Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2015

Eurozone flash PMI hits four-year high in June

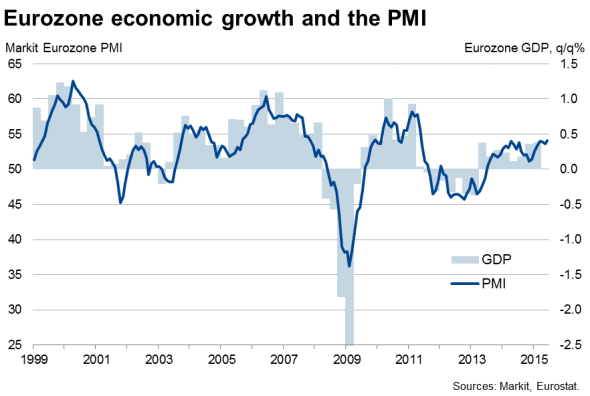

Despite the cloud of the Greek debt crisis hanging over the region, the eurozone saw economic growth accelerate to a four-year high in June. Markit's flash Eurozone PMI, based on around 85% of usual monthly survey replies, rose from 53.6 in May to 54.1 in June, its highest since May 2011 and comfortably beating analysts' expectations.

The upturn in June also took the average PMI reading for the second quarter as a whole to the highest for four years and signalling GDP growth of 0.4%.

Growth picked up speed in both services and manufacturing at the end of the second quarter. The improved performance rounded off the best quarter for four years in the service sector while factories enjoyed their best quarter of production growth for a year.

Broad based upturn

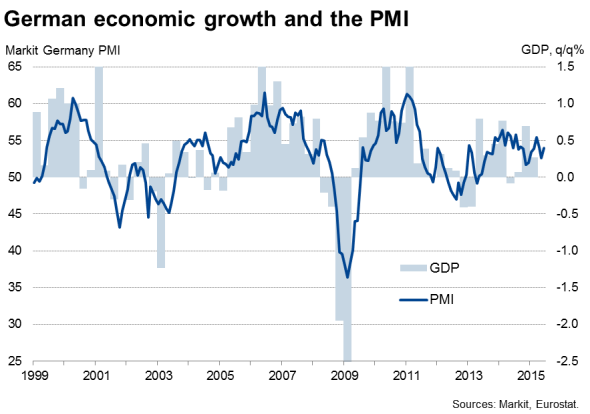

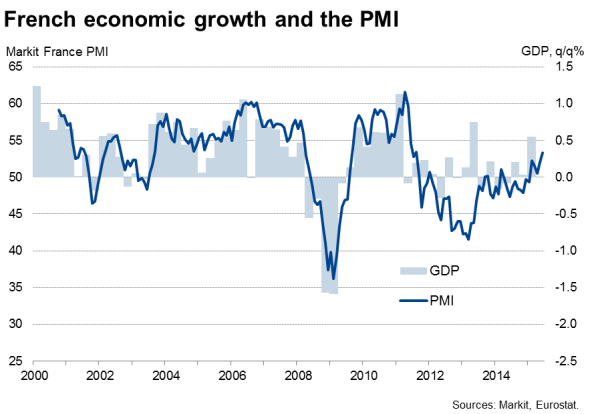

By country, growth accelerated in both Germany and France, although the former saw a weaker rate of expansion over the second quarter as a whole compared with the first quarter.

France saw weaker growth than Germany, but the PMI nevertheless hit its highest since August 2011, ending the best quarter that France has seen since the third quarter of 2011. New order growth also accelerated in France to reach the fastest since August 2011 and employment increased for a fourth successive month, with the rate of job creation the second-highest since December 2011.

Elsewhere in the region, growth slowed for a second successive month, but still outpaced that seen in both France and Germany. Over the second quarter as a whole, the region excluding France and Germany enjoyed its best performance for eight years.

Business activity growth

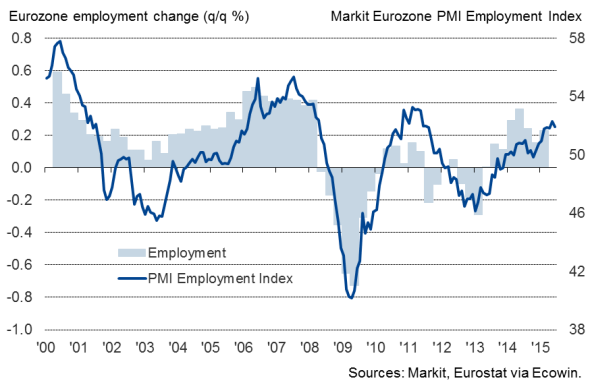

The survey also indicated that employment and new orders had likewise risen at the strongest rates for four years over the second quarter as a whole, although growth slowed in both cases in June. In the case of new orders, growth has now slowed for three successive months, easing in both services and manufacturing, with the latter also recording a slowdown in growth of exports.

Eurozone employment

Expectations of future growth in the service sector also slipped, dropping to a six-month low.

Slower order book growth and reduced optimism about the year ahead were largely attributable to an increase in the number of companies citing growing uncertainty regarding the impact of the current Greek debt crisis.

Uncertain future

The second quarter upturn signalled by the PMI puts the region on course to expand by around 2.0% this year, though much of course depends on the outcome of the Greek debt negotiations and any resulting impact on growth in the second half of the year.

The uncertainty generated by the recent escalation of the crisis appears to have taken some of the steam out of hiring growth, but employment over the second quarter as a whole has nevertheless shown the largest rise for four years to suggest that - at present at least - the eurozone economy is weathering the Greek storm relatively well.

Deflationary pressures easing

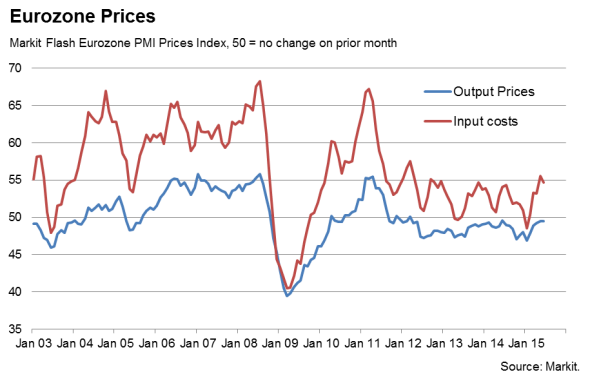

Companies' average input costs rose at a weaker rate than May's three-year high, but continued to grow on the back of higher oil prices and wage bills, as well as rising import costs resulting from the euro's depreciation.

Average selling prices for goods and services continued to fall, but the decline was once again only marginal and one of the smallest seen over the past three years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Economics-Eurozone-flash-PMI-hits-four-year-high-in-June.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Economics-Eurozone-flash-PMI-hits-four-year-high-in-June.html&text=Eurozone+flash+PMI+hits+four-year+high+in+June","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Economics-Eurozone-flash-PMI-hits-four-year-high-in-June.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI hits four-year high in June&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Economics-Eurozone-flash-PMI-hits-four-year-high-in-June.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+hits+four-year+high+in+June http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Economics-Eurozone-flash-PMI-hits-four-year-high-in-June.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}