Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 18, 2016

US financials' bonds rally with earnings season

The start of the second quarter earnings season has seen US bank credit regain all the ground lost in the wake of recent Brexit driven volatility.

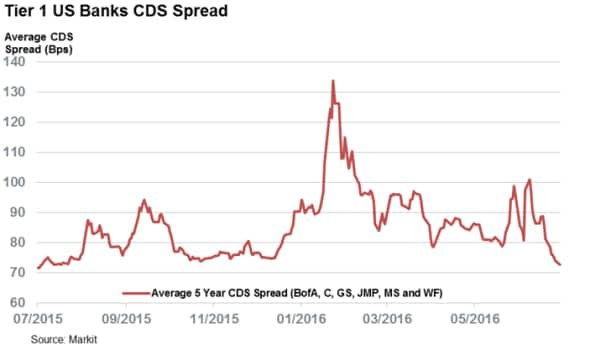

- Average tier one US banks' CDS spreads now below 73bps for the first time in 12 months

- Domestic banks' bond spreads tightened below their pre-Brexit level on Friday

- Subordinated financial bonds have rallied more strongly than senior peers

Last week heralded the start of the banking portion of the second quarter earnings season, which was heavily watched by market observers looking to gauge the impact of recent market volatility on the sector. Results coming from the leaders of the earnings pack, Bank of America, Citigroup, Wells Fargo and JP Morgan, were largely upbeat with the latter beating analyst expectations by over $0.10 a share. Positive reactions saw average spreads across the sector tighten to new recent lows.

The universal tightening seen across the six largest US banks, the three previously mentioned as well as Goldman Sachs and Morgan Stanley who are yet to release earnings, now stands at 72.5bps according to Markit CDS Pricing. The latest CDS spreads indicate that credit risk across large bank bonds has receded to the lowest level in nearly 12 months.

The post Brexit volatility had seen the CDS spreads across all six banks widen significantly as fears of global contagion grow, but the fact that all six now see their spreads trade tighter than on the eve of the referendum indicate that market fears have been placated in the subsequent weeks.

Bond spread tightens

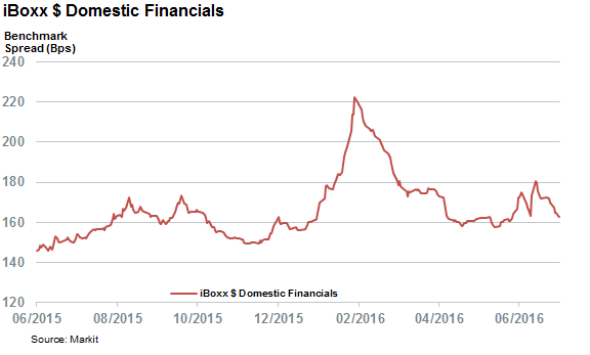

The brighter mood felt across top tier US banks is also reflected in the level of extra yield investors have been willing to receive in order to hold US listed dollar denominated investment grade bonds. The benchmark spread priced into the Markit iBoxx $ Domestic Financials index, which is made up of investment grade bonds issued in the US by investment grade financial institutions, retreated past its pre-Brexit levels for the first time on Friday. The latest spread, 163bps is 17bps tighter than the levels required on the Monday after Brexit, which proved to be the high water mark for the post referendum volatility.

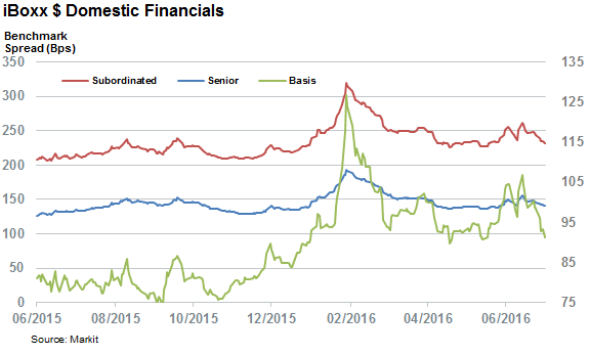

Investors are also increasingly willing to hold higher risk, and higher yielding, subordinated bonds as seen by the fact that their spreads have tightened by a wider margin than their senior peers. The basis between the senior and subordinated iBoxx domestic financials indices, which measured the different levels of benchmark spread across both asset class now stands 12bps tighter than its post-Brexit highs. The latest basis indicates that investors are willing to accept the lowest amount of extra yield in order to hold subordinated financials bonds since early May.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18072016-credit-us-financials-bonds-rally-with-earnings-season.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18072016-credit-us-financials-bonds-rally-with-earnings-season.html&text=US+financials%27+bonds+rally+with+earnings+season","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18072016-credit-us-financials-bonds-rally-with-earnings-season.html","enabled":true},{"name":"email","url":"?subject=US financials' bonds rally with earnings season&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18072016-credit-us-financials-bonds-rally-with-earnings-season.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+financials%27+bonds+rally+with+earnings+season http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18072016-credit-us-financials-bonds-rally-with-earnings-season.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}