Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 19, 2016

Brexit concerns weigh in; Miners' credit turns corner

With a potential Brexit looming the UK's credit risk has been soaring, while restructuring and a more positive outlook for oil prices this week bodes well for major miners.

- UK's 5-yr sovereign CDS spread has widened 89% so far this year

- Continued investment in gilt ETFs, but sterling corporate bond returns have underperformed

- Miners Anglo American and Glencore have seen credit risk recede to two month lows

Brexit fears impact credit

Just this week, asset manager Pimco said there was a 40% chance that the UK will vote to leave the EU. With economic implications high and the probability of a Brexit gathering momentum,UK Prime Minister David Cameron is in Brussels today to meet EU leaders in the hope of conjuring up a deal to keep the UK in the EU.

Goldman Sachs and Citigroup have forecast a sharp drop in sterling if Brexit occurs, and credit investors have already started hedging their downside risk exposures in anticipation of a summer vote.

The UK's 5-yr sovereign CDS spread has widened 89% so far this year, from 18bps to 34bps, according to Markit's CDS pricing service. It's now the widest since Europe's sovereign debt crisis in 2011 and wider than the heightened levels seen during the run up to the Scottish referendum and 2015 general election. While the unfavourable macroeconomic environment has multiplied risk off sentiment, similarly risky nations such as France (+38%) and Belgium (+49%) have seen their 5-yr CDS spreads widen to a lesser extent so far this year.

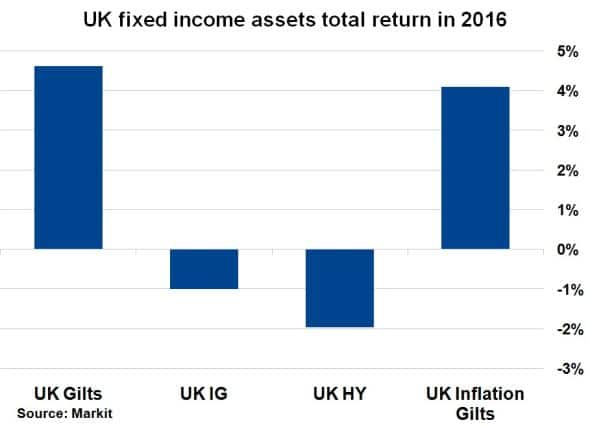

The negative risk sentiment has also weighed in on the sterling corporate bond market, which has seen returns start off the year in negative territory. According to Markit's iBoxx indices, sterling investment grade (IG) bonds have returned -1% year to date while high yield (HY) counterparts have fared even worse. In contrast, UK gilt returns have been spectacular, with returns topping 4% so far this year.

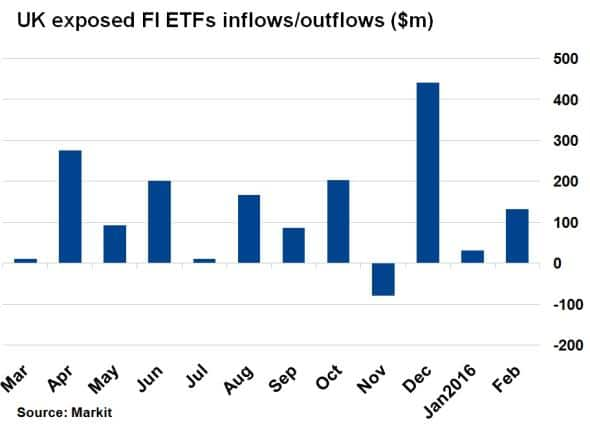

The prospect of a Brexit leading to a delay in the Bank of England's proposed tightening of monetary policy has also driven investor funds towards UK gilts. with fixed income ETFs exposed to the UK seeing consistent inflows over the past year. In fact, November last year was the only month that saw an outflow, while the first few weeks of this month has already seen over $100m of inflows. Much of the flows have been into funds tracking UK gilts, as investors look for perceived safe havens.

Turning a corner

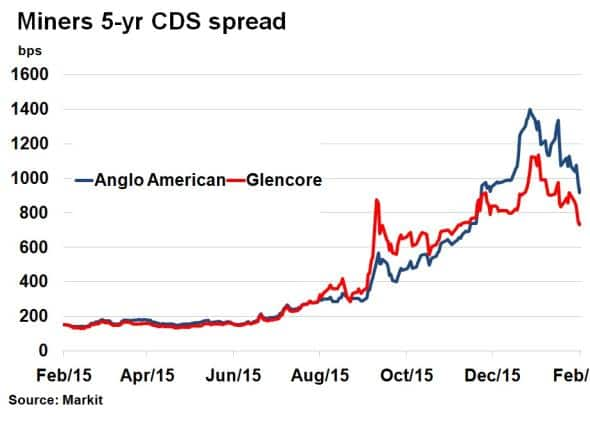

Beleaguered commodity miner Anglo American set out a restructuring plan this week amid slumping demand and prices. Despite Fitch and Moody's downgrading the company's debt to junk, credit markets reacted positively to the news - aided by several Opec members agreeing to freeze production levels.

Anglo American's 5-yr CDS spread tightened 137bps to 937bps, a two month low and 400bps lower than the highs seen in January. Fellow miners ArcelorMittal and Glencore also saw spreads tighten significantly, with the former's 5-yr CDS spread dipping below the level seen during last September's fears.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022016-Credit-Brexit-concerns-weigh-in-Miners-credit-turns-corner.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022016-Credit-Brexit-concerns-weigh-in-Miners-credit-turns-corner.html&text=Brexit+concerns+weigh+in%3b+Miners%27+credit+turns+corner","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022016-Credit-Brexit-concerns-weigh-in-Miners-credit-turns-corner.html","enabled":true},{"name":"email","url":"?subject=Brexit concerns weigh in; Miners' credit turns corner&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022016-Credit-Brexit-concerns-weigh-in-Miners-credit-turns-corner.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+concerns+weigh+in%3b+Miners%27+credit+turns+corner http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19022016-Credit-Brexit-concerns-weigh-in-Miners-credit-turns-corner.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}