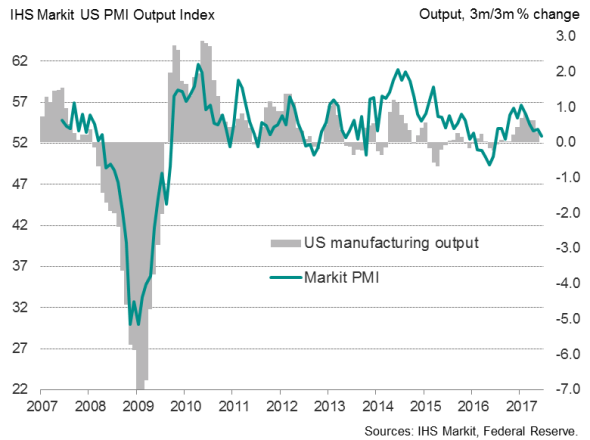

US manufacturing output

Weak end to the second quarter

The seasonally adjusted IHS Markit Flash Composite PMI fell from 53.6 to 53.0 in June, signalling the second-weakest expansion of business activity since last September.

Companies operating in both the service economy ('flash' business activity index at 53.0 in June) and manufacturing sector ('flash' output index at 52.9) reported slower rates of growth since May. The latest increase in manufacturing output was the least marked since September 2016.

The average expansion seen in the second quarter is down on that seen in the first three months of the year, indicating a slowing in the underlying pace of economic growth. The average PMI reading in the three months to June was 53.3, down from 54.3 in the three months to March.

Downside risks to the rebound

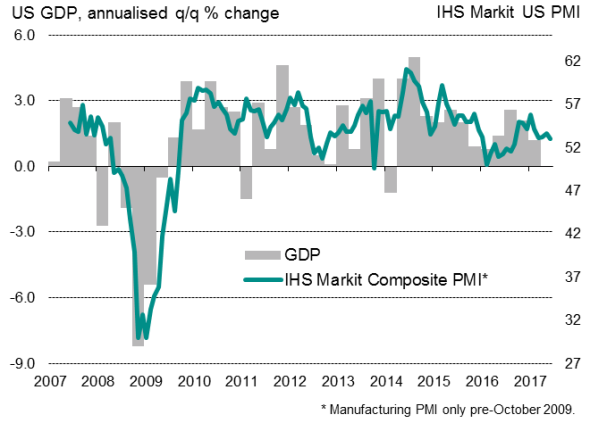

While official GDP data are expected to turn higher in the second quarter after an especially weak start to the year (our recent GDP tracker based on various official and survey data points to 3.0% growth), the relatively subdued PMI readings suggest there are some downside risks to the extent to which GDP will rebound.

Historical comparisons of the PMI against GDP indicates that the PMI is running at a level broadly consistent with the economy growing at a 0.4% quarterly rate (1.5% annualized) in the second quarter, or just over 2% once allowance is made for residual seasonality in the official GDP data.

US GDP and the PMI

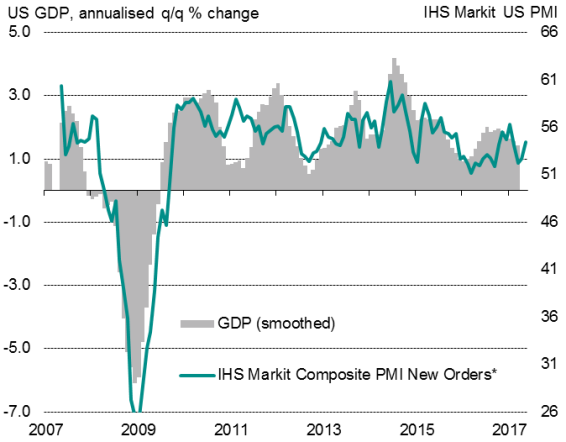

There are signs, however, that growth could pick up again: new orders showed the largest monthly rise since January, business optimism about the year ahead perked up and hiring remained encouragingly resilient. The survey is indicative of non-farm payroll growth of approximately 170,000.

Average prices charged for goods and services meanwhile showed one of the largest rises in the past two years, pointing to improved pricing power amid relatively healthy demand.

New orders

* covers manufacturing only pre-October 2009

Sources: IHS Markit, Commerce Dept.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-US-Flash-PMI-points-to-weak-end-to-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-US-Flash-PMI-points-to-weak-end-to-second-quarter.html&text=US+Flash+PMI+points+to+weak+end+to+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-US-Flash-PMI-points-to-weak-end-to-second-quarter.html","enabled":true},{"name":"email","url":"?subject=US Flash PMI points to weak end to second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-US-Flash-PMI-points-to-weak-end-to-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Flash+PMI+points+to+weak+end+to+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-US-Flash-PMI-points-to-weak-end-to-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}