Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 23, 2016

Bank bond spreads outperform wider market

Although bank bonds have unperformed so far this year, the past month has seen the spread between banks and the wider corporate bond market compress.

- Banks underperformed non-financials at the start of this year amid market volatility

- Spread ratio between Markit iBoxx $ Domestic Banks index and the Markit iBoxx $ Domestic Non-Financials index widened to 0.98 in April, from 0.75 three months earlier

- The past month has seen bank spreads beat their non-financial peers

After a turbulent start to the year, global banks' credit has enjoyed a recovery over the past month, with risk in the sector falling. This has been most evident in the bond market, where bank spreads (interest premium over government bonds) in the US, Europe and the UK have all outperformed their wider non-financial corporate bond markets.

Banks on the defensive

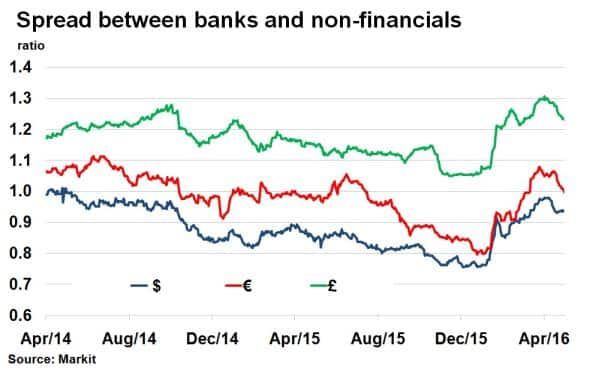

Strong regulatory oversight, insulation from weak commodity prices and the prospect of higher lending margins has meant that US banks benefitted from a sustained period of spread outperformance versus non-financials. Between April 2014 and January 2016, the spread ratio between the Markit iBoxx $ Domestic Banks index and the Markit iBoxx $ Domestic Non-Financials index compressed from parity (1.0) to 0.75, demonstrating the relative outperformance of US banks.

The defensive nature of the banking sector over this period was also reflected among European and UK banks, both of whom saw spreads outperform their non-financial counterparts.

This trend came to an abrupt end however at the start of this year as volatility gripped markets. This was compounded in the banking sector, as all three regions saw bank spreads widen at a quicker pace than the broader market.

An unsettled 2016

Weak first quarter earnings and a dovish Fed meant the US banks to non-financials spread ratio increased to 0.98 in mid-April. The trend was more pronounced among European banks, hampered by bad loans, restructurings, negative interest rates and litigation charges. The spread ratio between the Markit iBoxx " Banks index and the Markit iBoxx " Non-Financials index moved to 1.07 by mid-April, from 0.78 three months earlier, making European bank bonds riskier than corporate non-financial bonds in the eyes of the market.

UK bank bonds have traded more riskier than the wider sterling corporate bond market for the past two years, compounded by the potential negative impact of a Brexit on the UK's banking system. The spread ratio between the Markit iBoxx " Banks index and the Markit iBoxx " Non-Financials index rose to 1.30 in April.

Turning a corner?

After three months of underperformance, spread ratios across all three regions have started to compress. Fed rhetoric has swayed to the hawkish, fears of a Brexit have eased and European banks' credit has started playing catch up to ECB QE buoyed non-financial counterparts. In Europe, the bank to non-financials spread ratio has fallen below 1.0 for the first time since March 30th, while in sterling this ratio has come down to 1.23, from 1.30 in April. The ratio for US banks to non-financials never did quite hit parity, but remains significantly off January's low.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052016-Credit-Bank-bond-spreads-outperform-wider-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052016-Credit-Bank-bond-spreads-outperform-wider-market.html&text=Bank+bond+spreads+outperform+wider+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052016-Credit-Bank-bond-spreads-outperform-wider-market.html","enabled":true},{"name":"email","url":"?subject=Bank bond spreads outperform wider market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052016-Credit-Bank-bond-spreads-outperform-wider-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+bond+spreads+outperform+wider+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23052016-Credit-Bank-bond-spreads-outperform-wider-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}