Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 18, 2015

Week Ahead Economic Overview

The release of flash PMI results will provide first insights into global economic trends in June, while the US sees the release of durable goods orders data and final GDP numbers for the first quarter. The Bank of Japan meanwhile publishes minutes from its latest monetary policy meeting.

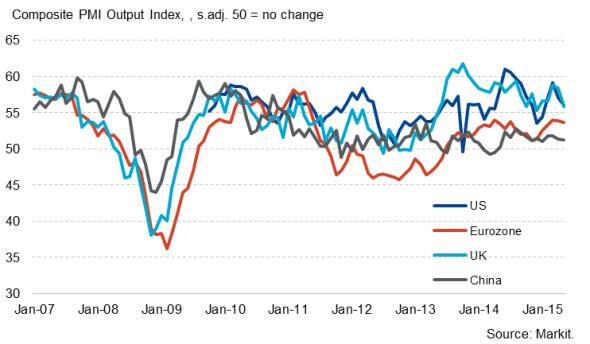

Composite PMI Output Index

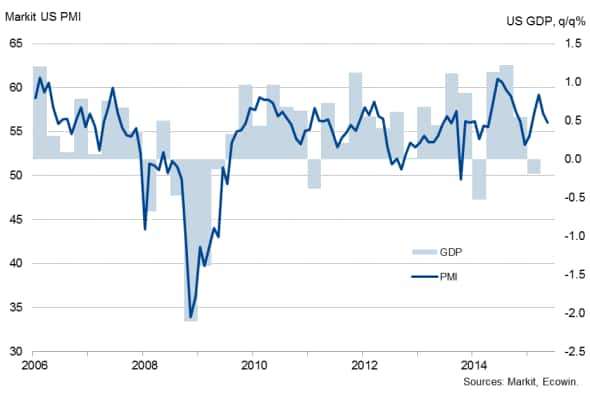

In the US, final gross domestic product data for the first quarter are likely to be revised higher to show a modest increase rather than shrinking at an annualised rate of 0.7%. However, policy makers will be more interested in durable goods orders and PMI numbers, and in particular the impact of the strong dollar, as the weak first quarter has already been shrugged off as a temporary blip, partly linked to extreme weather and port closures.

May's business survey results signalled a continuation of economic growth in the US. However, the data also raise question marks over the extent to which the economy has rebounded after contracting in the first three months of the year. This week's flash PMI results for both manufacturing and services in June will therefore provide important information about growth momentum and hiring at the end of the second quarter, and could play a crucial role in the Fed's decision on when to start raising interest rates. During the Fed's June meeting, rates were left unchanged, but Janet Yellen stated that "most [FOMC members] are anticipating a rate increase this year", with September still looking the most likely start date.

US GDP and the PMI

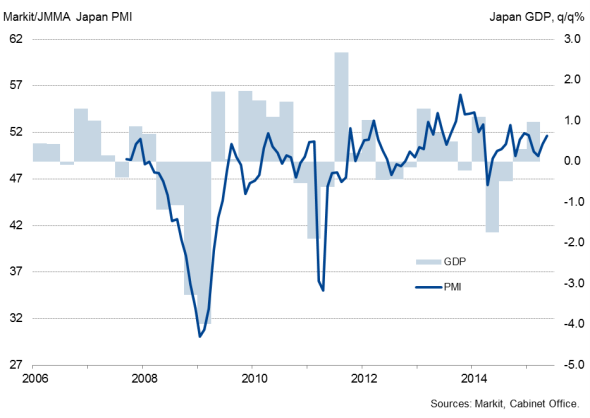

The Bank of Japan publishes minutes from its latest meeting in which the bank left monetary policy unchanged. While the bank's governor Haruhiko Kuroda insists that the current stimulus programme is working as planned, the International Monetary Fund (IMF) has called for Japan to expand its monetary easing in an effort to push inflation to two percent and raise economic growth. Updated flash PMI data for June will therefore be eyed for signs that factory growth and exports in particular are supporting the recovery.

Japan GDP and the PMI

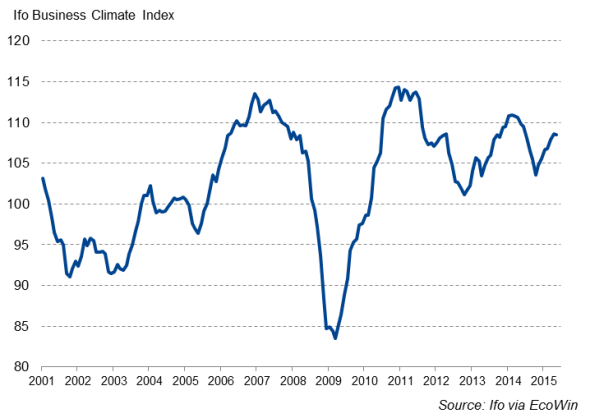

In the eurozone, the Greek debt crisis remains the hot topic. With two weeks left until Athens has to strike a deal with its creditors or face default, the crisis is clearly intensifying. Flash PMI data will meanwhile provide data watchers with important information about the health of the region's economy at the end of the second quarter. While May data signalled that the eurozone's recovery lost some momentum, linked to some extent to heightened uncertainty surrounding the Greek debt crisis, the data are nevertheless signalling that there's a good chance of GDP expanding by up to 2% in 2015. Other important releases in the currency bloc include business and consumer confidence data and the latest Ifo survey results for Germany.

Policymakers in China will meanwhile be hoping to see renewed signs of life in the country's economy. May's manufacturing PMI results showed output contracting for the first time in 2015 so far, and official data suggested that economic growth slowed to the weakest in six years in the opening three months of the year. If the data flow continues to disappoint, more stimulus measures look likely to be unveiled by the central bank in coming months.

Monday 22 June

Monthly GDP numbers are released in Russia.

In Greece, current account figures are updated.

The European Commission issues consumer confidence data for the currency union.

Payroll job growth numbers are meanwhile out in Brazil.

The US sees the publication of existing home sales data.

Tuesday 23 June

Flash PMI data are released in Japan, China, the eurozone and the US.

The Australian Bureau of Statistics issues house price information.

In Italy, industrial orders and retail sales figures are published.

Business climate data for France are released by INSEE.

The Confederation of British Industry updates their orders data.

Current account numbers are meanwhile issued in South Africa.

Durable goods orders and home price figures are published in the US.

Wednesday 24 June

In India, M3 money supply data are updated.

The Bank of Japan issues minutes from its May monetary policy meeting.

Detailed first quarter GDP information are released in France.

In Germany, import price numbers are issued alongside the latest Ifo survey results.

Ifo Business Climate Index

Wage inflation and non-EU trade data are meanwhile published in Italy.

Brazil updates its current account figures.

Final first quarter GDP numbers and building permit numbers are out in the US.

Thursday 25 June

Producer prices are issued in South Africa.

GfK consumer confidence data are out in Germany.

In the UK, CBI distributive trades numbers are released.

Initial jobless claims figures, personal income data and flash services PMI results are all published in the US.

Friday 26 June

Japan sees the release of household spending, inflation and unemployment numbers.

Consumer confidence data are published in Italy, France and Brazil.

M3 money supply information are issued for the eurozone.

The Reuters/Michigan Consumer Sentiment Index is released in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18062015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}