Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 21, 2015

European equity markets return to form

After a brief reversal of fortunes saw the Euro STOXX 50 lose over 7% from recent highs, eurozone equity markets have returned to their winning form; encouraging ETF investors to add to their positions.

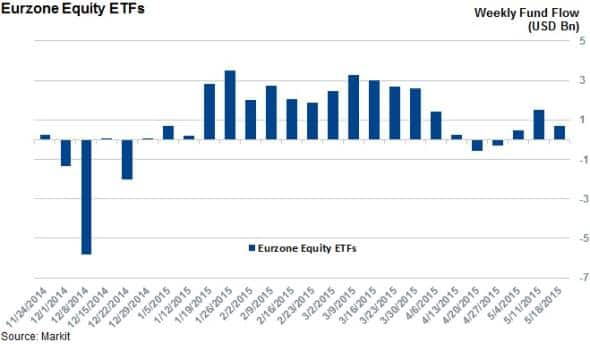

- Eurozone ETFs saw redemptions during April selloff; this trend has since reversed

- International investors have returned to Europe over the last ten days

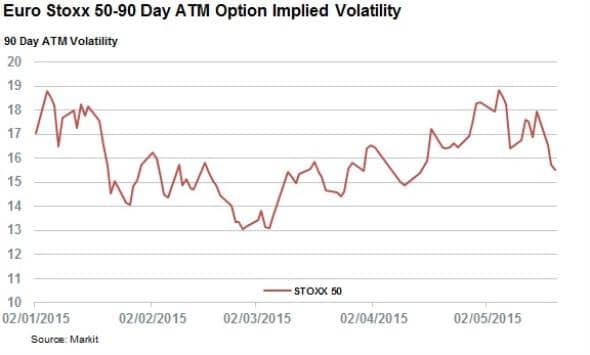

- Market calm is also reflected in options markets, where implied volatility has been falling

The eurozone QE story diverged from its aims over the last few weeks as both bund yields and the euro rebounded from their recent lows. This development was not constrained to currency and bond markets however, as the region's equity headed south with the Euro Stoxx 50 retreating by 7.5% from its yearly high.

The ECB has since taken steps to address the recent volatility, with a pledge to increase the pace of asset purchases in May and June. The market has shown little appetite to stand on the other side of that trade, with both bund yields and the euro retreating from their recent highs.

The equity market has also reacted well, with the Stoxx 50 regaining much of its recent lost ground; a move which has seen ETF investors regain their appetite for eurozone equities.

ETF investors react

The recent periods of volatility had seen investors rethink their eurozone exposure. Eurozone tracking ETFs experienced their first weekly outflow since January in the middle of April when the 287 eurozone tracking ETFs experienced $580m of outflows, a trend which continued in the subsequent week.

These outflows have since reversed as the market rebounded from its lows and eurozone tracking equity ETFs have seen $2.67bn of inflows over the last three weeks. This looks to have been a shrewd move as the markets have since regained most of their lost ground.

International investors return

The recent flow wobbles seen in both domestic and foreign listed ETFs. International investors withdrew $500m of assets from eurozone products in the opening two weeks of May. Flows have since reversed with $450 of assets flowing into the 31 overseas listed eurozone focused equity funds.

The WisdomTree Europe Hedged Equity Fund, which had attracted the most inflows so far this year, saw its first daily outflow in six months over the recent selloff. Inflows have since resumed with the fund seeing over $250m of inflows in the last two weeks.

Calm returns to options market

Options markets also reacted to the recent volatility with Stoxx 50 options registering a spike in 90 day at the money implied volatility. That number topped out at 18.8% in the opening week of May, when the market lows were registered.

The recent market rebound has seen option implied volatility revert back to their pre selloff levels.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-equities-european-equity-markets-return-to-form.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-equities-european-equity-markets-return-to-form.html&text=European+equity+markets+return+to+form","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-equities-european-equity-markets-return-to-form.html","enabled":true},{"name":"email","url":"?subject=European equity markets return to form&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-equities-european-equity-markets-return-to-form.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+equity+markets+return+to+form http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-equities-european-equity-markets-return-to-form.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}