Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 23, 2014

Short interest rises on new market highs

After retreating from their recent highs in early March, we’ve seen shorts sellers in the S&P 500 return to the picture over the last eight weeks as the index posted a new string of all time high closes.

- Short interest among index constituents is up by 8% over the last eight weeks

- Media companies, led by Cablevision, saw the largest rise in demand to borrow

- Utilities firms and food retailers also saw large jumps in demand to borrow

Last week saw the Fed’s comments push markets to another new all-time high, with the S&P 500 ending the week at 1962; 1.3% higher than at the start of the week. While the recent increase takes the year to date index return to a healthy 6%, the markets are do not seem to be exhuming the extravagance seen last year by which point the index had already notched up a 13% appreciation. Our review of sellers’ behaviour shows a similar sense of scepticism to the current market surge.

Short interest rising in recent weeks

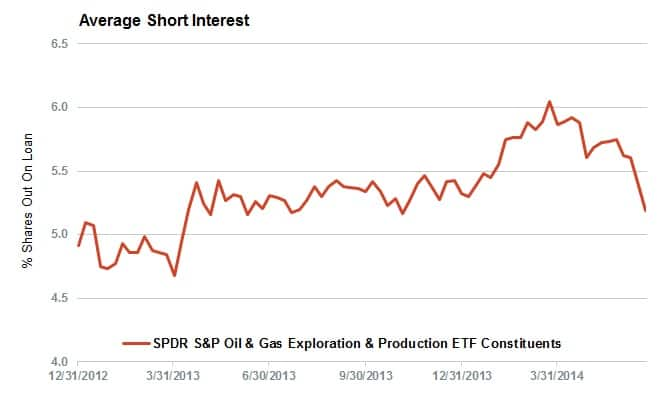

While most of the market’s recent price appreciation was seen over the last month, we’ve also seen shorts add to their positions in line with the market swell. Short interest, as measured by the average per cent of shares out on loan in the S&P 500 index, is up by over 8% in the last eight weeks. Although the current short interest is still low at just under 2.3% of shares outstanding, the recent jump in demand to borrow shows no signs of tapering.

Shorts have already had a shot at the market after the slow start to the year. But the recent surge in demand to borrow comes on the heels of a price surge, something which has not been seen in the last 18 months of the rally. Conversely, last year’s strong rally in the first six months saw shorts steadily close out their positions.

Media firms see largest jump in short interest

As to the sectors driving the recent increases in short interest, we’ve seen media firms leading the relative jump in demand to borrow, with12 of the 14 constituent firms seeing an increase in short interest. This across the board increase has seen average short interest jump by 50% to an above index average 2.4% of shares outstanding.

While the increased shorting has been pretty universal across the index, Cablevision has seen more than its fair share of shorting as the firm saw demand to borrow jump by more than two thirds to 12% over the last eight weeks. This makes the firms by far the most shorted of its sector peers in the S&P.

Also seeing large jumps in shorting in this sector are Gannett and Cbs Corp.

Low beta shorted

Interestingly, in the recent bout of shorting short sellers seem to be going off the established playbook, as the sectors seeing the largest jumps in shorting are not the usual names. The average demand to borrow traditional short favourites, such as consumer durables and semiconductors has actually fallen in the recent bout of shorting.

One sector which has seen a jump in demand to borrow is utilities, which comes in as the third most shorted sector over the last couple of months with the likes of Exelon and Consolidated Edison seeing increased demand to borrow. The large surge in Exelon is linked to its recent merger talk with Pepco.

This could be a momentum play as these firms have generally outperformed the market in since the start of the year, a trend that we covered last week.

The sector seeing the second largest jump in short interest is food retailers, though this increase is mostly driven by Whole Foods, which has seen demand to borrow more than double after poor results.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062014120000Short-interest-rises-on-new-market-highs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062014120000Short-interest-rises-on-new-market-highs.html&text=Short+interest+rises+on+new+market+highs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062014120000Short-interest-rises-on-new-market-highs.html","enabled":true},{"name":"email","url":"?subject=Short interest rises on new market highs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062014120000Short-interest-rises-on-new-market-highs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+interest+rises+on+new+market+highs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062014120000Short-interest-rises-on-new-market-highs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}