Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 21, 2016

CLOcomotion

After enjoying a recovery following January and February's market volatility, risk in the CLO market is on the rise again amid tighter regulation.

- CLO spreads have started to widen due to supply and regulation concerns

- Spread are however still tighter than the levels seen in March

- Market Value Coverage ratios, used to evaluate the credit worthiness of CLOs, have also seen a significant spike

The Collateralised Loan Obligations (CLOs) market has enjoyed a recovery after the market volatility seen at the start of the year, but recent regulation looks set to derail the rally. CLOs are securitisations which are backed by bank loans.

CLO spreads creep up

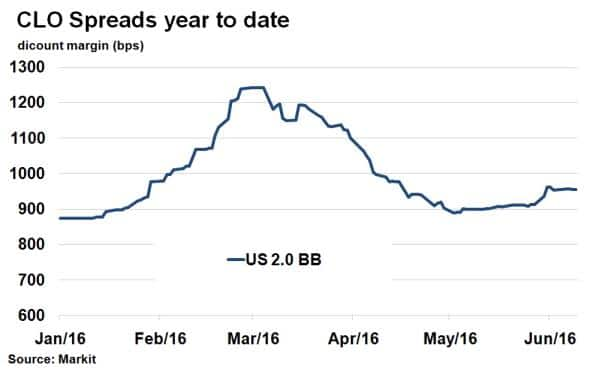

The CLO market has so far experienced a choppy year, both in terms of risk and issuance. According to Markit's Securitised product pricing service, CLO spreads (discount margins) widened rapidly at the start of 2016 in conjunction with falling crude oil prices and heightened volatility in the loans market.

US dollar denominated CLO's issued after the financial crisis (referred to as CLO 2.0) and rated BB, a sub investment grade rating, saw spreads widen to 1,242bps on March 1st, from 875bps at the start of the year. Primary supply tumbled in tandem as issuers put issuance on hold. Issuance in the Q1 fell to $7.1bn; a year on year drop of 77% ($30.8bn in Q1 2015). Overall, issuance in 2015 was approximately $120bn, a tally which already looks challenging to match.

Short lived rally

Since the beginning of March to mid-April, spreads tightened sharply as positive sentiment in the market resurfaced. This saw some cohorts in the capital structure, such as US 2.0 AAA and AA, return to spread levels seen at the end of 2015. Issuance also picked up and currently stands at nearly $21bn.

But the rally was short lived as supply and uncertainty around regulation pushed spreads wider in May, especially among the lower CLO tranches (mezzanine, BB, BBB rated). US 2.0 BB spreads widened to 956bps on June 9th, a 44bps rise over the preceding two weeks. However, spreads are still tighter than the highs seen in March.

Regulatory uncertainty has arisen because members of the European Parliament are calling for the risk retention percentage to be raised from 5% to 20%. Not only would this create additional hurdles for managers but also likely result in further consolidation within the CLO industry.

CLOs are typically the largest buyers of leveraged bank loans, especially in Europe. The lack new loans in a market where demand outstrips supply is putting further pressure on new issuance. An example would be the 2012 Madison Park single A tranche which covered near par during the week of March 6th and back in late January - a similar bond issued by CSAM would have been priced in the mid-90s (where par is 100).

Market Value Coverage ratios, a key data point when evaluating the credit worthiness of CLOs; have also seen a significant spike. The average BBB rated CLO issued in 2013 or 2014 had a ratio of 109/110 in early June thanks to the rally in loan prices, from around 104 at the end of February.

As the CLO market continues to evolve, focus on the quality of collateral rather than higher level metrics may be the way forward.

Markit's Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across agency pass through, agency CMO, non-agency RMBS, consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email:

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-credit-clocomotion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-credit-clocomotion.html&text=CLOcomotion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-credit-clocomotion.html","enabled":true},{"name":"email","url":"?subject=CLOcomotion&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-credit-clocomotion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CLOcomotion http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21062016-credit-clocomotion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}