Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 19, 2017

China tames bears ahead of People's Congress

Short sellers have actively trimmed their bets on Chinese equities in the 12 months leading up to Wednesday’s upcoming National People's Congress

- Shorting activity among H shares near the lowest levels in over two years

- Short sellers still active among Chinese automakers despite recent rally

- HSI constituents have also experienced sustained short covering

Chinese equities have forged ahead in the months leading up to the National People's Congress – which occurs twice a decade – and short sellers are taking notice. Chinese equities experienced more than their fair share of volatility in the 18 months leading up to the 19th edition of this Congress; doubts exist about the country’s ability to sustain its growth, which led some to question whether the country was heading for a “hard landing”.

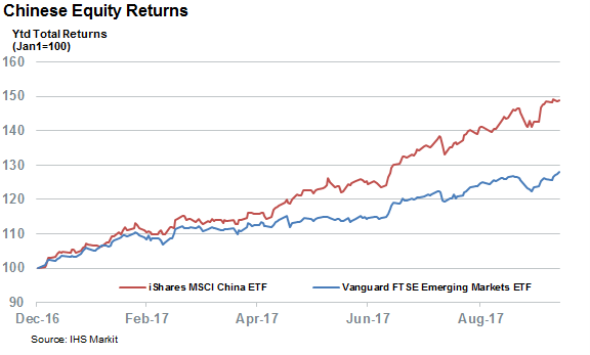

Since January, the asset class has soared ahead of emerging market peers – after the aggressive monetary easing from Chinese policy makers put fears of a “hard landing” to rest. This rally is supported by facts on the ground as the Caixin China Composite PMI Output Index, which measures both China’s manufacturing and services sectors, indicated that business activity in the country grew for the 19th month in a row in September – the longest such streak since 2010.

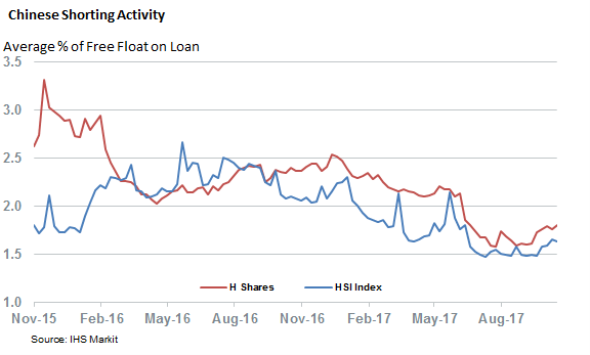

Short sellers have so far found no reason to take the other side of the rally. Borrow activity among the constituents of the Hong Kong listed Chinese domiciled Hang Shares H-Shares index reflects the general lack of interest from shorts – the average borrow demand now sits at around half the levels experienced in late 2015, the height of the “hard landing” volatility.

The one lingering H-Shares short play that continues to keep shorts interested are carmakers Byd and Great Wall – the only two constituents of the H-Shares index to have more than 10% of their free float on loan. Both stocks have been highly painful shorts year to date after they each rallied by over 50%, but shorts sellers have so far been willing to double down, owning to the fact that both stocks now see a greater proportion of their stock on loan than during January.

This pattern is particularly evident in Byd, which has seen the demand to borrow its shares surge to a three year high of 15% of its free float since early September – despite a 60% surge in its share price.

Hong Kong short sellers retreat

Short sellers are also in full retreat on Hong Kong’s HSI index, which is disproportionally exposed to China. 1.5% of that index’s freely traded shares are now out on loan; roughly 40% less than the highs experienced last year. The anemic short interest comes in spite of several high profile activist short campaigns that alleged fraud among the ranks of Hong Kong listed stocks.

HSI constituent Aac Technologies, which was singled out by activist Gotham City Research back in May, has actually seen shorts cover over the last five months, and demand to borrow its shares now stands at a three year low.

Interestingly, the most shorted stock in that index, computer maker Lenovo, has much less pure play Chinese exposure than the rest of the index, given that half of its revenue comes from Europe and North America. Short sellers have steadily increased their bets in the firm over the last few months after a string of poor earnings updates sank its shares to the lowest level in over a decade.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102017-equities-china-tames-bears-ahead-of-people-s-congress.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102017-equities-china-tames-bears-ahead-of-people-s-congress.html&text=China+tames+bears+ahead+of+People%27s+Congress","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102017-equities-china-tames-bears-ahead-of-people-s-congress.html","enabled":true},{"name":"email","url":"?subject=China tames bears ahead of People's Congress&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102017-equities-china-tames-bears-ahead-of-people-s-congress.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+tames+bears+ahead+of+People%27s+Congress http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19102017-equities-china-tames-bears-ahead-of-people-s-congress.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}