Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 20, 2015

Ukrainian bonds erase losses; EM dollar credit fragile

Ukraine's recovery continues as Russia eases its debt repayment stance, while the latest Fed minutes point towards a December rate hike.

- Ukraine's 5-yr USD government bond price has risen to the highest level since June 2014

- USD EM bond spreads are wider now than four year average during easy Fed policy

- US retail has seen CDS spreads widen, Dillard's credit spread has doubled since May

Putin effect

Ukrainian government bonds rose this week as Russia agreed to restructure a $3bn bond principal payment due in December. The Russians had previously been holding out, demanding full and timely payment, but recent political developments have led Russian president Vladimir Putin to relax his stance. Private bondholders had already previously agreed to a restructuring deal with Ukraine in September, which sparked a credit event.

Ukraine's debt struggles began ever since the annexation of Crimea in March 2014, which was only compounded by the falling exports and a strong dollar.

The price Ukraine's 5-yr government bond denominated in US dollars jumped 18.625pts to 98.25(% of par) this week, according to Markit's bond pricing service. A remarkable turnaround for a bond that was priced below 40 just eight months ago, the gains meant levels were now back to those last seen in June 2014. Ukraine's economy is expected to return to growth in Q4 and with Moody's upgrading its credit rating today from Caa3 to Ca, a corner may have been turned.

Fed minutes

The Fed's October FOMC meeting removed global developments from its list of possible destabilisers to the US economy, paving the way for a December rate hike. FOMC minutes from that meeting released this week reinforced that notion.

But while the Fed's sentiment has switched to hawkish, risks remain. Inflation remains tepid, sapping nominal investment returns, commodity prices are at multi year lows while the strength of the US dollar could derail US corporate profitability.

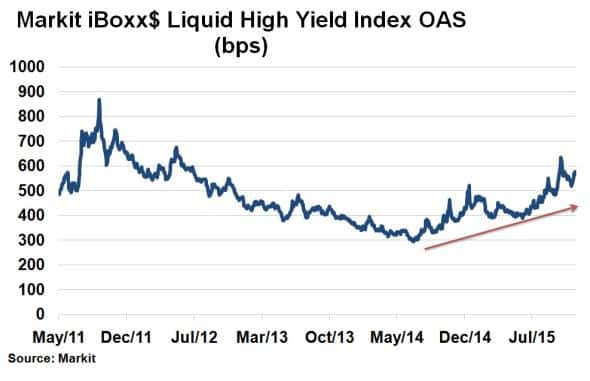

In credit markets, US high yields (HY) bond spreads have been on a widening trajectory ever since May 2014. Widening spreads are predominately an indicator of increasing credit risk, but also incorporate market factors such as liquidity. The Markit iBoxx $ Liquid High Yield Index recently saw its index spread surpass 600bps for the first time since July 2012. Historically, rising spreads are an indication of pending defaults, which has the potential to destabilise the wider economy.

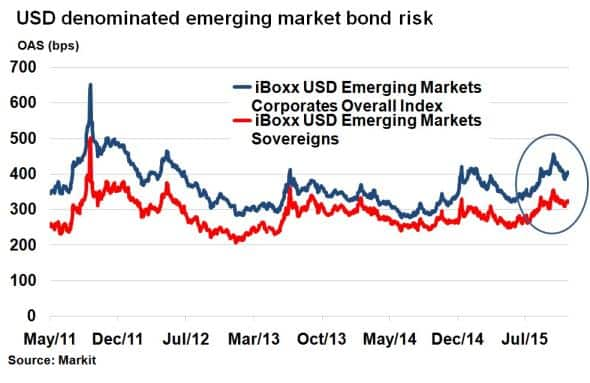

But concerns in the credit space are not restricted domestically. US interest rate policy impacts the $4tn+ of non-financial USD denominated bonds issued abroad, mainly through potential higher borrowing costs. The iBoxx USD Emerging Markets Corporates Overall Index spread is currently 401bps, 44bps wider than the 4-yr average, while the iBoxx USD Emerging Markets Sovereign's index spread is 35bps wider than its 4-yr average, as the Fed contemplates tighter policy.

Retailers suffer

After slumps this year in the oil & gas sector, media, basic materials and healthcare, US retail was the latest sector to have suffered an investor backlash. Weak consumer spending heading into the holiday season saw third quarter earnings disappoint with a host of names such as Macy's and Urban Outfitters exemplifying the trend.

But it was retailers JC Penny and Dillard's that caught the eye of credit investors, with both names being listed as the top weekly CDS wideners in North America. Dillard's saw its 5-yr CDS spreads widen to 242bps as of November 18th, double the level seen in May. Similarly JC Penny saw its CDS spread rise to 812bps for the first time since early 2015. It was not the first time the Texas based department store has been in trouble. Spreads reached 1800bps in February 2014, equivalent to paying $1.8m per $10m annually to insure against default.

With the holiday period fast approaching, retailers will be hoping for a boost from consumers.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Credit-Ukrainian-bonds-erase-losses-EM-dollar-credit-fragile.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Credit-Ukrainian-bonds-erase-losses-EM-dollar-credit-fragile.html&text=Ukrainian+bonds+erase+losses%3b+EM+dollar+credit+fragile","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Credit-Ukrainian-bonds-erase-losses-EM-dollar-credit-fragile.html","enabled":true},{"name":"email","url":"?subject=Ukrainian bonds erase losses; EM dollar credit fragile&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Credit-Ukrainian-bonds-erase-losses-EM-dollar-credit-fragile.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ukrainian+bonds+erase+losses%3b+EM+dollar+credit+fragile http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112015-Credit-Ukrainian-bonds-erase-losses-EM-dollar-credit-fragile.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}