Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 21, 2015

US banks now less risky than European peers

Strong second quarter earnings and positive stress tests have helped reduce US banks' credit risk, while their European counterparts battle with further penalties and systemic risk.

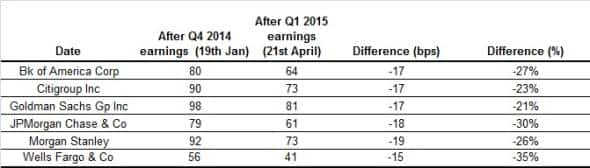

- Since Q4 2014 earnings, major US banks have seen their CDS spreads tighten over 20%

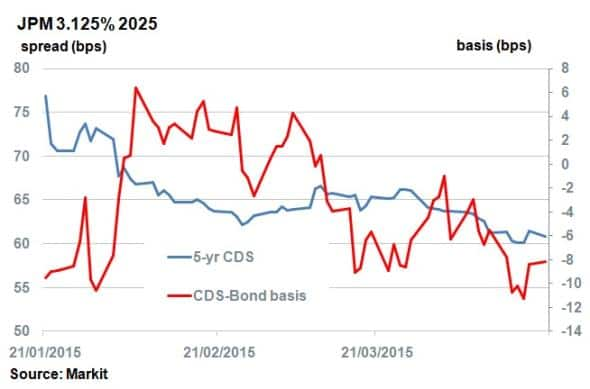

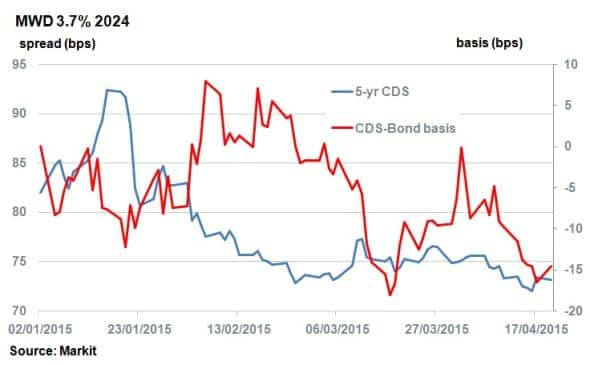

- Declining CDS spreads have pushed the CDS-bond basis for JPM, MS into negative

- Credit risk associated with US banks and European financials now diverging

US banks have stood out as a bright spot this earning season, which has seen many firms struggle in the stumbling macroeconomic and strong dollar environment.

JP Morgan saw profits rise 12% in part due to strong trading revenues, which was also seen by its investment banking peers Goldman Sachs and Morgan Stanley. Large retail lenders Wells Fargo, Citigroup and Bank of America continued to struggle in the current low interest rate environment, but lower litigation costs have helped these firms post strong profits.

Credit rebound

This recent strong run marks a rebound from the last earnings season which saw US bank credit deteriorate. While CDS spreads were already rebounding after the six largest US banks successfully completed the Fed stress tests, the strong Q1 results have seen CDS spreads tighten further.

CDS spreads, which measure the the cost of insuring against default, have fallen over the year to date with all six major banks seeing at least a 15bps tightening in 5-yr spreads. The best performer, Morgan Stanley, has seen its 5-yr spread tighten 19bps to reach a level not seen since last September. In percentage terms, all six banks have seen their credit spreads tighten 20% or more over year to date, with JP Morgan falling 30% to 61bps; a level now lower than that of the CDX NA index which is composed of high grade US corporates.

Cash playing catch up

The rapidly declining CDS spreads have created a disconnect between the bond and credit markets. As a result, JP Morgan and Morgan Stanley's bond now trade with a negative basis to their CDS spreads. This means that the cash (bond) spread is trading higher than the CDS spread. Traders can lock in profits from basis by buying the bond (receiving a spread) and buying an equivalent CDS contract (pay spread) simultaneously.

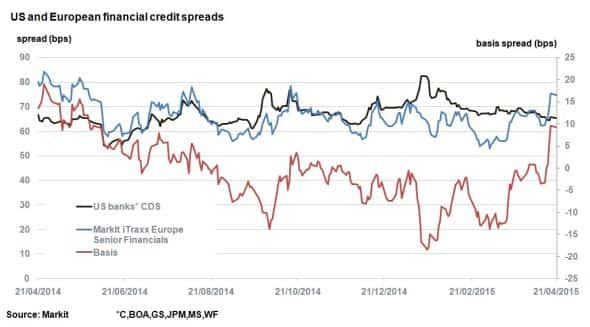

US safer than Europe

The strong earnings performance has seen, US banks' credit trading tighter than European financials for the first time since October of last year, as represented by the Markit iTraxx Europe Senior Financials, which is composed of investment grade corporates. In fact the basis between the two now stands at 9bps; a level not seen since July last year.

This spread isn't just driven by the strengthening of US banks. The European financial sector has been treated with increased bearishness over the last few weeks. While ECB QE did much to boost bank profitability, banks in Europe and the UK are still likely to face looming litigation charges, while the worst is now behind US banks. The deteriorating situation in Greece has also impacted French and German banks, which have the largest exposure to Greek and periphery European debt.

A default would put banks in unchartered territory with unknown consequences. European banks' CDS spreads are reflecting this uncertainty with 5-yr spreads for Commerzbank and BNP Paribas having widened 32% and 27% respectively since the beginning of March.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Credit-US-banks-now-less-risky-than-European-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Credit-US-banks-now-less-risky-than-European-peers.html&text=US+banks+now+less+risky+than+European+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Credit-US-banks-now-less-risky-than-European-peers.html","enabled":true},{"name":"email","url":"?subject=US banks now less risky than European peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Credit-US-banks-now-less-risky-than-European-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+banks+now+less+risky+than+European+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21042015-Credit-US-banks-now-less-risky-than-European-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}