Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 20, 2014

Success stories for retail investors

After seeing a surge in negative sentiment in the run up to the back to school season, we look at the factors driving retail share prices as explained by the Markit Research Signal US Retail model.

- The best ranked US retailers have outperformed their lower ranked peers by 15% this year

- Apparel retailers dominate the worst ranking group of shares

- Shorts have been successful in the sector as worst ranked names, which have underperformed the rest of the universe by 8% year to date, have the highest average short interest

Yesterday's look at investor sentiment in the run up to the back to school period showed that short sellers have seized upon the recent bout of below expected consumer spending and added to their already above average presence in the sector. Today's look at the general retail and consumer sector uses the Markit Research Signal Retail model to analyse the type of factors driving returns in the sector, highlighting shares which score highly and those which do not. Please see appendix for a further description of the factor.

Retail model performing well

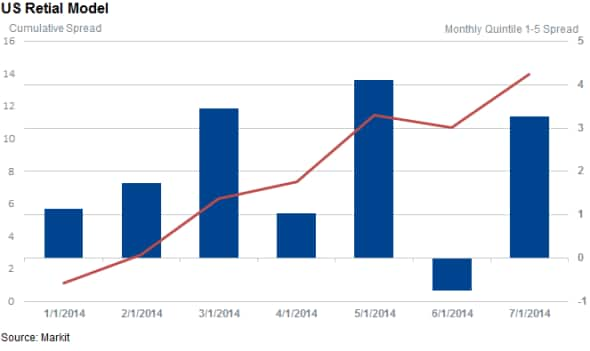

The retail model has performed strongly over the last seven months, as the return spread between the 20% of shares with the best scores and those in the opposite end of the spectrum has cumulated to 15.3% since the start of the year. This strong return differential is driven by both ends of the spectrum, as the best ranked shares have outperformed the rest of the universe (by 7%) while the worst ranked 20% of companies have lagged behind (by 8.3%).

Currently sitting at the top of the rankings is Build-A-Bear Workshop as it scores highly across operating and investors sentiment ranks.

As for absolute returns, only the best ranked 20% of shares have managed to bring positive returns since the start of the year while the other 80% of the retail universe has posted negative average returns. This sector makes a poster case for the power of market neutral, fundamental quant investing strategies in a sideways market.

Apparel worst ranked

As for the shares which feature in the worst ranked group, apparel firms and their retailers feature heavily amongst the 47 worst ranked firms in the sector, with 17 slots held.

Driving the negative sentiment in this sector is the fact that these stores score badly in the store growth efficiency criteria which measures real growth among firms by looking at yearly changes in same store sales and their profitability.

Companies currently driving this trend are fashion firms Coach and Aeropestale, as well as more general retailers such as Big 5 Sporting Goods and Francesca's Holdings.

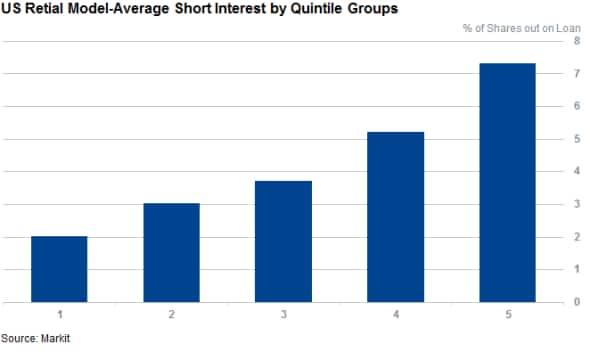

Sector makes for profitable shorts

While the overall retail sector has proven painful for investors, short sellers look to have got their bets on underperformance right, as the shares in the worst performing worst ranked group find themselves with the highest average short interest. These 20% of companies have fallen by a cumulative 13.5% since the start of the year.

Highlights among the most shorted group, which have 70% higher average short interest than the rest of the universe, include struggling green grocer Fresh Market and outdoors retailer Cabela's which have both seen large surges in short interest over the last seven months.

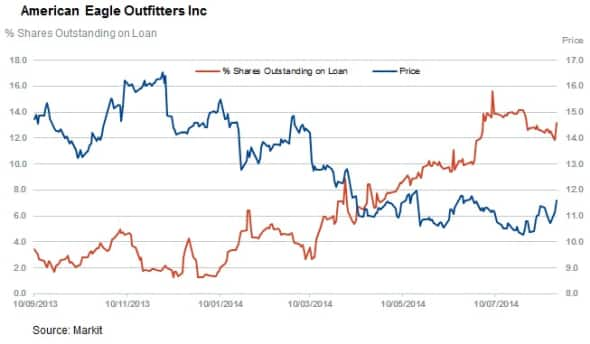

While these firms are seeing some of the worst investor sentiment, the company seeing the largest surge in shorting is teen retailer American Eagle, which has seen shorts nearly multiply by ten since the start of the year to make it one of the most shorted retailers going into back to school season.

Appendix: Model definition

The retail factor ranks US listed retailers across seven factor groups which measure fundamental valuation, investor sentiment and store performance. An aggregate score is built from the factor groups with good scoring companies receiving a low score. The constituents are then grouped into five groups based on composite score.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014Success-stories-for-retail-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014Success-stories-for-retail-investors.html&text=Success+stories+for+retail+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014Success-stories-for-retail-investors.html","enabled":true},{"name":"email","url":"?subject=Success stories for retail investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014Success-stories-for-retail-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Success+stories+for+retail+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21082014Success-stories-for-retail-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}