Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 18, 2015

Greek credit deteriorates ahead of meeting

Time appears to be running out for Greece with no deal as yet apparent, leading the bond and credit markets to treat Greek credit with increasing bearish sentiment.

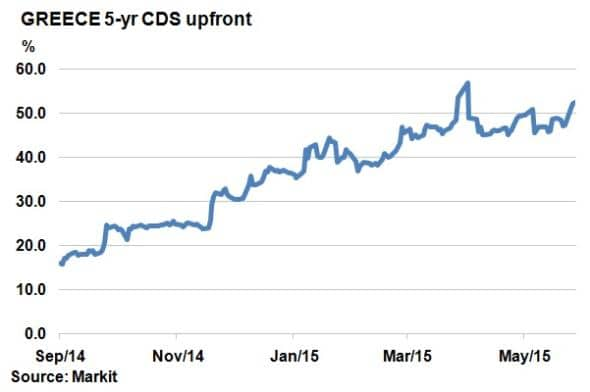

- Greece's upfront 5-yr CDS spread has risen back over the 50% mark

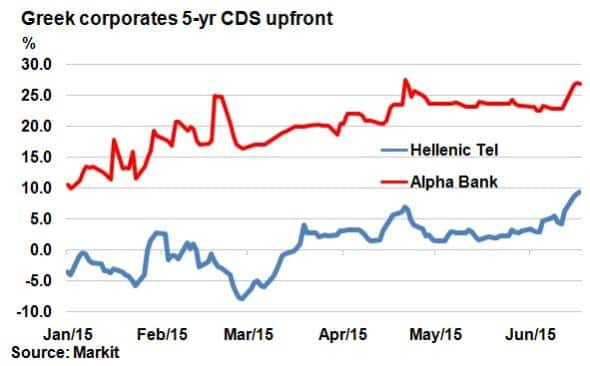

- Corporates are also feeling the heat with banks and telecoms spreads trading wider

- Greece's short term bonds touch 30% yield; widest since Syriza came to power

Lawmakers are sitting down this afternoon to discuss a way out of the latest Greek impasse. While the situation is nothing new given the ongoing crisis since the election of the anti-austerity Syriza party, the run-up to this meeting has seen the language used by parties on both sides of the negotiating table ratchet up to levels previously unseen. Increasing numbers of people are now considering the possibility of a break thorough unlikely, which would see Greece go down the default and possible euro exit path.

The possibility of this once unthinkable scenario occurring has seen the credit market treat Greek debt with some of the most bearish sentiment since Syriza came into power.

CDS bears the brunt

Greece's CDS spread has been one of the best bellwethers of the ongoing crisis and the upfront spread has now jumped back over the key 50% mark. The latest 5 year spread is 52.4% upfront, which is just under the previous record high seen in the closing week of April. The figure implies an 81.7% default probability over the next five years.

It's worth noting that liquidity in the country has remained relatively low during the recent crisis, with market activity virtually non-existent over the last few weeks. Only two to three dealers continue to make a market, and there appears to be few buyers, with only $588m of outstanding net exposure covered by CDS contracts according to DTCC trade volumes. This puts Greece on par with Romania and Norway in terms of sovereign volumes; no doubt driven by the fact that there are few private holders of Greek debt or Greek correlated exposure - a prerequisite for buying Greek CDS.

Corporates also feeling heat

The country's corporates are also feeling the heat of the recent dialogue with banks feeling most of the negative sentiment. The most liquid Greek bank, Alpha Bank, now trades at 26.8% upfront, up from 22.8% a week ago. The other two Greek banks have also seen their CDS spreads trade wider in the latest chapter of the crisis, with National Bank of Greece trading at 31.1% upfront and Piraeus Bank 31.3% upfront.

The country's largest telecom firms Hellenic Telecom now sees its CDS spread trade at 9.4% upfront, the widest in two years.

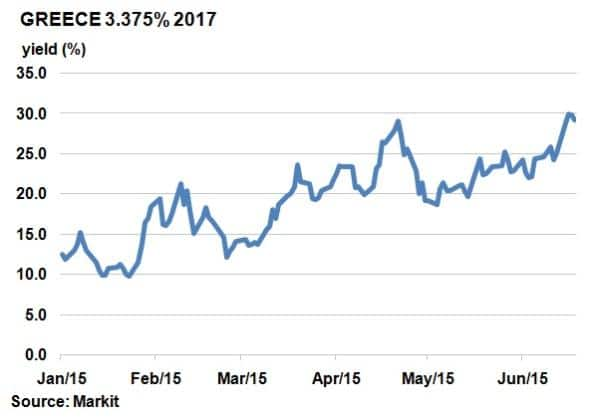

Bonds widen

Things are equally bleak in the bond market where short term Greek debt is now trading at its widest since the crisis. Bonds remain a better indicator of Greek credit quality than CDS spreads due to higher liquidity. The country's reference two year bond, the 3.375% note due 2017, is now trading with the highest yield since the current government came to power with the intraday yields touching 30% yesterday.

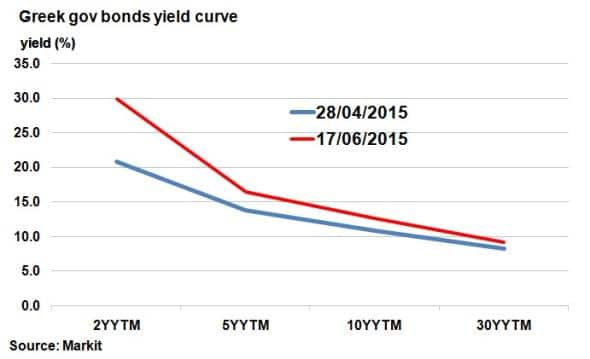

This has pushed the Greek bond curve further into inversion territory, as the two year curve point is now over three times the 30 year point which is trading at 9.2%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-credit-greek-credit-deteriorates-ahead-of-meeting.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-credit-greek-credit-deteriorates-ahead-of-meeting.html&text=Greek+credit+deteriorates+ahead+of+meeting","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-credit-greek-credit-deteriorates-ahead-of-meeting.html","enabled":true},{"name":"email","url":"?subject=Greek credit deteriorates ahead of meeting&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-credit-greek-credit-deteriorates-ahead-of-meeting.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+credit+deteriorates+ahead+of+meeting http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-credit-greek-credit-deteriorates-ahead-of-meeting.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}