Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 19, 2015

US domestic exposed bonds evade slowdown

With China facing economic uncertainty and commodity prices set for a secular decline, certain sectors in the US corporate bond market face greater risk than others.

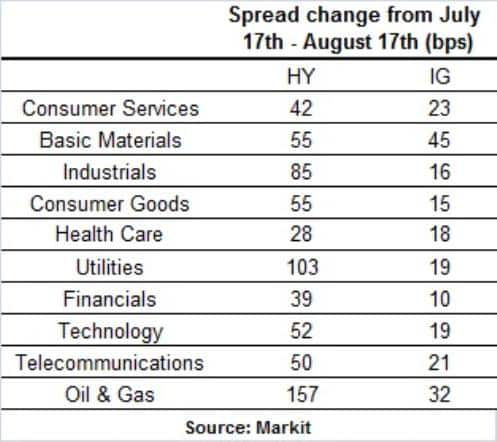

- In HY, utilities and oil and gas saw a 100bps+ spread widening over the past month

- Basic materials saw the biggest spread widening in IG, 45bps over the past month

- Financials and healthcare spreads held up the best amid the recent commodities slump

Recent economic data on China points towards a slowdown. Latest GDP figures showed that the world's second largest economy barely made its annual 7% GDP target. The country's struggles reach beyond its borders however, as a number of emerging market economies are over reliant on trade with China. In addition, global commodity prices have followed China's downward trend as the market anticipates dampened global demand led by the biggest importer, China.

The Bloomberg commodity index has fallen by 7.2% over the last month; attributed by some market commentators to a secular change in the commodities market on the back of reduced global trade, which could even heap further pressure on prices.

This trend has caused significant re pricing across risky assets, and corporate bonds have not been spared. A review of the performance of US corporate bonds over the past month may provide an indication of those sectors best positioned to withstand further global headwinds.

Sector performances

All sectors across the US corporate bond market, as gauged by the constituent bonds of the Markit iBoxx USD Liquid Investment Grade index (LQD) and the iBoxx USD Liquid High Yield index (HYG), saw their spread over treasuries, a measure of credit risk, widen over the past month. While the selloff has been across the board, some sectors have fared better than others.

The worst performing sector in high yield (HY) was unsurprisingly oil & gas, which saw a 157bps widening (WTI crude price hit a 6 year low this week) led by small explorers and producers. More notably, HY utilities saw a 103bps widening, led by names like GenOn Energy Inc and NRG Energy Inc. Utilities, a traditionally defensive sector, saw only a 19bps widening in investment grade (IG), which highlights the disparity between large domestic led IG names and the highly leveraged energy based utility names.

In the investment grade space, basic materials was the worst performing sector (45bps wider). Industrial metals and mining were the sub sectors that led the widening. Canadian metal and mining firm, Teck resources, has seen its long term bond yields surpass 9%, which is notably higher than the average US HY bond (the current yield for HYG is 6.91%).

Oil & gas IG held up better, with a 32bps widening; suggesting credits in this space are well positioned to withstand headwinds among credits directly exposed to commodity prices. In the metals and mining sector, where production costs are homogenous across the credit spectrum, IG credit has underperformed over the past month as opposed to the IG oil & gas sector where economies of scale have been built up over the years.

More broadly, cyclical sectors that are more exposed to the US market rather than the rest of the world performed better. These include IG and HY healthcare, IG utilities and financials. The relative outperformance comes as no surprise since US economic fundamentals remain stronger compared to the rest of the world.

Financials outperform

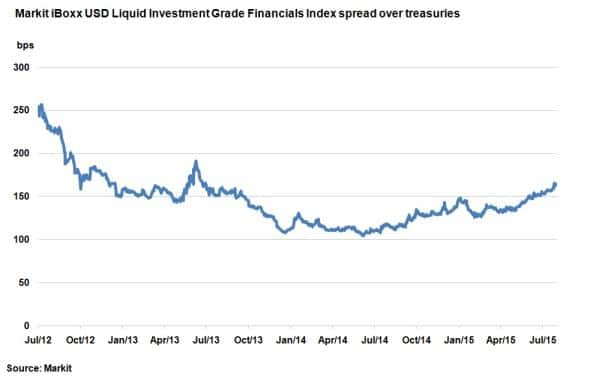

Financials were the stand out best performing sector, with IG credit seeing only a 10bps widening. The Markit iBoxx USD Liquid Investment Grade Financials Index currently trades at 164bps over treasuries. With US financials under heavy regulatory scrutiny, credit quality has improved. They also remain more domestically led and less susceptible to commodity prices. Spreads remain around 58bps above levels seen in mid-2014.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-credit-us-domestic-exposed-bonds-evade-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-credit-us-domestic-exposed-bonds-evade-slowdown.html&text=US+domestic+exposed+bonds+evade+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-credit-us-domestic-exposed-bonds-evade-slowdown.html","enabled":true},{"name":"email","url":"?subject=US domestic exposed bonds evade slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-credit-us-domestic-exposed-bonds-evade-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+domestic+exposed+bonds+evade+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19082015-credit-us-domestic-exposed-bonds-evade-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}