Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 18, 2016

European investors stick to domestic HY bonds

Global high yield bond ETFs have been shunned by investors despite yields continuing to fall, but the European high yield market has proved an exception.

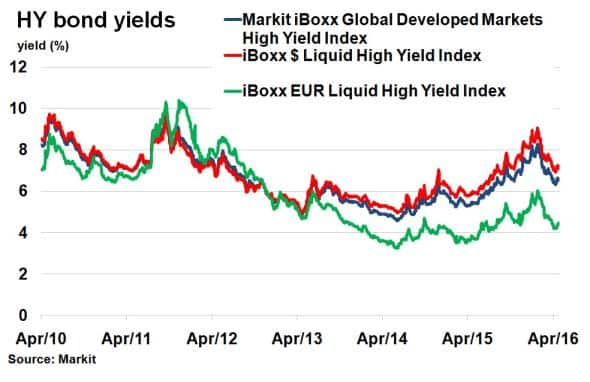

- Markit iBoxx Global Developed Markets High Yield Index has seen its yield fall to 6.52%, from 8.30% in February

- Investors have continued to invest in the European HY market over the past two months

- US HY bonds offer 2.68% more yield on average than European HY bonds

Investors' appetite for global high yield (HY) bonds has started to wane, despite yields continuing to fall over the past two months. The one bright spot however has been the European HY market, which continues to enjoy significant investor demand.

The riskier end of the bond market has continued to see prices recover since February's depths, with US HY bonds spurred on by rising crude oil prices and European HY by an accommodative monetary backdrop. The Markit iBoxx Global Developed Markets High Yield Index, which incorporates over 1,400 HY bonds across four currencies, has seen its yield fall to 6.52% from 8.30% in February. Exchange traded fund (ETF) investors were previously keen to take advantage of the falling yields (yields move inversely to prices), as funds tracking HY indices saw over $5bn of inflows in March.

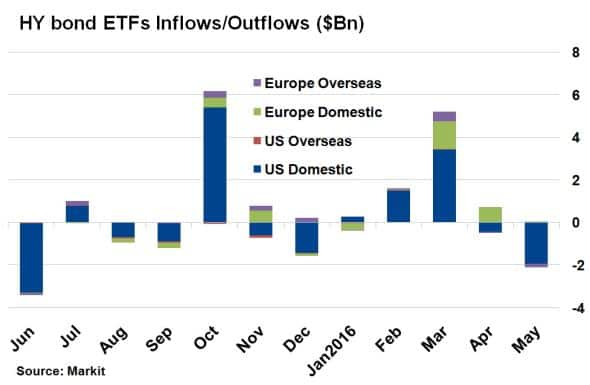

The last two months however have seen a reverse in this trend, with outflows accumulating despite global HY yields continuing to fall. A closer look at the composition of the ETF outflows sheds further light on how investors have been positioning themselves lately.

Investors favour Europe

HY bond ETF flows over the last two months (April and May) show around $1.8bn of outflows according to Markit's ETP analytics service.

Interestingly, these outflows have been mainly concentrated within the US HY bond market, as domestic investors reduce their exposure to the market. US-listed ETFs investing in the US HY bond market have seen the majority of the outflows, with $2.4bn in April and May. European investors have also shunned overseas HY bond markets (primarily US HY) with European-listed ETFs seeing $235m of outflows over the past two months.

The only bright spot however has been the European HY market, which has continued to see inflows from both domestic and overseas investors. European-listed ETFs tracking the European HY market have seen nearly $750m of inflows over the past two months.

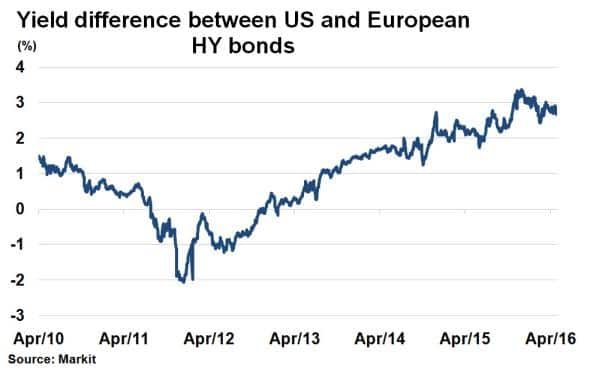

The ETF flows showcase investors' appetite for the European HY bond market over the US HY bond market, in spite of the lower average yields on offer. The yield difference between the Markit iBoxx $ Liquid High Yield Index and the Markit iBoxx EUR Liquid High Yield Index currently stands at 2.68%, close to six year highs. Investors' preference for European HY is likely to be related to its marginal exposure to global commodity prices and the easy monetary conditions offering in Europe.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052016-Credit-European-investors-stick-to-domestic-HY-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052016-Credit-European-investors-stick-to-domestic-HY-bonds.html&text=European+investors+stick+to+domestic+HY+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052016-Credit-European-investors-stick-to-domestic-HY-bonds.html","enabled":true},{"name":"email","url":"?subject=European investors stick to domestic HY bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052016-Credit-European-investors-stick-to-domestic-HY-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+investors+stick+to+domestic+HY+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18052016-Credit-European-investors-stick-to-domestic-HY-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}