Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 22, 2016

Indian bonds prove resilient to recent upheaval

A slowing manufacturing sector and the upcoming departure of its popular central banker have not put investors off Indian bonds both at home and in overseas markets.

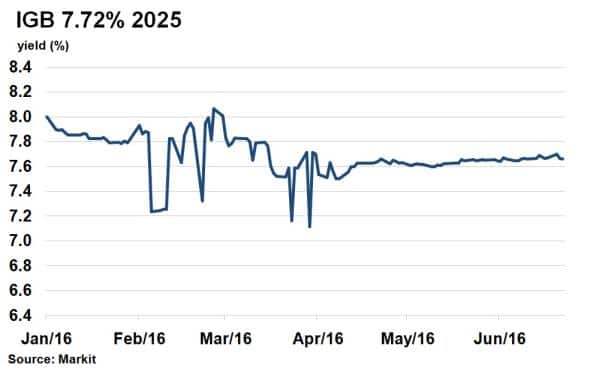

- 10-yr Indian government bond yields initially rose 3bps before falling back down to 7.66%

- Markit iBoxx ALBI India index saw yields remain stable at 7.82%, highs of 8.3% recorded in February

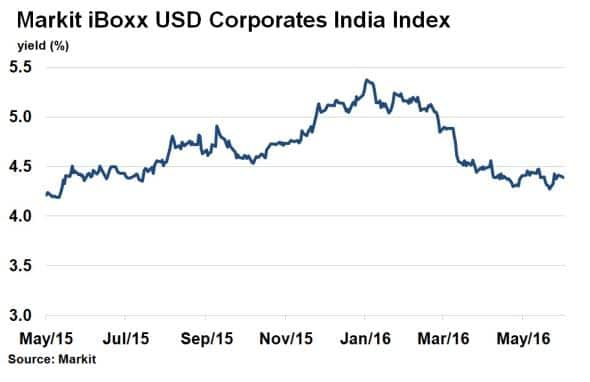

- The Markit iBoxx USD Corporates India Index currently yields 4.29%, near 12 month lows

India's manufacturing saw the second month of lacklustre growth in a row according to the May release of the Nikkei Manufacturing PMI compiled by Markit. These numbers no doubt make for sobering reading for India's Prime Minister Modi and his flagship "make in India" campaign aimed at spurring manufacturing growth in the country, especially since PMI survey respondents indicated that new export orders fell for the first time since 2013.

The Indian Rupee is reflecting the slowed/weak growth as its currently trading close to the recent lows registered against the US dollar. The Rupee's strength was weakened further this week when India's popular central banker Raghuram Rajan announced his decision not to seek a second term in office, something which was customary for recent governors.

Despite these dual pressures, Indian bonds have managed to hold on to their recent gains with both locally and overseas listed issuance trading much tighter in recent months.

Corporate credit also benefits

Government bond investors remained positive. According to Markit's bond pricing service, India's 7.72% coupon government bond maturing in 2025 saw yields rise initially - 3bps to 7.70% on June 20th, before retreating to 7.66% as of June 22nd. India's economy has improved vastly over the past few years, where inflation has been tamed, and investors remain confident of a smooth transition.

Overall, local currency Indian government bonds, as represented by the Markit iBoxx ALBI India index, saw yields remain stable at 7.82%, as any negative shock was absorbed by investor's who see India relatively insulated from overseas volatility in markets caused by China and Brexit. Markit iBoxx ALBI India index had been as high as 8.3% in February.

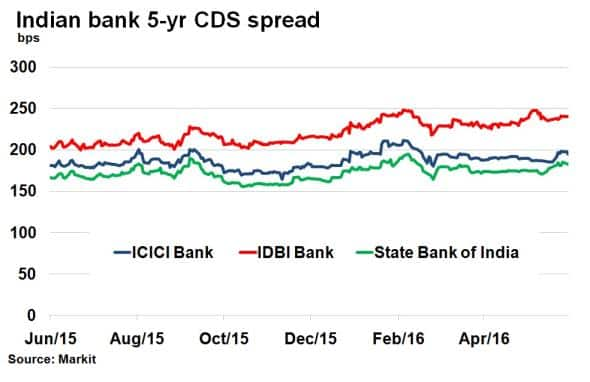

India's banking sector, which is still loaded with bad loans, remained resilient. CDS spreads in India's largest banks saw little movement this week, despite risk in the sector rising over the past year. Raghuram Rajan did much to clean up India's debt laden banking system, with investors clearly confident of a likeminded successor.

India's US dollar denominated corporate bond sector also remained resilient, with yields stable. The Markit iBoxx USD Corporates India Index currently yields 4.29% or 292bps over US treasuries, close to 12 month lows.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062016-Credit-Indian-bonds-prove-resilient-to-recent-upheaval.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062016-Credit-Indian-bonds-prove-resilient-to-recent-upheaval.html&text=Indian+bonds+prove+resilient+to+recent+upheaval","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062016-Credit-Indian-bonds-prove-resilient-to-recent-upheaval.html","enabled":true},{"name":"email","url":"?subject=Indian bonds prove resilient to recent upheaval&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062016-Credit-Indian-bonds-prove-resilient-to-recent-upheaval.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indian+bonds+prove+resilient+to+recent+upheaval http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22062016-Credit-Indian-bonds-prove-resilient-to-recent-upheaval.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}