Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 20, 2016

Week Ahead Economic Overview

Markets will be on tenterhooks during the week, awaiting US and UK third quarter GDP results as well as flash PMI results for October. The latter will provide analysts with the first available information on global economic trends in the fourth quarter.

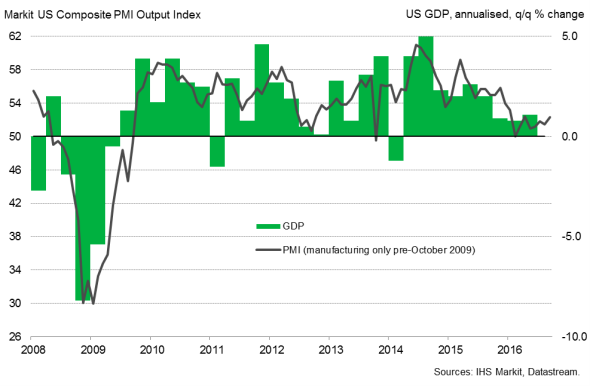

The US Federal Reserve Bank will be monitoring preliminary third quarter GDP and October PMI results for clues on the health of the world's largest economy. Expectations have been growing that the Fed will raise interest rates at their December meeting, but this of course depends on the data flow in the coming weeks. In the second quarter, the US economy grew 1.4%, with inventory investment subtracting 1.2 percentage points from real GDP growth. IHS Markit predicts an expansion of 1.8% in the third quarter as the drag from inventories will subside and official data point to US industry seeing signs of renewed life. However, the trend in consumer spending weakened in the third quarter and latest PMI results signal that there remain some downside risks to the outlook.

US economic growth and the PMI

Flash PMI results will provide analysts and data watchers with important information on how the US economy is faring at the start of the final quarter. Data for the manufacturing sector are out on Monday, while updates on the service sector are released on Wednesday. Other important releases in the US include consumer confidence, durable goods orders and mortgage data.

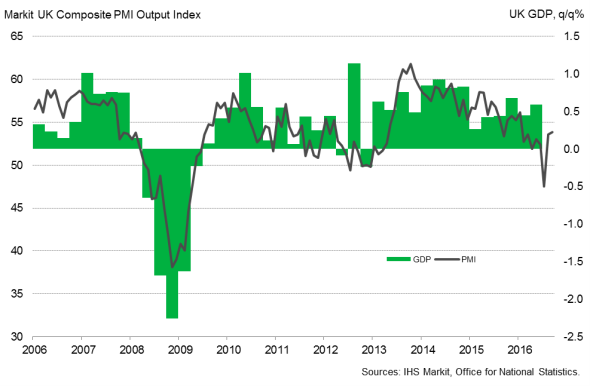

The monetary policy outlook in the UK has grown uncertain, and third quarter GDP results are likely to add to the policy debate. On the one hand, a solid rise in consumer prices and a possible overshooting of the bank's inflation target in the near future are arguments supporting tighter monetary policy. On the other hand, economic growth is expected to slow with the weak pound likely to reduce households' disposable income, thereby diminishing consumer spending. Markit's HFI showed that more than one quarter of UK households expect the Bank of England to cut rates, while some 43% predict a tightening of monetary policy over the next year.

Third quarter UK GDP results are released by the Office for National Statistics on Thursday. Latest PMI results point to the UK economy growing by 0.3%, with the survey data suggesting that the economy has regained growth momentum after recovering the initial shock of the EU referendum in late-June. GfK consumer confidence and mortgage approval figures will also be published during the week.

UK economic growth and the PMI

Over in the eurozone, October flash PMI results are published on Monday and policymakers will hope to see a reacceleration of economic growth after the PMI fell to a 20-month low in September. The survey data are still consistent with steady, although unspectacular GDP growth of 0.3% in the region. However, more clues to the region's economic performance in the third quarter can be gauged from GDP updates in France and Spain, released by their respective statistical offices on Friday. Moreover, various eurozone countries see business and consumer sentiment data published, which will be monitored for important information on the general health of the euro area economy.

Flash PMI results are also released for Japan's goods-producing sector, which will be eyed for signs that manufacturing is continuing to emerge from its recent prolonged downturn. However, activity in the service sector fell at the fastest pace in almost two-and-a-half years, thereby suggesting that Japan's economic performance remained subdued. Other notable releases in Japan include inflation and unemployment figures, which are both out on Friday.

Monday 24 October

Flash PMI results are published in Japan, France, Germany, the eurozone and the US.

Japan sees the release of trade data.

In Russia, monthly GDP numbers are updated.

Wholesale trade figures are issued in Canada.

Tuesday 25 October

Import price data and latest Ifo business climate results are published in Germany.

In France, business confidence numbers are issued by INSEE.

Italy sees the release of industrial orders figures.

Meanwhile, current account data are out in Brazil.

Consumer confidence and home price numbers are published in the US.

Wednesday 26 October

Inflation numbers are issued in Australia.

In South Africa, budget balance data are updated.

Retail sales are out in Italy and Germany, with the latter also seeing the release of GfK consumer confidence figures.

France and Brazil also see the publication of consumer confidence numbers.

BBA mortgage approval numbers are issued in the UK.

Mortgage data and latest flash services and composite PMI results are out in the US.

Thursday 27 October

Import and export price figures are published in Australia.

Producer price numbers are meanwhile out in South Africa.

M3 money supply data are updated in the eurozone.

In Italy, business confidence and wage inflation figures are released.

The Office for National Statistics publishes preliminary third quarter GDP results for the UK.

Unemployment data are out in Brazil.

Initial jobless claims, durable goods orders and building permit numbers are released in the US.

Friday 28 October

In Australia, producer price and home sales numbers are issued.

Japan sees the publication of household spending, consumer price and unemployment data.

The Central Bank of Russia announces its latest monetary policy decision.

Inflation figures are released by Destatis in Germany.

The Bank Austria Manufacturing PMI is published.

Preliminary third quarter GDP results are issued in France and Spain, with the former also seeing the publication of inflation and consumer spending numbers.

GfK consumer confidence data are out in the UK.

In the US, latest Reuters/Michigan consumer sentiment numbers and preliminary third quarter GDP results are released.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}