Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2017

Eurozone Flash PMI signals buoyant second quarter

Eurozone economic growth continued to run at its fastest for six years in May, according to PMI survey data. Job creation also perked up to one of the strongest recorded over the past decade amid improved optimism about future prospects. Price pressures meanwhile remained elevated, albeit with some easing in input cost inflation.

The IHS Markit Eurozone PMI held steady at 56.8 in May, unchanged on April's six-year high, according to the preliminary 'flash' estimate (based on approximately 85% of final replies).

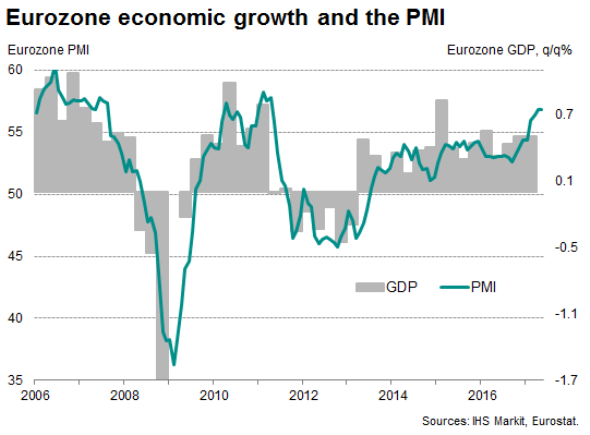

The buoyant PMI reading indicates that business activity is expanding at a rate consistent with 0.6-0.7% GDP growth. The consensus forecast of 0.4% second quarter growth could therefore well prove overly pessimistic if the PMI holds its elevated level in June.

Manufacturing led the upturn, with output growth accelerating to the fastest in over six years. Service sector business activity growth also remained strong, easing only marginally from April's six-year peak to underscore the broad-based nature of the upturn.

By country, similar robust business activity growth was recorded in both France and Germany, the former enjoying the slightly faster pace of expansion. French businesses reported the steepest rate of increase since May 2011 while German firms reported the best gain since April 2011. Growth eased across the rest of the single currency area but remained close to a ten-year high.

Business optimism about the year ahead meanwhile revived to the joint-highest in the five-year history of the survey's future output question.

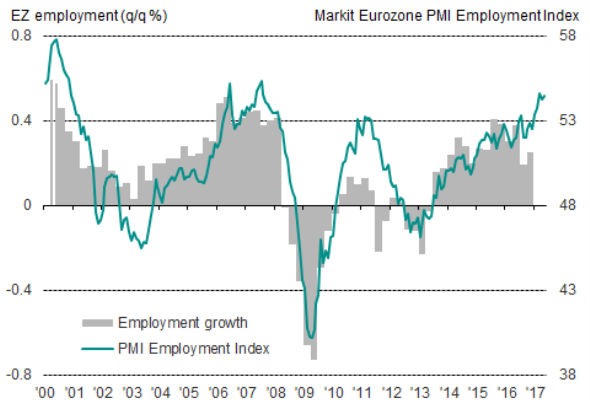

Job creation has surged as firms seek to expand capacity and meet rising demand. The overall rise in employment was the second-largest since August 2007, with manufacturing adding jobs at the steepest rate in the survey's 20-year history. Service sector job gains matched those seen in April, sustaining the best spell of employment growth that the tertiary sector has enjoyed since early-2008.

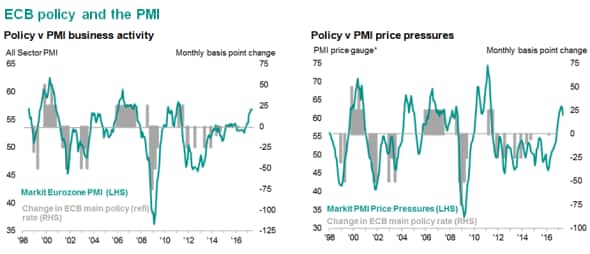

The upturn continued to be accompanied by strong price pressures. Average selling prices for goods and services rose at the second-fastest rate since July 2011, the increase falling just shy of March's recent peak. However, a mild easing in input cost inflation to a five-month low suggests some pressure may come off selling prices in coming months.

Although selling prices have continued to march higher, there are signs of input cost pressures beginning to ease. This suggests underlying inflationary forces could moderate as we move into the second half of the year, playing into the ECB's hands.

While the pace of economic growth signalled by the PMI is historically consistent with the ECB taking a hawkish stance, the dip in cost pressures will add weight to arguments that there's no rush to taper policy.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Eurozone-Flash-PMI-signals-buoyant-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Eurozone-Flash-PMI-signals-buoyant-second-quarter.html&text=Eurozone+Flash+PMI+signals+buoyant+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Eurozone-Flash-PMI-signals-buoyant-second-quarter.html","enabled":true},{"name":"email","url":"?subject=Eurozone Flash PMI signals buoyant second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Eurozone-Flash-PMI-signals-buoyant-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+Flash+PMI+signals+buoyant+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052017-Economics-Eurozone-Flash-PMI-signals-buoyant-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}