Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 19, 2014

Doubling down on volatility

As volatility falls to its lowest level in over five years, we see no end to the amount of investors are prepared bet on a reversal.

- Volatility is hovering at its lowest point in over five years according to Markit Equity Volatility

- Despite dismal returns, investors have piled in nearly $400m into equity volatility funds in the last

- Short sellers are also keen to ride the recent streak of low volatility

Janet Yellen’s comments yesterday saw the VIX level fall to six and a half year lows as markets saw little appetite from the Fed to reverse its monetary stimulus policy. This latest fall was the continuation of a trend started over three years ago which has seen the implied volatility priced into S&P 500 90 day at the money options halve according to Markit Equity Volatility.

Despite the market lull, investors have shown no signs of tapering their appetite for equity volatility products, which benefit from a rise in the VIX and other volatility gauges.

Volatility appetite still strong

Year to date, the 60 ETPs with exposure to equity volatility have seen more than $650m of new inflows. These strong inflows were mostly seen in the second quarter, with the first two and a half weeks of the quarter accounting for $400M of fund flow.

Interestingly, the recent market lull has ensured that any funds invested in equity volatility ETFs plummeted in value. For example, the year to date performance of the iPath S&P 500 VIX Short-Term Futures ETN (VXX), the largest Volatility ETP has seen its net asset value fall by a nearly a third since the start of the year.

This poor performance has not deterred investors as the fund has seen $277m of inflows over the year.

Leveraged funds have performed even worse. The ProShares Ultra VIX Short-Term Futures ETF, the volatility product that has seen the largest inflow year to date has seen its NAV fall by 60%.

Investors are also surprisingly consistent in their view on volatility across the ETP product spectrum as inverse funds, which benefit from falling volatility have seen withdraws since the start of the year. This is exemplified by the VelocityShares Daily Inverse VIX Short Term ETN which has seen over $70m of redemptions despite returning over 29% since the start of the year.

As for the long term asset performance of the asset class, the nearly $10bn of assets that were invested in volatility funds over the last five years are now worth $3bn.

Short sellers disagree

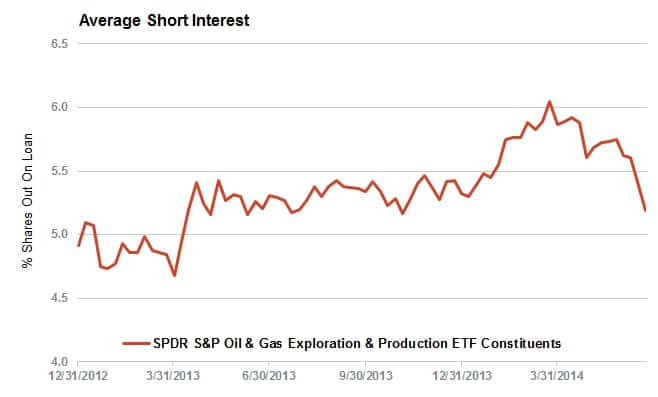

Short sellers are not in agreement with ETF investors’ view that volatility is about to rise. All three of the largest ETPs which stand to benefit from a rise in volatility have seen strong demand to borrow. The VXX for example has consistently seen over half its available stock of inventory available to short out on loan.

The largest leveraged fund, the UVXY sees even more demand to borrow with 98% of its available inventory currently out on loan.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062014120000doubling-down-on-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062014120000doubling-down-on-volatility.html&text=Doubling+down+on+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062014120000doubling-down-on-volatility.html","enabled":true},{"name":"email","url":"?subject=Doubling down on volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062014120000doubling-down-on-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Doubling+down+on+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19062014120000doubling-down-on-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}