Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 20, 2016

Turkish coup fails to dent appetite for EM bonds

Turkey, one of the largest issuers of emerging market dollar denominated debt, has seen a rise in credit risk in the wake of last week's coup attempt and the resulting crackdown, but investor appetite for the asset class has remained undeterred.

- Turkish sovereign bond spreads widen as its CDS spread surges by a quarter

- USD EM Sovereign bonds spreads below the 300bps mark for the first time in 11 months

- Emerging market bond ETFs see $392M inflows this week to take ytd inflow tally to new record

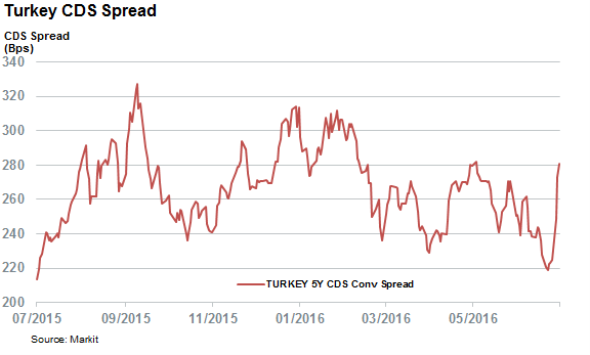

Last week's failed Turkish coup, and the resulting crackdown has spooked holders of Turkey's dollar denominated government bonds. Gauged by turkey's CDS spread, the market's perceptions of the country's credit risk has jumped by more than a quarter from its close on Thursday. Investors are now requiring 283bps of annual premium to ensure Turkish bonds against defaults, the most since February.

The majority of the recent widening has happened since Monday's close which shows that the market is equally worried about the escalating scale of the crackdown as well as any direct impact from the coup.

Despite the recent surge in spreads, Turkish CDS are still way off the lows seen after last year's inconclusive elections when spreads reached 327bps.

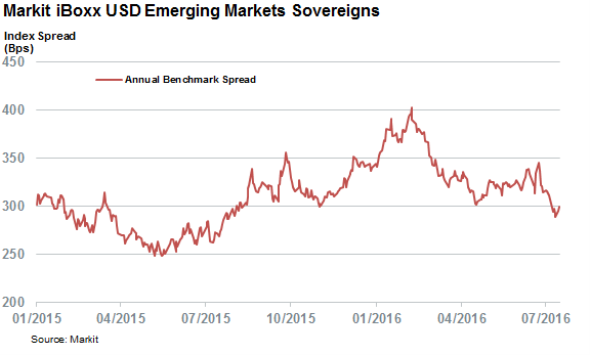

This surging credit risk has seen the average spread of the 25 dollar denominated Turkish government bonds (which make up the Markit iBoxx USD Emerging Markets Sovereigns index) jump by 31bps from the end of June. Investors are now requiring 3% of extra yield over US treasuries in order to hold dollar denominated Turkish bonds, a number in line with that required by holders of Croatian and Brazilian dollar denominated bonds.

Emerging spreads rally

Turkey's surging spreads are not reflective of investor sentiment in the wider emerging market world as only four of the 68 constituent countries of the iBoxx USD Emerging Markets Sovereigns index have seen their average spreads widen in July so far.

This trend has ensured that the asset class is now trading 21bps tighter to US treasuries with the index now spread below the 300bps mark for the first time since August of last year.

Emerging market ETFs see inflows

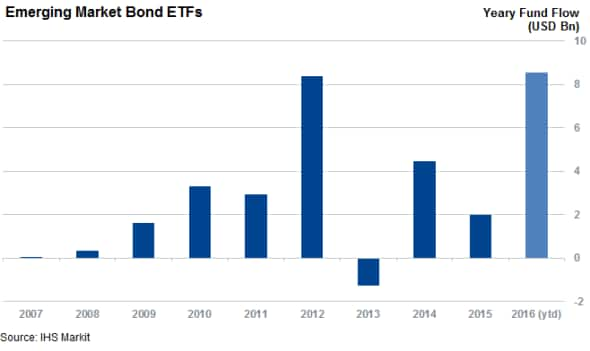

While you could be excused for thinking that Turkey's recent upheaval could be enough to put a pause to the investor's insatiable appetite for emerging market bonds, especially since Turkey is the largest constituent of the iBoxx USD Emerging Markets Sovereigns index with a 9.6% weight, the Markit ETF analytics database has seen no signs of this. In fact, investors poured nearly $400m into the 48 emerging market bond ETFs in the two trading days since the coup, extending the asset class's inflow streak to 15 days.

These inflows were enough to take the year to date inflow total for emerging market exposed bonds ETFs to $8.5bn, overtaking 2012's record setting inflows.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072016-Credit-Turkish-coup-fails-to-dent-appetite-for-EM-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072016-Credit-Turkish-coup-fails-to-dent-appetite-for-EM-bonds.html&text=Turkish+coup+fails+to+dent+appetite+for+EM+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072016-Credit-Turkish-coup-fails-to-dent-appetite-for-EM-bonds.html","enabled":true},{"name":"email","url":"?subject=Turkish coup fails to dent appetite for EM bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072016-Credit-Turkish-coup-fails-to-dent-appetite-for-EM-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Turkish+coup+fails+to+dent+appetite+for+EM+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20072016-Credit-Turkish-coup-fails-to-dent-appetite-for-EM-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}