Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 22, 2015

Chinese property bonds hold up despite default

Despite Kaisa Group's recent default on its dollar denominated bonds, the rest of the offshore listed Chinese bond market has shown little sign of stress.

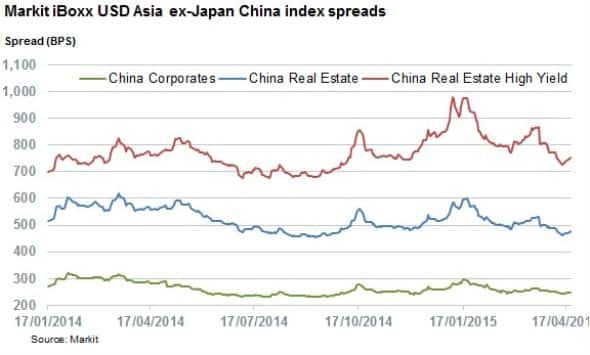

- Extra yield required by investors to hold dollar denominated Chinese real estate bonds over US Treasuries is now 4.8%; down from 6.2% in January

- Spreads in the Markit iBoxx USD Asia ex-Japan China Real Estate High Yield are down

- Glorious Property bucks the trend as its bonds are trading at distressed levels

The long running saga which has seen bond investors incur a paper loss of $1.2bn from their loans to Chinese property developer Kaisa Group looks to be nearing its conclusion after the firm defaulted on its dollar denominated bonds last week. While this marks the first dollar denominated property developer bond default, the rest of the dollar denominated Chinese bond market market has shown little sign of panic in the wake of Kaisa's default.

Bonds hold flat

Dollar denominated Chinese real estate bonds did widen slightly from their close at the end of last week, gauged by the Markit iBoxx USD Asia ex-Japan China Real Estate index. But the extra yield required by investors to hold these bonds over US treasuries is still some way off the highs seen in the opening weeks of the year. While latest index spread is just under 6bps than last Friday's close, its current level of 476bps is still just a third lower than the highs seen in January.

The riskier end of the Chinese real estate debt market has also shown the same trend, with the spread of the Markit iBoxx USD Asia ex-Japan China Real Estate High Yield index now 224bps lower than the highs seen earlier in the year.

No signs of contagion

The impact of Kaisa's default on the wider dollar denominated Chinese corporate bond market has also been relatively low as gauged by the Markit iBoxx USD Asia ex-Japan China Corporates index, whose spread now stands at 247bps; just 1.5bps more than at the end of last week.

This relatively calm reception to the default shows that the market is taking the Kaisa default in its stride in an area that has grown to be a key source of funding for Chinese companies.

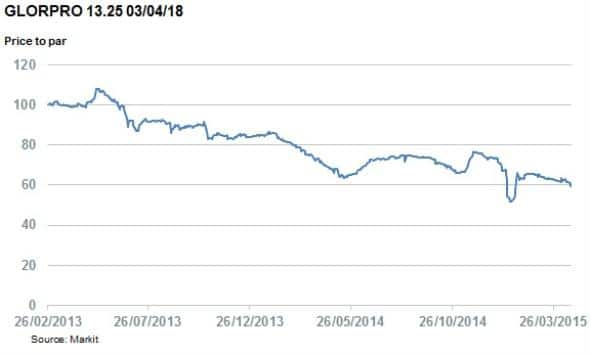

Less than Glorious

While the overall dollar denominated real estate bond market has been relatively stable over the last four weeks, several constituent bonds of the iBoxx USD Asia ex-Japan China Real Estate Chines Real Estate index still trade at distressed level. On such example is the bond issued by Glorious Property, maturing in March 2018. The bond has seen its price dive to less than 60 cents on the dollar taking it near its January lows of 52 cents.

The bond's current yield is now 40%; four times that of high yield Chines real estate bonds.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-credit-chinese-property-bonds-hold-up-despite-default.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-credit-chinese-property-bonds-hold-up-despite-default.html&text=Chinese+property+bonds+hold+up+despite+default","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-credit-chinese-property-bonds-hold-up-despite-default.html","enabled":true},{"name":"email","url":"?subject=Chinese property bonds hold up despite default&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-credit-chinese-property-bonds-hold-up-despite-default.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+property+bonds+hold+up+despite+default http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042015-credit-chinese-property-bonds-hold-up-despite-default.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}