Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 22, 2016

Japan flash PMI signals worst manufacturing conditions for over three years

Japan's manufacturing sector slid into decline in March, according to the Nikkei Flash Japan Manufacturing PMI. Business conditions deteriorated at the fastest rate for just over three years as output, new orders and exports all fell. The destocking trend meanwhile accelerated, job creation slowed and deflationary pressures intensified.

At a 37-month low of 49.1 in March, the flash PMI suggests that the Bank of Japan may soon see the need for further stimulus. The central bank ended its latest monetary policy meeting having taken no action but saying it was prepared to add more stimulus if required. The Bank had already cut interest rates into negative territory at the start of the year, responding to a renewed threat of recession. The economy contracted in the final quarter of last year and data for the first quarter so far have disappointed. A recession is often defined as two or more consecutive quarterly declines of gross domestic product.

Here are five key charts from the March flash PMI:

1. Production falls slightly in March

The headline PMI is a composite indicator derived from survey questions on output, new orders, employment, inventories and suppliers' delivery times. The Output Index (shown above, tracked against comparable official data) hit an 11-month low in March, consistent with an official quarterly growth rate of approximately -1%.

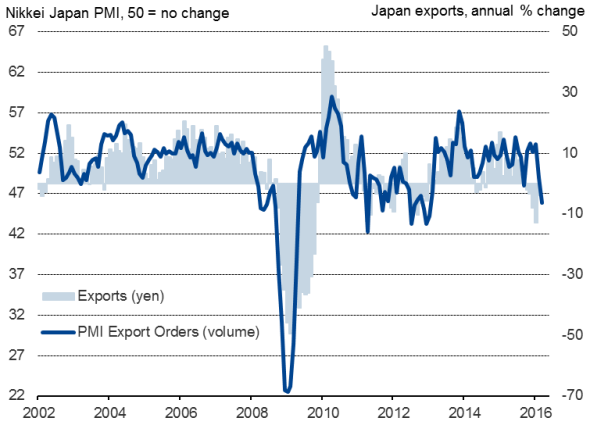

2. Exports fall at fastest rate for over three years

Sources: Markit, Nikkei, METI.

New orders fell for a second straight month, with the rate of decline accelerating amid a worsening export trend. The survey signalled the largest monthly drop in export volumes since January 2013. Respondents reported that weak overseas demand and the strength of the yen - up almost 8% since the end of last year against the US dollar - had increasingly hit overseas sales in recent weeks.

3. Hiring at six-month low

Factory headcounts showed the smallest monthly rise for six months, the rate of job creation having steadily cooled since peaking last October. Hiring slowed in response to companies becoming more cautious about the outlook and scaling back expansion plans in the face of falling order books. Backlogs of work fell at the fastest rate for almost two years.

4. Deflationary pressures mount

Manufacturers' average input prices fell at the steepest rate since August 2012. Companies reported both lower global commodity prices as well as the reduced cost of imports arising from the yen's appreciation. Manufacturers' average selling prices meanwhile showed the biggest monthly fall since January 2013, as they passed on lower costs to customers.

5. Destocking trend intensifies

Manufacturers' inventories of finished goods showed one of the largest declines seen since the height of the global financial crisis. Companies were often deliberately running down stock levels in the light of the gloomier outlook for sales.

One upside of the destocking trend is that production may revive in coming months once excess stocks have been reduced. However, with inventories of purchased inputs also falling at an increased rate in February, and quantities of purchases showing the largest fall for almost two years, an imminent upturn seems unlikely.

Email economics@markit.com for access to the data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Economics-Japan-flash-PMI-signals-worst-manufacturing-conditions-for-over-three-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Economics-Japan-flash-PMI-signals-worst-manufacturing-conditions-for-over-three-years.html&text=Japan+flash+PMI+signals+worst+manufacturing+conditions+for+over+three+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Economics-Japan-flash-PMI-signals-worst-manufacturing-conditions-for-over-three-years.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals worst manufacturing conditions for over three years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Economics-Japan-flash-PMI-signals-worst-manufacturing-conditions-for-over-three-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+worst+manufacturing+conditions+for+over+three+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22032016-Economics-Japan-flash-PMI-signals-worst-manufacturing-conditions-for-over-three-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}