Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 23, 2015

European corporate credit sees record tightening

Hopes of a Greek deal this week have buoyed European credit markets, with corporate spreads seeing strong tightening.

- Markit iTraxx Europe Crossover has tightened 41bps so far this week

- Markit iTraxx Europe Main saw the biggest one day tightening for two years

- Financials lead the way; Lloyds and Banco Santander 5-yr CDS tightening further 8% today

With Greek repayment deadlines looming, prospects of a breakthrough surfaced last Sunday when European Commission president Jean-Claude Juncker stated that he was confident that the Eurogroup would able to finalise the process this week.

Corporates see record tightening

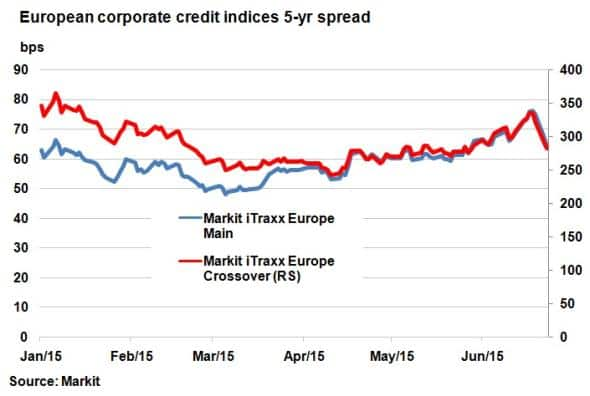

Credit markets have reacted buoyantly, with the spread on the Markit iTraxx Europe Main index, made up of 125 investment grade single name CDS, tightening 8bps on Monday. This was the largest single one day move (excluding rollover dates) for two years and did much to reverse the widening seen over the past month when Greek tensions intensified.

There have been similar moves in high yield corporate credit, with the Markit iTraxx Europe Crossover having tightened 41bps so far this week; deleveraging much of the risk garnered over the last month around a potential Grexit.

Corporate credit in Europe has been a game of two halves so far this year. The first half was dominated by QE and the corporate de-risking associated with a much stronger eurozone, with sovereign credit spreads tightening. Markit iTraxx Europe Main index tightened to 48bps on March 6th; the lowest post financial crisis level. But the second quarter this year saw heightened bond volatility and Greek pressures pushing the index out wider. The current level of 64bps still remains 16bps above the March low. With QE planned to continue through to September 2016 it will be interesting to see if these levels can be tested once again as Greek related risks diminish.

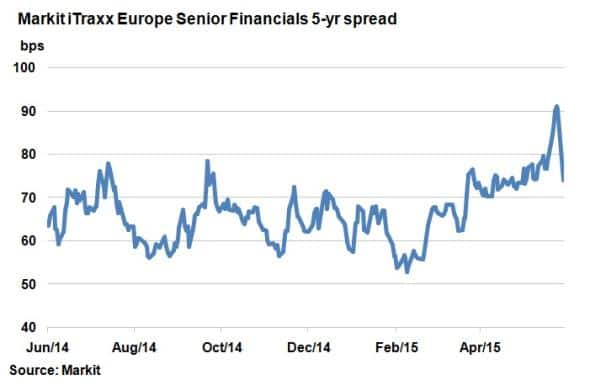

Financials lead the way

Unsurprisingly, financials have led the tightening. The Markit iTraxx Europe Senior Financials index has tightened 18bps so far this week after trading as wide as 91bps last Friday. The fact that the index had widened to such an extent speaks volumes of how resolute the markets were heading into the latest debt deadline. The single names such as Lloyds and Banco Santander continued to see movement today, with intraday 5-yr CDS spread 8% tighter at the latest level.

Note that while the Markit iTraxx Europe Senior Financials index has tightened, its level is still elevated relative to the start of the year; something that will no doubt continue until the market is presented with a credible Greek solution.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Credit-European-corporate-credit-sees-record-tightening.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Credit-European-corporate-credit-sees-record-tightening.html&text=European+corporate+credit+sees+record+tightening","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Credit-European-corporate-credit-sees-record-tightening.html","enabled":true},{"name":"email","url":"?subject=European corporate credit sees record tightening&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Credit-European-corporate-credit-sees-record-tightening.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+corporate+credit+sees+record+tightening http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062015-Credit-European-corporate-credit-sees-record-tightening.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}