Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 21, 2015

Platinum trails gold

Platinum has seen its price lag behind gold in recent weeks as mining shares come under increased negative sentiment.

- Platinum ETFs have seen outflows in the last three months while gold funds have seen inflows

- Largest platinum ETF down by 15% YTD while gold has stayed flat

- The three largest platinum miners have seen short interest surge to all-time highs

Gold and platinum started 2015 38% off their 2012 all-time highs, but the last ten months have seen the price of the two metals deviate away from each other. GLD, the largest Gold ETF, is trading at roughly the same level that it started the year at while its peer in the platinum space, the ETFS Physical Platinum Shares, is now over 15% lower than at last year's close. While the fund has rallied somewhat after hitting its lowest level since its January 2010 listing last month, the recent underperformance means that platinum is trailing gold by its largest margin since both commodities started to sell off as investors' fears over runaway inflation started to receded.

This slump looks set to continue if analysts are anything to go by. A recent Reuters survey saw analysts trim their 2016 price target for the commodity by 12%, owing to plentiful supply after South African mines, which had been beset by labour issues over the last year, came back online. Demand in the metal has also been weak according to Chinese jewellery buyers, and a clouded outlook for diesel catalytic converters, after the Volkswagen emissions scandal, were also cited by the report as a cause for the recent commodities slump.

ETF investors head to the door

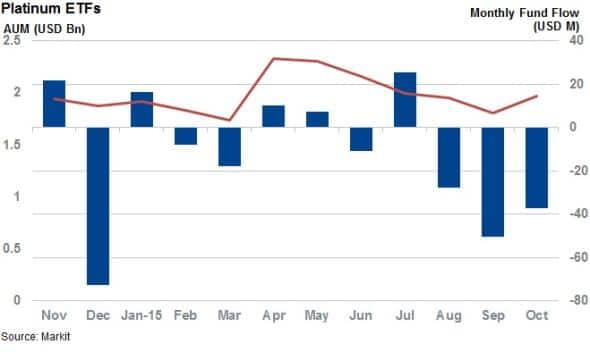

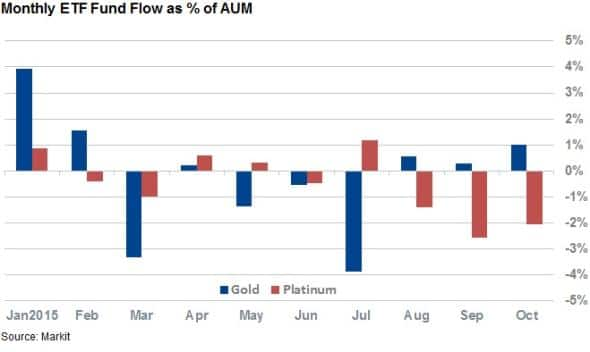

ETF investors seem to also be giving up hope on the commodities as investors have pulled a combined $115m from platinum ETFs over the last three months. These outflows represent approximately 6% of the AUM managed by these funds at the start of the recent outflow period and run against the rest of the precious metals field.

Gold ETFs are currently on track for their third straight month of inflows, taking their inflow total for the period past the $1bn mark as the dollar weakened following the Fed's recent decision to delay raising interest rates.

Mining share see resurgent short interest

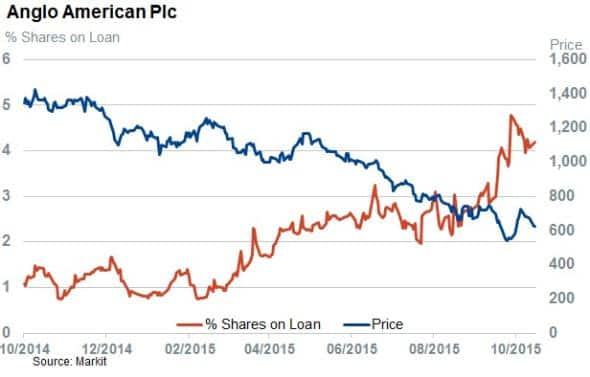

The recent fall in platinum also looks to have emboldened short sellers after mining share hit recent low levels. Demand to borrow shares in Anglo American, the largest platinum miner, surged past the 4% mark in recent weeks.

The second largest producer, Impala Platinum, has also seen short interest jump to all-time highs. Demand to borrow its shares overtook 6% for the first time ever last week as its shares slumped to ten year lows.

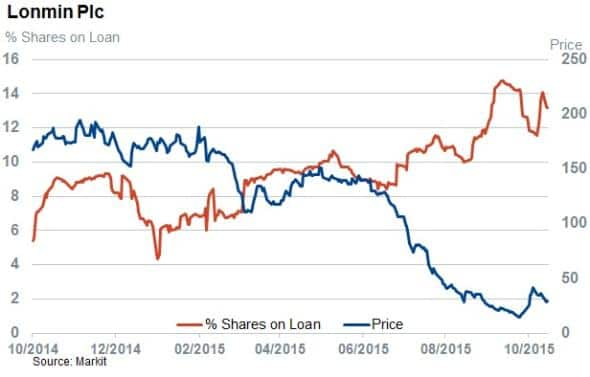

Lonmin, which is looking to restructure its debt pile, has also been the target of heavy short interest. Its short interest has hovered in the 12%-14% range in the last few weeks, with short sellers recently returning in earnest after a recent bout of covering led by a resurgent share price.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-equities-platinum-trails-gold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-equities-platinum-trails-gold.html&text=Platinum+trails+gold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-equities-platinum-trails-gold.html","enabled":true},{"name":"email","url":"?subject=Platinum trails gold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-equities-platinum-trails-gold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Platinum+trails+gold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21102015-equities-platinum-trails-gold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}