Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 20, 2017

Most shorted ahead of earnings

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week

- RH most sees persistently high short interest despite a recent rebound

- Meyer Burger continues to feature among the favorite short targets

- Aluminium Corporation of China is the most shorted Asian stock

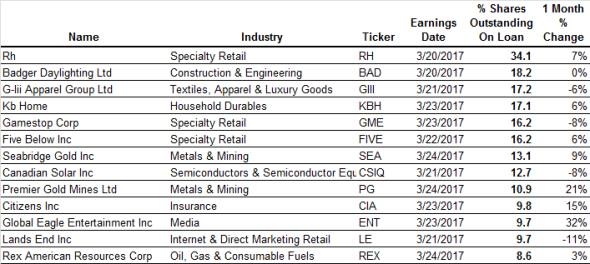

North America

Short sellers continue to be highly active among retailers. This trend was recently highlighted in our recent report looking at bearish sentiment in the sector as well as retail focused REITs whose fortunes have also been impacted by customers shifting to online shopping.

Rh, which operates Restoration Hardware stores. is this week's high conviction short target as it has over a third of its shares are out on loan to short sellers. RH shares have rebounded in recent months however short sellers, who have zeroed in on RH since last summer, have been willing to double down as demand to borrow the firm's shares has climbed to the highest level in over three years. RH earnings updates have proved to be highly profitable for short sellers as three of the last four results announcements were followed by a 20% fall in price.

Other high conviction short plays in the retail sector this week are GameStop and Five Below which both have 16% of their shares out on loan to short sellers.

Not having a store presence doesn't necessarily guarantee a firm won't come under pressure from short sellers however Lands End, which draws most of its revenue from direct catalogue and online channels, also finds itself among this week's heavily shorted stocks. The company isn't totally unencumbered from physical retail however as it draws 15% of its sales from its retail distribution located in both standalone stores and in Sears locations. The company's current high short interest masks some brightening investor sentiment though, as its shorting activity has come down significantly in recent months.

Another firm seeing heavy short covering in recent months is Badger Daylighting, the second most shorted firm announcing earnings this week. Badger saw over a third of its shares out loan over last summer, but short sellers have since covered half their positions after the firm posted brighter earnings which sent is shares up sharply.

Gold miners also feature prominently among the top short targets for the coming week as Seabridge Gold and Premier Gold mines make the list of heavily shorted firms ahead of earnings.

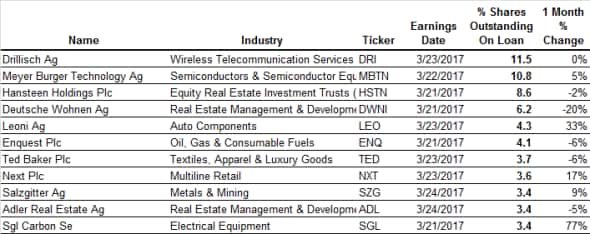

Europe

Telecommunication firm Drillisch is the most shorted firm announcing earnings next week as it has over 11% of its shares out on loan. While high, the short interest unlikely to be driven by any directional players as the firm has several convertible bond issuances outstanding.

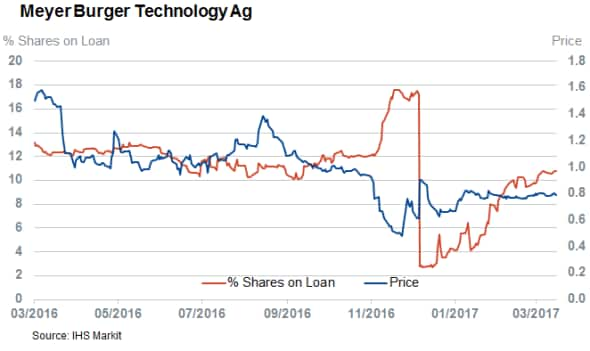

The same isn't the case for Meyer Burger, the solar cell manufacturing firm which lands as the second most shorted firm announcing earnings this week. Meyer Burger's persistently high short interest stems from the ongoing global glut of solar cells which has depressed prices and hampered investment in new capacity.

Fashion firms comprise the main UK short plays next week as Ted Baker and Next both make the list of heavily sorted firms ahead of earnings.

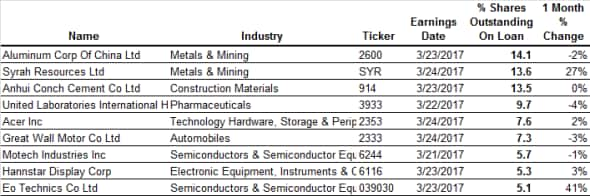

Asia

Aluminium Corporation of China is the most shorted firm announcing earnings in Asia this week as it has 14% of its shares on loan to short sellers. Short sellers have stood the course in Aluminium Corp despite a recent rebound in aluminium price, driven by improving global growth, which has seen nearly doubled the firm's shares from the lows set last year.

Shares in Australian mining firm Syrah, which is looking to Segway into the graphite market, is the second most shorted Asian company announcing earnings this week. Current short interest in the firm stands at an all-time high despite the fact that its shares have rebounded after losing over two thirds of their value from the all-time highs registered last June.

Computer manufacturer Acer is the most shorted tech mane announcing earnings this week as just under 8% of its shares are out on loan to short sellers. Acer has been a constant feature among the list of heavily shorted Asian stocks for much of the last few years although appetite to short the firm has fallen somewhat in recent weeks as evidenced by the fact that the demand to borrow its shares fell to a three year low over February.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032017-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20032017-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}