Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 19, 2014

Short sellers target organic retailers

Following its recent disappointing earnings announcement, short interest in organic retailer Whole Foods has risen to a two year high. With shorts also moving in on other specialist grocers, we discuss whether short sellers are abandoning conventional retailers to focus on their specialist peers.

- Short interest in Whole Foods has tripled since the start of the year

- Sprouts Farmer’s market also sees record high short interest with 2.5% shares out on loan

- Demand to borrow consumer staples retailers has halved in last 18 months to all-time low

A recent report by the Organic Trade Association showed that demand for organic products surged 12% over 2013 to an all-time high of $35b. Driven by a surge in demand for “better for you” foods such as organic kale and milk, organics now make up 4% of the communal American grocery basket after the sector reported its strongest year on year growth in five years.

This confirmation of the strong demand for organic product comes at an uncomfortable time for industry leader Whole Foods, which recently saw its shares tumble after posting weaker than expected earnings. This totemic company, which brought organics away from the commune and onto the S&P 500, highlighted increased competition as the core source of its recent weakness. With the threat of a value-destroying price war, we look at the US grocery market to see if investors are turning away from health and “better for you” stocks.

Short interest rising

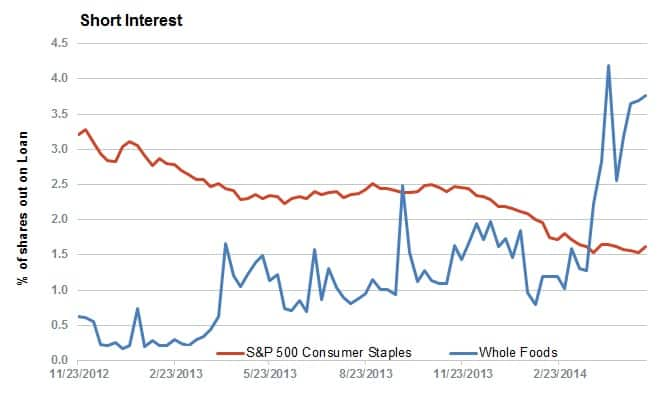

Short sellers seem to have been aware that something may be amiss in Whole Food’s latest results as the company saw a large surge in demand to borrow ahead of its earnings release. This year to date, Whole Foods has seen short interest more than triple to a two year high. Shorts stayed the course in the wake of the 19% one day drop, which may indicate some scepticism towards managements goals of reaching $35b in sales in the next five years.

The rising demand to borrow Whole Foods shares comes at a time when its consumer staples peers see record low short interest. Over the last 18 months, average demand to borrow consumer staples stocks within the S&P 500 has halved to an all-time low of 1.53% of shares outstanding.

Sprouting shorts

Recently listed Sprouts Farmers Market, which also operates in the organic health food sector, has seen a rise in demand to borrow in recent weeks with 2.5% of the company’s shares out on loan. While the company just posted upbeat first quarter results, the prospects of having to enter a price war with a bigger established rival have seen many investors rush to the door. Sprouts shares are down by over a quarter since the start of the year.

Mainstream retailers

Most conventional retailers have not seen a large jump in demand to borrow, which may indicate that the recent storm around organics may only be centred on specialist firms.

The one exception to the rule has been one-time short favourite Safeway, which has seen shorts triple in the last eight weeks to nearly 6% of shares outstanding. This increase in short interest started in the days prior to the company’s lacklustre first quarter earnings and continued in earnest in the following couple of weeks. Despite this recent stint of shorting, Safeway’s overall short interest is still less than a third of what it was a couple of years ago when over 30% of its shares were out on loan.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052014120000Short-sellers-target-organic-retailers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052014120000Short-sellers-target-organic-retailers.html&text=Short+sellers+target+organic+retailers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052014120000Short-sellers-target-organic-retailers.html","enabled":true},{"name":"email","url":"?subject=Short sellers target organic retailers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052014120000Short-sellers-target-organic-retailers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+target+organic+retailers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19052014120000Short-sellers-target-organic-retailers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}