Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 20, 2014

The future of Swedish dividends

OMXS30 Dividend Futures were launched this week, allowing investors to trade the future dividends of Swedish listed companies. The futures are based on the constituents of the OMXS 30 Dividend Point Index.

- While a few OMX 30 members see short selling activity due to low oil prices and a strong dollar, the majority of index constituents are expected to grow dividends

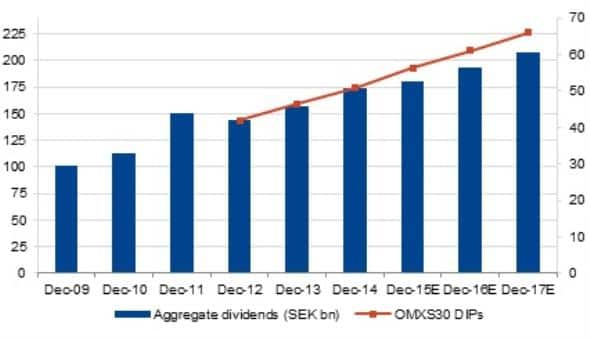

- Markit's dividend forecasting expects aggregate dividends of the index to grow by 4% to SEK 180bn in 2015

- The biggest dividend contributor is expected to be Nordea at 8.2 DIPS*

The Swedish dividend story

Markit's dividend research reveals that constituents of the OMXS30 index and their respective dividends have maintained an upward trend, and increased dividends on a nominal basis since 2012. This incline is expected to continue through to 2017.

Swedish banking sector dividends have rebounded on a relative basis far more than their European counterparts. Total nominal dividend payments in the region now exceed pre-crisis levels.

This apparent dividend recovery can be attributed to aggressive dividend cuts made during and after the crisis in order to strengthen balance sheets across the sector. Shareholders of Swedish banks can now on average expect approximately 65 - 70% in dividend pay-out ratios over the next few years.

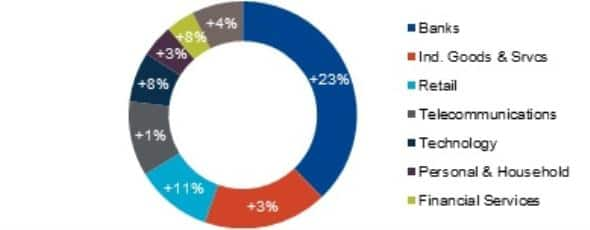

The banking sector weight of DIPS is expected to increase from 35% to 38% in December 2015, mainly driven my Nordea. Banks dividends in total are expected to grow by 23% but are diluted on an aggregate basis to 4%, reaching SEK 180bn in 2015.

Other sectors expecting material growth in dividends in the region include; retail, telecommunication, technology and financial services.

The short term future looks unfavourable for dividend contributions from energy and basic materials related sectors' amid low energy prices and the strengthening dollar.

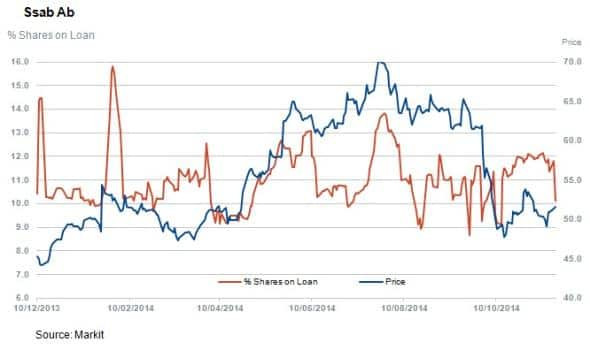

The largest steelmaker in the Nordic region, Ssab, is currently the most shorted constituent of the OMX30 with 10% of shares outstanding on loan.

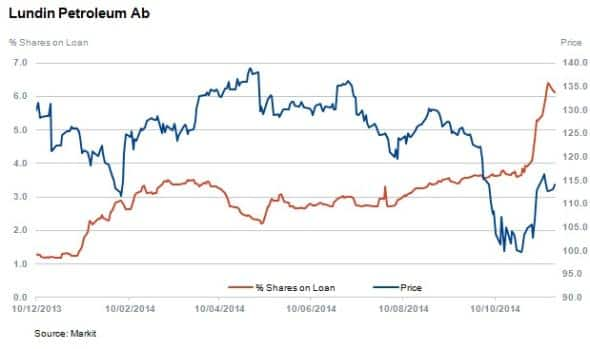

Natural oil and gas explorer and producer Lundin Petroleum currently has 6% of shares outstanding on loan in the wake of multiyear low oil prices. Short interest in the stock has doubled since August from 3.0% to 6.0% currently.

It is worth noting that firms with significant short interest in the OMX 30 index, including Ssab and Lundin petroleum, represent less that 13% of the total.

Meanwhile Nokia has resumed dividends in 2014 with an ordinary payment of €0.11, full year consensus EPS is for €0.27**. The firm also paid a special dividend of €0.26 post restructuring with Microsoft during the year.

*Dividend index points

**Source: Factset

For further information and the full report please contact;

Alessandro Ferretti

Director

Dividend Forecasting

Markit

Tel: +44 207 260 2124 Email: alessandro.ferretti@markit.com

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-Equities-The-future-of-Swedish-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-Equities-The-future-of-Swedish-dividends.html&text=The+future+of+Swedish+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-Equities-The-future-of-Swedish-dividends.html","enabled":true},{"name":"email","url":"?subject=The future of Swedish dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-Equities-The-future-of-Swedish-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+future+of+Swedish+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-Equities-The-future-of-Swedish-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}