Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 20, 2017

Japanese export growth picks up, but PMI hints at softer trend

Official data showed that growth in Japan's exports gained momentum in August, confirming the pick-up signalled by the earlier PMI survey data, but the extent of the upturn in the government statistics has likely overstated the underlying picture in the third quarter.

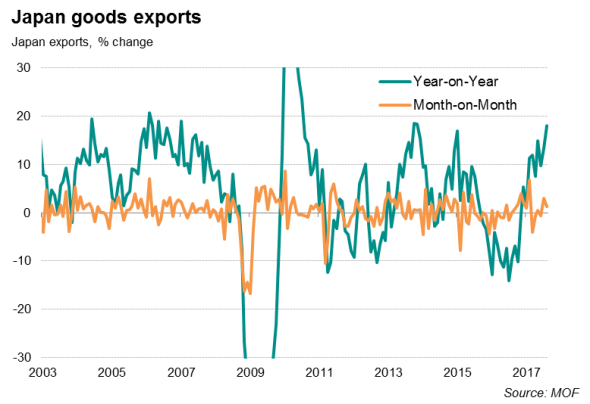

According to the Ministry of Finance, exports rose at an annual rate of 18.1%, up from 13.4% in July and the fastest for over three-and-a-half years. The improvement marked a ninth consecutive month of export growth. The strong headline number provided further assurance that overseas demand remains resilient, helping allay recent concerns that GDP growth engines are shifting away from foreign markets towards domestic sources.

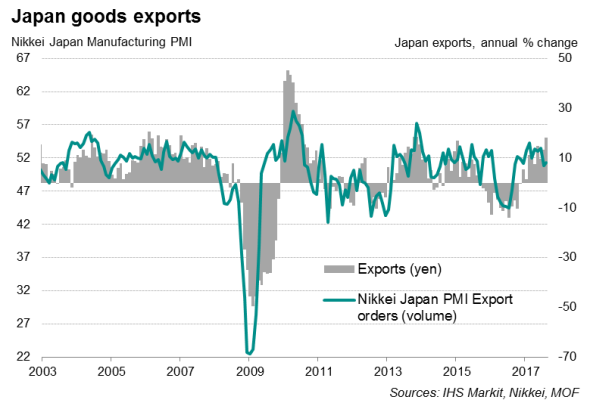

The August increase also came in above market expectations for a 14.7% rise in exports, but a pick-up had been signalled in advance by the New Export Orders Index from the Nikkei PMI survey (compiled by IHS Markit). As early as late-August, we had reported that export sales growth quickened in the month.

However, the survey data have so far pointed to relatively modest growth in exports in the third quarter, suggesting the strong official growth rate for August may exaggerate the underlying export trend. The average PMI export orders reading for the past two months was below the average seen for the first half of this year.

Furthermore, a historical comparison of the PMI with official data suggests that double-digit annual growth in exports is unlikely to be sustained in coming months.

Indeed, annual growth statistics from the official data have been inflated by favourable base effects (exports were down 9.6% year-on-year in August 2016). A look at the monthly growth rate in seasonally adjusted terms revealed a more modest 1.2% increase.

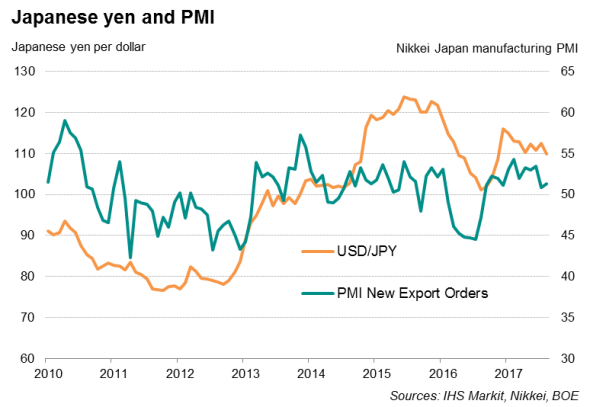

The softer PMI survey data for exports in the third quarter so far in part reflected changes to trading conditions. A weaker exchange rate had previously supported foreign demand, but the recent appreciation of the yen may have eroded some export competitiveness: the yen has strengthened over 2% against the US dollar since July, with the average spot price in August the highest for nine months.

The next update to flash PMI data will be published on September 25, which will provide early insights as to manufacturing and export trends at the end of the third quarter.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20092017-economics-japanese-export-growth-picks-up-but-pmi-hints-at-softer-trend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20092017-economics-japanese-export-growth-picks-up-but-pmi-hints-at-softer-trend.html&text=Japanese+export+growth+picks+up%2c+but+PMI+hints+at+softer+trend","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20092017-economics-japanese-export-growth-picks-up-but-pmi-hints-at-softer-trend.html","enabled":true},{"name":"email","url":"?subject=Japanese export growth picks up, but PMI hints at softer trend&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20092017-economics-japanese-export-growth-picks-up-but-pmi-hints-at-softer-trend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+export+growth+picks+up%2c+but+PMI+hints+at+softer+trend http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20092017-economics-japanese-export-growth-picks-up-but-pmi-hints-at-softer-trend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}