Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 20, 2017

Short sellers notch up early win in US retail

Many bricks and mortar retailers struggled over the holiday shopping period, encouraging short sellers to add to their already high positions.

- Retailers have seen short interest tick up while the rest of the market experienced covering

- Top five most shorted retailers have fallen in price this year to date

- Short sellers have targeted lagging retailers such as J C Penney

Retail stocks are treading water in the opening weeks of the year while the wider S&P 500 has seen the post Trump rally continue in the New Year with a 1.4% return. This underperformance hasn't been uniform however, as online focused outlets such as Amazon posted strong numbers which came at the expense of their bricks and mortar competition. This performance seems to have emboldened short sellers to further commit to one of the high conviction trades of the last few years as retailers have seen an increase to their already high short interest since the start of the year.

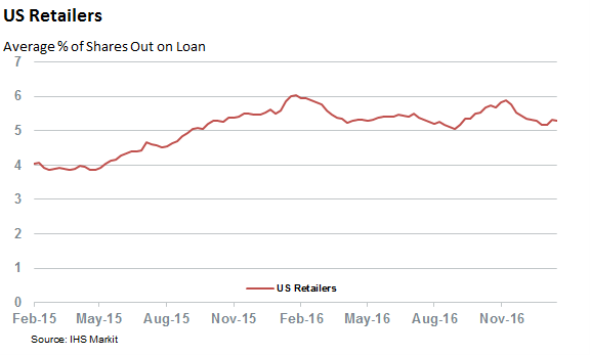

The uptick in short interest is evidenced by the fact that the average demand to borrow shares in the 200 or so US retailers with a market cap greater than $200m has increased by roughly 3% since the start of the year, with an average of 5.3% of shares outstanding. This increase runs contrary to the rest of the US market where the buoyant mood has prompted short sellers to return 5% of their S&P 500 borrow since the start of the year. These diverging paths mean that the already heavily shorted sector now sees more than twice the average demand to borrow than the rest of the market.

Bearish sentiment in retailers has also been expressed through XTR, the SPDR S&P Retail ETF. Short sellers have borrowed a staggering 52% of the ETF's shares outstanding as of latest count.

High conviction shorts pay off

Not surprisingly, short sellers have been focusing their attention on the sector's laggards as the 10 firms which have seen the largest rise in demand to borrow since the start of the year have seen their shares fall by an average of 5% over the same period of time.

This trend was led by J C Penney which has seen short sellers increase their borrow in the company's shares by over 4% of shares outstanding since the start of the year. This surge, which takes J C Penney's shorting activity to a new yearly high, was spurred on by news that the company's same store sales declined over November and December. These disappointing results sent J C Penney shares down by 16% in the opening two and a half weeks of the year, but the surging demand to borrow the retailer's shares indicates that short sellers think the selloff may have room to run.

Tailored Brands, which joins J C Penney among the top 10 retail short targets of 2017 so far has also seen its shares fall by over 15% this year to date.

Top short targets underperform

While short sellers have been targeting the laggards in the retail space, their top targets heading into the year have also underperformed as the 20 retailers which had the greatest proportion of their shares on loan to short sellers have fallen by 3% on average in 2017 so far. This trend is most evident among the five highest conviction short positions in the sector which have fallen by 8% on average.

Sports retailers Hibbertt Sports, which was the most shorted retailer heading into the year, has by and large proven shorts right as its shares are down by 9% this year to date.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012017-equities-short-sellers-notch-up-early-win-in-us-retail.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012017-equities-short-sellers-notch-up-early-win-in-us-retail.html&text=Short+sellers+notch+up+early+win+in+US+retail","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012017-equities-short-sellers-notch-up-early-win-in-us-retail.html","enabled":true},{"name":"email","url":"?subject=Short sellers notch up early win in US retail&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012017-equities-short-sellers-notch-up-early-win-in-us-retail.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+notch+up+early+win+in+US+retail http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20012017-equities-short-sellers-notch-up-early-win-in-us-retail.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}