Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 18, 2015

Fed holds rates amid global growth worries

The Federal Reserve decided to keep interest rates on hold at its September meeting, staving off the first tightening of policy that the US will have seen since 2006. But this is likely to be merely a temporary postponement of the inevitable.

Growth worries

Economists had been fairly evenly split on whether rates would rise in what has been one of the most eagerly-awaited and uncertain policy decisions in modern history.

The decision will be seen by many as appropriate, but the lack of action leaves lingering uncertainty about the outlook for US policymaking, which will no doubt fuel further volatility in the markets.

Although the domestic economy appears to be in sound health, current worries about slowing growth outside of the US, notably China, and recent financial market turmoil meant the Fed decided on balance that it's not a good time for the first US rate hike in almost a decade.

The Fed has become more dovish, with growth projections revised down amid rumblings of 'secular stagnation'. The Fed's GDP growth forecast for 2016 was revised down to 2.3% from 2.5%, while (core) inflation forecasts were also revised down to 1.7% in 2016 and 1.9% in 2017 - below the Fed's 2% target.

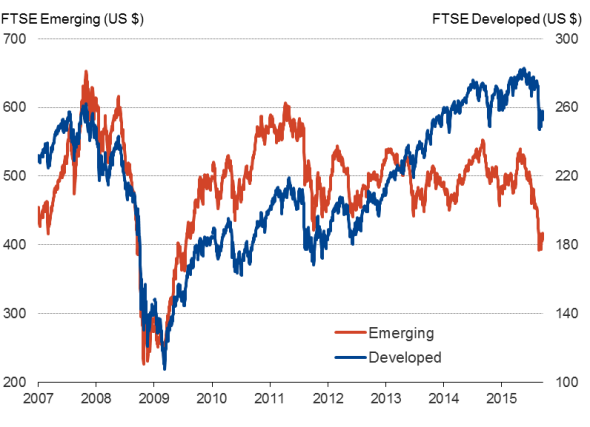

Although stock markets initially picked up on the dovish outlook for rates, key indices remain sharply down from recent peaks. Developed world equities are down 9% from their prior peak this year and emerging markets are down 23%. The US dollar has meanwhile gained 15% in trade-weighted terms over the past year, which is likely to hit exports and foreign earnings of US companies.

US economic growth

Stock markets

Trade-weighted dollar

Despite the gloomier outlook, there's a clear signal that, in the absence of any serious derailing of the economy, rates will likely rise before the year is out. Some 13 of the 17 officials still see rates rising at least once in 2015, down from 15 at the last meeting but still a solid majority.

Attention shifts to December

Speculation will now shift to December as the next most likely month for US rates to start rising. The 'data dependent' Fed will want to see further robust non-farm payroll growth between now and then as well as indications that the pace of economic growth is not wilting under the pressure of China's slowdown. If the labour market continues to improve and push beyond full-employment alongside solid business survey data, which seems likely, it will be hard for the Fed to argue that a rate hike is not warranted, albeit with the potential for further financial market volatility adding an unknown element to the rate outlook.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Economics-Fed-holds-rates-amid-global-growth-worries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Economics-Fed-holds-rates-amid-global-growth-worries.html&text=Fed+holds+rates+amid+global+growth+worries","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Economics-Fed-holds-rates-amid-global-growth-worries.html","enabled":true},{"name":"email","url":"?subject=Fed holds rates amid global growth worries&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Economics-Fed-holds-rates-amid-global-growth-worries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed+holds+rates+amid+global+growth+worries http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18092015-Economics-Fed-holds-rates-amid-global-growth-worries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}